By George Lei, Bloomberg markets live commentator and reporter

Three things we learned last week:

1. Electricity shortages amid a severe drought have replaced Covid lockdowns as the latest and potentially biggest threat to economic growth, at least in the month of August. Sichuan, a southwestern province with more than 83 million people, had to cut its hydropower generation by more than half as of Friday, state broadcaster CCTV reports. Dazhou, a city of more than 5 million, has implemented rolling blackouts on non-household users and is making plans for residential power cuts if the situation doesn’t improve.

The blackout in Sichuan has led to factory closures of Toyota, Panasonic and CATL, the world’s top battery maker, while threatening supply chains to automakers including Tesla. Power generation in other parts of the country may come under pressure as well. Capital Economics noted on Friday that China’s eastern provinces -- industrial hubs that normally consume power from the west -- are now being asked to send electricity in the other direction, leading to a quick depletion of their thermal coal inventories.

Electricity shortages are so far at an early stage and relatively concentrated in the southwest, according to Morgan Stanley. Further deterioration, however, could start to drag on manufacturing and other economic activities, posing additional downward risks to corporate earnings and stock-market sentiment, analysts Laura Wang, Jonathan Garner and Fran Chen wrote last week.

2. The Chinese yuan, trading both onshore and offshore, fell on Friday to the weakest since September 2020 and investors only see more downside ahead. The People’s Bank of China isn’t standing in the way of the currency’s devaluation path, and a raft of 2022 GDP downgrades (with the full impact of blackouts unknown) only add to negative market sentiment.

The offshore yuan has lost more than 1% so far in August, on course for the worst month since April’s 4.3% plunge. Things might be a bit different this time, however, as a “slow boil” yuan decline is the most likely scenario and runaway depreciation pressures appear less acute, JPMorgan wrote in a client note on Thursday. Investor positioning on the Chinese currency is already “extremely bearish” and foreign bond outflows have also lightened up somewhat, according to the US bank.

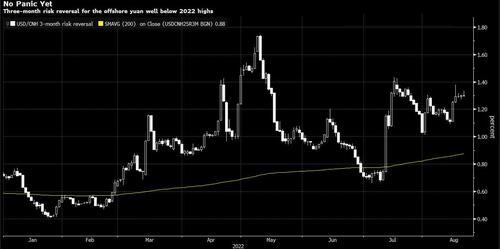

A gradual FX weakening could prompt the offshore yuan to first test 6.90, a level last seen in August 2020, and then onto the key 7.00 level, reached in July that year. The three-month CNH risk reversal, which measures the cost of protection against depreciation, traded around 1.3% on Friday -- well above its 200-day moving average of 0.88% yet still shy of 2022 high near 1.75%, last seen on May 10.

3. Chinese banks are poised to cut their benchmark lending rates on Monday, following the PBOC’s 10 basis-point reduction to its 1-year MLF rate last week. Seven out of 20 economists polled by Bloomberg expect a 15bps cut to the five-year loan prime rate, a reference for mortgage costs, while six see an easing of 10bps.

Just don’t expect a turnaround any time soon. More policy support is on the way, yet “it will probably be too late too little to prevent output from stagnating this year,” according to Capital Economics.

By George Lei, Bloomberg markets live commentator and reporter

Three things we learned last week:

1. Electricity shortages amid a severe drought have replaced Covid lockdowns as the latest and potentially biggest threat to economic growth, at least in the month of August. Sichuan, a southwestern province with more than 83 million people, had to cut its hydropower generation by more than half as of Friday, state broadcaster CCTV reports. Dazhou, a city of more than 5 million, has implemented rolling blackouts on non-household users and is making plans for residential power cuts if the situation doesn’t improve.

The blackout in Sichuan has led to factory closures of Toyota, Panasonic and CATL, the world’s top battery maker, while threatening supply chains to automakers including Tesla. Power generation in other parts of the country may come under pressure as well. Capital Economics noted on Friday that China’s eastern provinces — industrial hubs that normally consume power from the west — are now being asked to send electricity in the other direction, leading to a quick depletion of their thermal coal inventories.

Electricity shortages are so far at an early stage and relatively concentrated in the southwest, according to Morgan Stanley. Further deterioration, however, could start to drag on manufacturing and other economic activities, posing additional downward risks to corporate earnings and stock-market sentiment, analysts Laura Wang, Jonathan Garner and Fran Chen wrote last week.

2. The Chinese yuan, trading both onshore and offshore, fell on Friday to the weakest since September 2020 and investors only see more downside ahead. The People’s Bank of China isn’t standing in the way of the currency’s devaluation path, and a raft of 2022 GDP downgrades (with the full impact of blackouts unknown) only add to negative market sentiment.

The offshore yuan has lost more than 1% so far in August, on course for the worst month since April’s 4.3% plunge. Things might be a bit different this time, however, as a “slow boil” yuan decline is the most likely scenario and runaway depreciation pressures appear less acute, JPMorgan wrote in a client note on Thursday. Investor positioning on the Chinese currency is already “extremely bearish” and foreign bond outflows have also lightened up somewhat, according to the US bank.

A gradual FX weakening could prompt the offshore yuan to first test 6.90, a level last seen in August 2020, and then onto the key 7.00 level, reached in July that year. The three-month CNH risk reversal, which measures the cost of protection against depreciation, traded around 1.3% on Friday — well above its 200-day moving average of 0.88% yet still shy of 2022 high near 1.75%, last seen on May 10.

3. Chinese banks are poised to cut their benchmark lending rates on Monday, following the PBOC’s 10 basis-point reduction to its 1-year MLF rate last week. Seven out of 20 economists polled by Bloomberg expect a 15bps cut to the five-year loan prime rate, a reference for mortgage costs, while six see an easing of 10bps.

Just don’t expect a turnaround any time soon. More policy support is on the way, yet “it will probably be too late too little to prevent output from stagnating this year,” according to Capital Economics.