Chatter about China easing its Zero-COVID strategy sparked some joy overnight (in crude prices), but the labor market report was a smorgasbord of confusion for algos (keying off the 'beat' on the payrolls print and slowing wage growth) and traders (who dug below the surface and saw the real shitshow of job-losses and lack of participation):

-

Good: payrolls beat expectations (tightening not working - bad for stocks)

-

Bad: wage growth slowed modestly (less-flation - good for stocks?), full-time workers dropped 490k (economic weakness - not good for stocks)

-

Ugly: number of unemployed Americans highest since Feb (recession reality - bad for stocks)

On the day, the market took a dovish angle on all this and cut terminal rate-hike expectations. But on the week, short-term interest rates signaled a notably hawkish tone shift...

Source: Bloomberg

But then the FedSpeak began again:

-

1000ET: Boston Fed's Susan Collins: "...it is time to shift focus from how rapidly to raise rates, or the pace, to how high... followed by a period of holding rates at a sufficiently restrictive level for some time."

-

1005ET: Richmond Fed's Tom Barkin: "Fed has more work to do as labor market still tight... with a longer period of rate increases and potentially higher terminal rate..."

It took a while for that set in and the algos to calm down, but as Europe closed, US equity markets puked all their gains back. The majors hovered around unch to weaker until the last hour or so then started to magically levitate back into the green and beyond into the close. By the cash close, Nasdaq was the day's biggest gainer but everything traded together as the machines ran the show...

On the week, it was all about Powell's rug-pull. Nasdaq was the biggest loser (down around 6% while The Dow was the prettiest horse in the glue factory, down only 1.5% on the week). This was the Nasdaq's worst week since January...

Or for those who learn through visuals...

All the majors broke down below key technical levels this week...

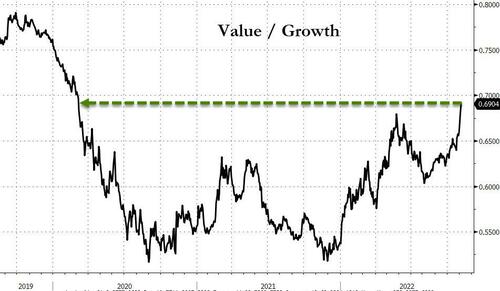

Value stocks dramatically outperformed Growth on the week, surging up to pre-COVID levels relative to one another. Value has outperformed growth for 7 of the last 8 days. This week was the biggest value outperformance of growth since Jan 7th...

Source: Bloomberg

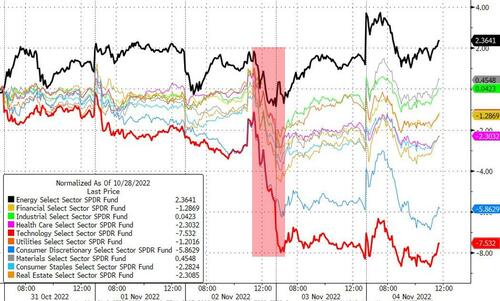

That fits with the fact that US Tech stocks puked around 8% on the week while Energy stocks outperformed (up 2% on the week)...

Source: Bloomberg

And before we leave stock-land, Bloomberg notes that the outlook for US corporate profits outside the energy sector is deteriorating fast. Blended earnings estimates for the S&P 500 Ex-Energy Index have been slashed so much since June that they are now back to last December levels.

Source: Bloomberg

While energy companies are benefiting from higher oil prices amid Russia’s invasion of Ukraine, the broader corporate world is feeling the pinch of raging inflation, higher rates and slowing demand.

VIX and Stocks completely decoupled since Powell dropped the hammer as traders monetized hedges...

Source: Bloomberg

...but were not fearful enough to reload on downside put protection (until today a little)...

Source: Bloomberg

Treasuries were very mixed on the day with the long-end underperforming (30Y +6bps, 2Y -5bps), but on the week, its the opposite picture with 2Y yield sup 25bps and 30Y up only 10bps as the entire curve repriced higher in yields...

Source: Bloomberg

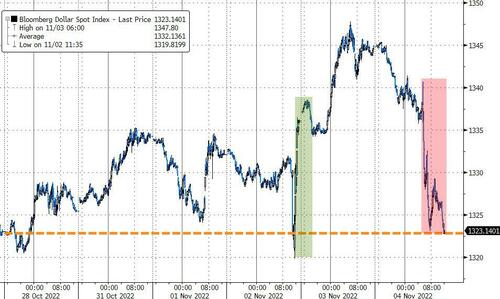

The dollar ended the week almost perfectly unchanged after puking back all of the mid-week post-Powell gains today...

Source: Bloomberg

China's Yuan soared today (by the most since 2005), but that only lifted it back to one-week highs...

Source: Bloomberg

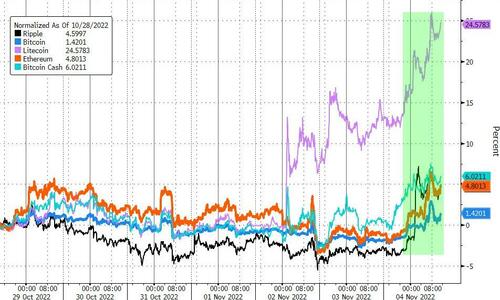

Cryptos rallied today lifting them into the green for the week (Litecoin outperformed)...

