A significantly softer than expected PPI print confirmed yesterday's headline CPI (just ignore the core), and with no FOMC minutes or FedSpeak to get in the way today, the algos ran with it lifting stocks to yesterday's highs, along wth gold and crypto as the dollar dived yet again.

Fed staff: Recession is coming

— Sven Henrich (@NorthmanTrader) April 13, 2023

Markets: 😂 pic.twitter.com/q63aayxqMV

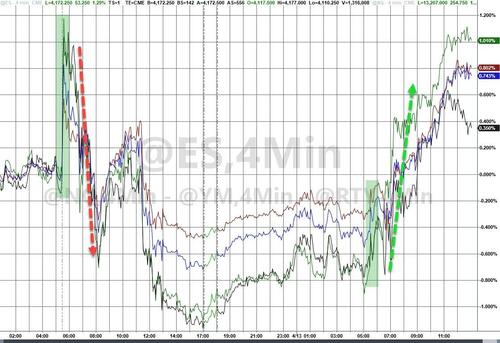

Nasdaq led the surge today, as all of the US majors tagged yesterday's highs, but could not extend (ahead of tomorrow's retail sales print)...

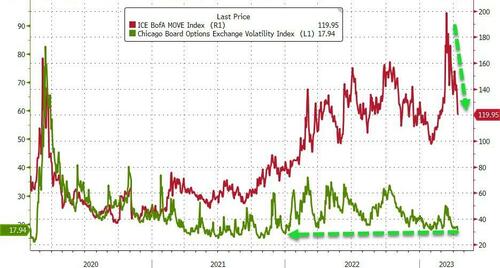

Perhaps most notably in equity-land, VIX tumbled back to a 17 handle, testing its lows since Jan 2022. We also note that MOVE (bond VIX) is tumbling back from near-record highs...

Source: Bloomberg

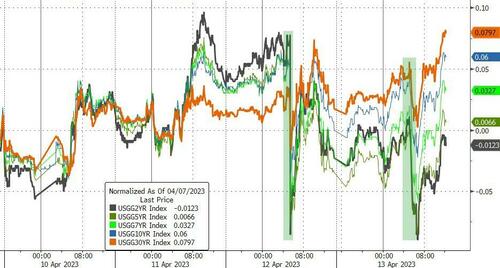

Treasury yields were all higher on the day with the long-end underperforming (30Y +6bps, 2Y +1bps). Intraday, yields tested down to yesterday's lows before bouncing back. 2Y yields remain the only ones lower on the week (barely)..

Source: Bloomberg

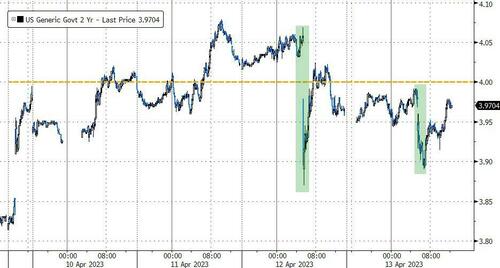

The 2Y yield closed below 4.00% for the second day in a row...

Source: Bloomberg

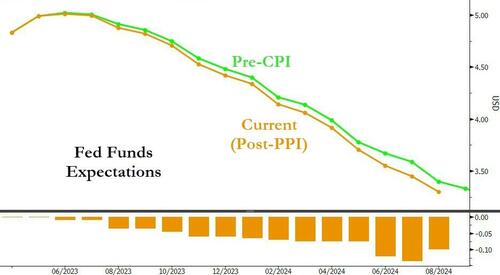

Interestingly, after an initial drop, rate-hike odds are basically flat on the day from yesterday's close, but overall - from before the CPI data, the STIRs curve is dovishly lower by around 5-10bps...

Source: Bloomberg

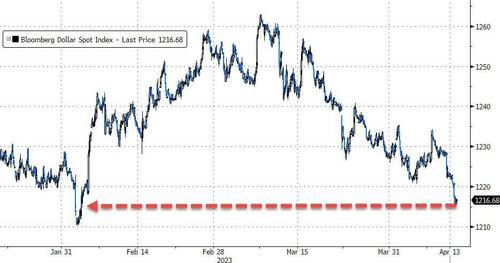

The dollar continued its decline, falling back to its lowest since 2/2...

Source: Bloomberg

Bitcoin rallied back above $30,000

Source: Bloomberg

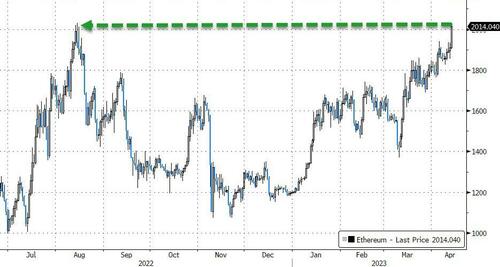

But it was Ethereum that outperformed, surging back above $2000 for the first time since Aug 2022 after its hard fork did not prompt as much staker selling pressure as feared...

