Several months ago, Credit Suisse strategist and former NY Fed "liquidity plumber" Zoltan Pozsar predicted that as a result of Russian commodity exports being shunned by western nations and/or distributors while greeted by eastern nations (such as India and China) would would find delight in the 30% discount to spot on Russian oil, shipping costs would soar as a result of the challenging - and expensive - realignment of global supply chains which would see legacy tanker flows be scrapped only to be resurrected in the form of much more expensive alternatives.

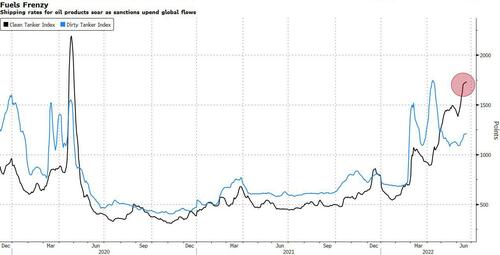

Well, Pozsar was right again because four months after the Russian invasion of Ukraine, the resulting dislocation of global fuel markets has lead to a surge in shipping costs of products such as diesel by sea.

Rates to haul fuels such as gasoline and diesel, known in the industry as clean tanker freight, have more than doubled this year to the highest since April 2020, according to Baltic Exchange data. On one key route in Asia, ship owners are now earning over $47,000 a day transporting products from South Korea to the distribution hub of Singapore, compared with $98 a day prior to the war.

The Russian invasion has exacerbated a tightening of energy markets, upending trade flows and forcing buyers to scour the world for alternative fuel supplies, according to Bloomberg. At the same time, an initial surge in rates for hauling crude hasn’t been sustained, partly due to reduced demand from China, leading to some shipowners switching part of their fleet to haul fuels rather than oil, according to two tanker charterers.

The last time clean tanker freight rates were this elevated was in early 2020, after the pandemic decimated oil consumption and forced fuel producers to export as much product as possible to alleviate swelling storage tanks. Now, we are observing a mirror image of that predicament as demand for ships to haul fuels is expected to climb by 6% this year, underpinned by Europe, said Anoop Singh, head of tanker research at Braemar ACM Shipbroking.

"The European resolve to reduce reliance on Russian supplies will likely outlive the war in Ukraine and that will re-draw trade routes,” said Singh, who notes that Russia was the single largest external supplier of diesel to Europe prior to the war.

Furthermore, and also as Zoltan predicted, more long-range class ships are being used to transport refined fuels since the invasion in late February, according to S&P analysts Fotios Katsoulas and Krispen Atkinson. Longer voyages are reducing the amount of available capacity on vessels and driving up freight rates, they said. LR tankers are the most common and are used to carry both products and oil.

The surge in rates is being replicated across other regions. Ship owners transporting fuel from the Middle East to Japan on a route known as TC-5 -- a key passage for naphtha -- were earning more than $50,000 a day on Wednesday, compared with as low as $61 a day in February, an 82000% increase, according to Baltic Exchange data. The cost of shipping fuel from the US to Brazil on the TC-18 route was near $37,000 a day, up "more modestly", from $3,800 a day four months ago.

Several months ago, Credit Suisse strategist and former NY Fed “liquidity plumber” Zoltan Pozsar predicted that as a result of Russian commodity exports being shunned by western nations and/or distributors while greeted by eastern nations (such as India and China) would would find delight in the 30% discount to spot on Russian oil, shipping costs would soar as a result of the challenging – and expensive – realignment of global supply chains which would see legacy tanker flows be scrapped only to be resurrected in the form of much more expensive alternatives.

Well, Pozsar was right again because four months after the Russian invasion of Ukraine, the resulting dislocation of global fuel markets has lead to a surge in shipping costs of products such as diesel by sea.

Rates to haul fuels such as gasoline and diesel, known in the industry as clean tanker freight, have more than doubled this year to the highest since April 2020, according to Baltic Exchange data. On one key route in Asia, ship owners are now earning over $47,000 a day transporting products from South Korea to the distribution hub of Singapore, compared with $98 a day prior to the war.

The Russian invasion has exacerbated a tightening of energy markets, upending trade flows and forcing buyers to scour the world for alternative fuel supplies, according to Bloomberg. At the same time, an initial surge in rates for hauling crude hasn’t been sustained, partly due to reduced demand from China, leading to some shipowners switching part of their fleet to haul fuels rather than oil, according to two tanker charterers.

The last time clean tanker freight rates were this elevated was in early 2020, after the pandemic decimated oil consumption and forced fuel producers to export as much product as possible to alleviate swelling storage tanks. Now, we are observing a mirror image of that predicament as demand for ships to haul fuels is expected to climb by 6% this year, underpinned by Europe, said Anoop Singh, head of tanker research at Braemar ACM Shipbroking.

“The European resolve to reduce reliance on Russian supplies will likely outlive the war in Ukraine and that will re-draw trade routes,” said Singh, who notes that Russia was the single largest external supplier of diesel to Europe prior to the war.

Furthermore, and also as Zoltan predicted, more long-range class ships are being used to transport refined fuels since the invasion in late February, according to S&P analysts Fotios Katsoulas and Krispen Atkinson. Longer voyages are reducing the amount of available capacity on vessels and driving up freight rates, they said. LR tankers are the most common and are used to carry both products and oil.

The surge in rates is being replicated across other regions. Ship owners transporting fuel from the Middle East to Japan on a route known as TC-5 — a key passage for naphtha — were earning more than $50,000 a day on Wednesday, compared with as low as $61 a day in February, an 82000% increase, according to Baltic Exchange data. The cost of shipping fuel from the US to Brazil on the TC-18 route was near $37,000 a day, up “more modestly”, from $3,800 a day four months ago.