Source: Bloomberg

Bitcoin rallied back above $21k...

Source: Bloomberg

Gold rallied today, hitting its highest in 3 weeks (futs above $1680)...

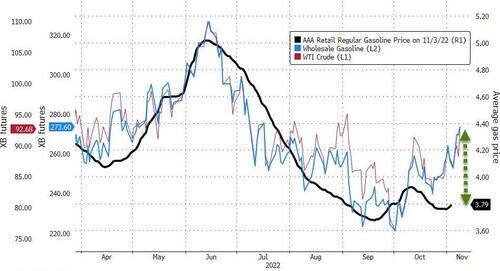

Oil prices soared this week (helped by chatter about easing China COVID restrictions) with WTI back above $92 (at 3-mo highs)...

Finally, some bad news America, pump prices are about to start soaring again as crude and wholesale gasoline prices are back at 3-month highs...

Source: Bloomberg

And we know who to blame right?

Chatter about China easing its Zero-COVID strategy sparked some joy overnight (in crude prices), but the labor market report was a smorgasbord of confusion for algos (keying off the ‘beat’ on the payrolls print and slowing wage growth) and traders (who dug below the surface and saw the real shitshow of job-losses and lack of participation):

-

Good: payrolls beat expectations (tightening not working – bad for stocks)

-

Bad: wage growth slowed modestly (less-flation – good for stocks?), full-time workers dropped 490k (economic weakness – not good for stocks)

-

Ugly: number of unemployed Americans highest since Feb (recession reality – bad for stocks)

On the day, the market took a dovish angle on all this and cut terminal rate-hike expectations. But on the week, short-term interest rates signaled a notably hawkish tone shift…

Source: Bloomberg

But then the FedSpeak began again:

-

1000ET: Boston Fed’s Susan Collins: “…it is time to shift focus from how rapidly to raise rates, or the pace, to how high… followed by a period of holding rates at a sufficiently restrictive level for some time.”

-

1005ET: Richmond Fed’s Tom Barkin: “Fed has more work to do as labor market still tight… with a longer period of rate increases and potentially higher terminal rate…”

It took a while for that set in and the algos to calm down, but as Europe closed, US equity markets puked all their gains back. The majors hovered around unch to weaker until the last hour or so then started to magically levitate back into the green and beyond into the close. By the cash close, Nasdaq was the day’s biggest gainer but everything traded together as the machines ran the show…

On the week, it was all about Powell’s rug-pull. Nasdaq was the biggest loser (down around 6% while The Dow was the prettiest horse in the glue factory, down only 1.5% on the week). This was the Nasdaq’s worst week since January…

Or for those who learn through visuals…

[embedded content]

All the majors broke down below key technical levels this week…

Value stocks dramatically outperformed Growth on the week, surging up to pre-COVID levels relative to one another. Value has outperformed growth for 7 of the last 8 days. This week was the biggest value outperformance of growth since Jan 7th…

Source: Bloomberg

That fits with the fact that US Tech stocks puked around 8% on the week while Energy stocks outperformed (up 2% on the week)…

Source: Bloomberg

And before we leave stock-land, Bloomberg notes that the outlook for US corporate profits outside the energy sector is deteriorating fast. Blended earnings estimates for the S&P 500 Ex-Energy Index have been slashed so much since June that they are now back to last December levels.

Source: Bloomberg

While energy companies are benefiting from higher oil prices amid Russia’s invasion of Ukraine, the broader corporate world is feeling the pinch of raging inflation, higher rates and slowing demand.

VIX and Stocks completely decoupled since Powell dropped the hammer as traders monetized hedges…

Source: Bloomberg

…but were not fearful enough to reload on downside put protection (until today a little)…

Source: Bloomberg

Treasuries were very mixed on the day with the long-end underperforming (30Y +6bps, 2Y -5bps), but on the week, its the opposite picture with 2Y yield sup 25bps and 30Y up only 10bps as the entire curve repriced higher in yields…

Source: Bloomberg

The dollar ended the week almost perfectly unchanged after puking back all of the mid-week post-Powell gains today…

Source: Bloomberg

China’s Yuan soared today (by the most since 2005), but that only lifted it back to one-week highs…

Source: Bloomberg

Cryptos rallied today lifting them into the green for the week (Litecoin outperformed)…

Source: Bloomberg

Bitcoin rallied back above $21k…

Source: Bloomberg

Gold rallied today, hitting its highest in 3 weeks (futs above $1680)…

Oil prices soared this week (helped by chatter about easing China COVID restrictions) with WTI back above $92 (at 3-mo highs)…

Finally, some bad news America, pump prices are about to start soaring again as crude and wholesale gasoline prices are back at 3-month highs…

Source: Bloomberg

And we know who to blame right?