Source: Bloomberg

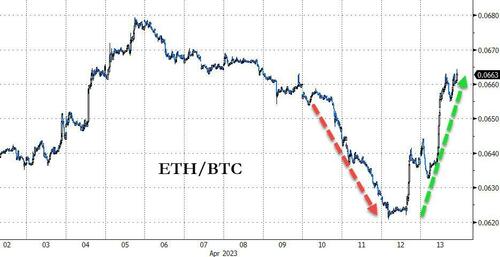

The last few days have seen ETH dumped and pumped relative to BTC as the hard fork was executed...

Source: Bloomberg

Gold has only closed higher than this on 2 days in history (8/6/20 and 3/8/22)...

Source: Bloomberg

Oil prices slipped lower today, with WTI falling from almost $83.50 intraday to almost an $81 handle by the close...

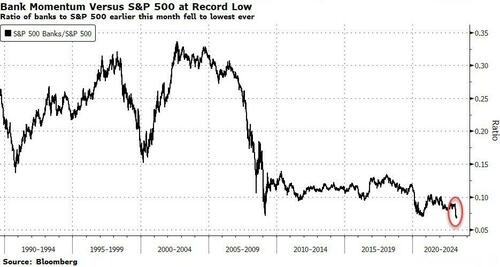

Finally, bank stocks refuse to embrace the rebound in broad stocks ahead of bank earnings beginning tomorrow. Bloomberg notes, since the March 13 low in the wake of Silicon Valley Bank’s meltdown, the S&P 500 has gained ~7% and Nasdaq 100 ~10%. But the KBW Bank Index is little changed, the KBW Regional Banking index is down ~5% and the S&P 500 banks index has fallen more than 1%. Earlier this month the ratio between the S&P 500 Banks and SPX slid to the lowest ever in data going back over 30 years.

Source: Bloomberg

Bank earnings can easily disappoint a low bar as lenders struggle with vast shifts in deposits and plummeting deal-making. Nicholas Colas, co-founder of DataTrek Research, notes bank stocks are saying “there is something wrong with this critical part of the US financial system.” Bank earnings calls may be market-moving, he wrote in a note today. Being cheap probably won’t be enough to help bank stocks.

A significantly softer than expected PPI print confirmed yesterday’s headline CPI (just ignore the core), and with no FOMC minutes or FedSpeak to get in the way today, the algos ran with it lifting stocks to yesterday’s highs, along wth gold and crypto as the dollar dived yet again.

Fed staff: Recession is coming

Markets: 😂 pic.twitter.com/q63aayxqMV

— Sven Henrich (@NorthmanTrader) April 13, 2023

Nasdaq led the surge today, as all of the US majors tagged yesterday’s highs, but could not extend (ahead of tomorrow’s retail sales print)…

Perhaps most notably in equity-land, VIX tumbled back to a 17 handle, testing its lows since Jan 2022. We also note that MOVE (bond VIX) is tumbling back from near-record highs…

Source: Bloomberg

Treasury yields were all higher on the day with the long-end underperforming (30Y +6bps, 2Y +1bps). Intraday, yields tested down to yesterday’s lows before bouncing back. 2Y yields remain the only ones lower on the week (barely)..

Source: Bloomberg

The 2Y yield closed below 4.00% for the second day in a row…

Source: Bloomberg

Interestingly, after an initial drop, rate-hike odds are basically flat on the day from yesterday’s close, but overall – from before the CPI data, the STIRs curve is dovishly lower by around 5-10bps…

Source: Bloomberg

The dollar continued its decline, falling back to its lowest since 2/2…

Source: Bloomberg

Bitcoin rallied back above $30,000

Source: Bloomberg

But it was Ethereum that outperformed, surging back above $2000 for the first time since Aug 2022 after its hard fork did not prompt as much staker selling pressure as feared…

Source: Bloomberg

The last few days have seen ETH dumped and pumped relative to BTC as the hard fork was executed…

Source: Bloomberg

Gold has only closed higher than this on 2 days in history (8/6/20 and 3/8/22)…

Source: Bloomberg

Oil prices slipped lower today, with WTI falling from almost $83.50 intraday to almost an $81 handle by the close…

Finally, bank stocks refuse to embrace the rebound in broad stocks ahead of bank earnings beginning tomorrow. Bloomberg notes, since the March 13 low in the wake of Silicon Valley Bank’s meltdown, the S&P 500 has gained ~7% and Nasdaq 100 ~10%. But the KBW Bank Index is little changed, the KBW Regional Banking index is down ~5% and the S&P 500 banks index has fallen more than 1%. Earlier this month the ratio between the S&P 500 Banks and SPX slid to the lowest ever in data going back over 30 years.

Source: Bloomberg

Bank earnings can easily disappoint a low bar as lenders struggle with vast shifts in deposits and plummeting deal-making. Nicholas Colas, co-founder of DataTrek Research, notes bank stocks are saying “there is something wrong with this critical part of the US financial system.” Bank earnings calls may be market-moving, he wrote in a note today. Being cheap probably won’t be enough to help bank stocks.

Loading…