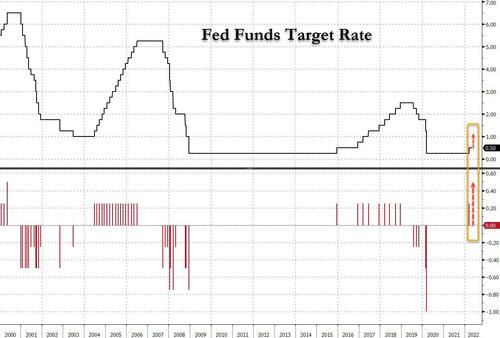

At the conclusion of tomorrow's FOMC meeting, consensus expects the Committee to raise the target range for the federal funds rate by 50bp to 0.75% to 1.0%, the first "double" rate hike since May 2000 (when the Fed definitively burst the dot com bubble)...

... and to announce the start of the reduction of the size of the Fed’s balance sheet, in line with the parameters set out in the March FOMC minutes, somewhere to the tune of $95BN-$100BN per month in bond maturities without active sales (for now).

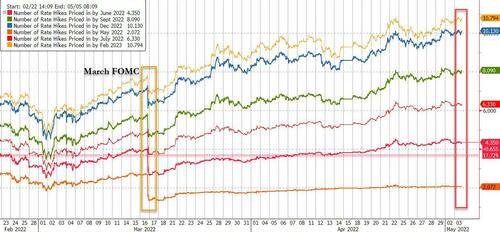

As shown below, while a 50bps rate hike is fully priced in (and in fact, markets are pricing in a modest probability of a 75bps rate hike), rates traders price a roughly 35% chance of a 75bps rate hike in the June meeting. Overall, markets are expecting just over 10 rate hikes by year-end and just under 11 rate hikes through February 2023, at which point the Fed is expected to halt its tightening cycle and start easing.

In its FOMC preview, JPMorgan expects the most relevant part of the FOMC statement — the forward guidance on rates — to indicate an expectation that “ongoing increases” in the funds rate will be appropriate; in the post-meeting press conference the bank looks for Powell to convey the need to expeditiously return the funds rate to neutral, and the high likelihood that the funds rate will need to go into restrictive territory.

Notably, JPM believes that it is possible we could see a dissent or two for a larger 75bp move, and while the bank thinks there’s an outside chance (perhaps one-in-five) that the hawks persuade their colleagues to support this bigger move, it sees most of the Committee preferring moves in 50bp increments until they finally get the desired tightening in financial conditions.

Turning to the fundamentals, JPM notes that it’s pretty clear that this economy doesn’t need stimulative monetary policy. However, less clear are the speed at which this stimulus should be removed, and the reasons for choosing that speed. Whatever the reasons, almost all FOMC policymakers who spoke since the last meeting indicated varying degrees of comfort with hiking by 50bp at next week’s meeting. Notably, Bullard suggested 75bp might be more appropriate (and more “expeditious” than 50bp), though this seemed to receive little buy-in among other Fed officials. According to JPM, "the near-unanimity of this view suggests that perhaps this option has already been tacitly agreed upon, through either a conference call or bilateral calls." Indeed, the Powell Fed has displayed a strong preference to telegraph its intentions ahead of meeting day, and for that reason 50bps is the most likely outcome . But if there is a time to break from habit it’s when the Fed’s inflation credibility is being called into question 0 like right now - and so don’t fully write off the possibility of a larger rate move.

The statement’s forward guidance will be another critical channel by which to influence financial conditions. The Committee is expected to copy the guidance from the last meeting, that it “anticipates that ongoing increases in the target range will be appropriate.” If this phrase is used at meetings at which the FOMC hikes by 25bp (March) and 50bp (May, presumably), then it wouldn’t lock in expectations for a given size of future rate increases, only that more hikes are needed. The risks to this guidance skew very hawkish. However, something like “continue to expeditiously remove accommodation” might imply 50s until the funds rate gets to neutral, which may be too much for the majority of the Committee to stomach.

Other changes to the FOMC statement should be fairly modest. Given the contraction in GDP in 1Q, the upbeat phrase about economic activity could be replaced with an upbeat phrase about domestic demand (more particularly about consumer and business spending).

Turning to QT, the statement will almost certainly indicate the start of balance sheet reduction (QT), though most of the details of that decision will be relegated to an accompanying "implementation note." Those details will stick closely to the plan spelled out in the March FOMC meeting minutes: monthly runoff caps of $60bn for Treasuries and $35bn for mortgages, and will likely be phased in over a period of three months.

As per recent public remarks, actual asset run-off will likely begin at the start of June. Fed officials have indicated that they expect the balance sheet reduction will be a set-it-and-forget-it process, although that's what Yellen said back before the previous QT and we all know how that ended. JPM thinks there is a chance in coming months that the Committee could revisit their decision to subject T-bill runoff to the monthly caps for Treasuries. That said, don’t expect to hear anything further on asset sales in the implementation note.

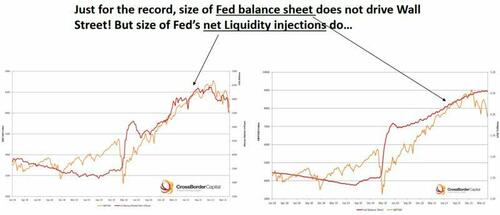

Needless to say, QT matters: as these charts from Crossborder Capital's from Mike Howell show, the S&P 500 reacts in real time to rises and falls in the balance sheet. The Fed has already made some liquidity reductions since the turn of the year, and they coincided more or less exactly with the beginning of the trouble for the stock market:

As Bloomberg's John Authers adds, a further factor is QT’s effect on collateral, or on the ability to roll over or refinance investments: it leaves less cash in markets, and make it harder to find collateral when it is needed (this is what triggered the infamous repo crash of Sept 2019 which then led to the even more infamous "NOT QE" QE episode of late 2019. Sharp QT implies a drastic tightening of conditions and the risk of financial accidents. For an analogy, Authers writes, "remember the subprime debacle. That was based on the assumption that adjustable-rate mortgages with low teaser rates could swiftly be refinanced before higher rates bit. It was when borrowers found that they couldn’t refinance, and then started to default, that the crisis set in."

It is the the risk of such accidents, which will first and foremost hit the same tech stocks that benefited greatly from the Fed's balance sheet expansion in the past decade...

... that leaves many in the market still deeply skeptical that QT will happen as scheduled. The following comment from Bear Traps Report author Larry McDonald captures this reality best:

The beast inside the market has Chair Powell in his sights for the 2nd time since Q 4 2018. Once again it was the Fed whispering into the ear of a journalist over the weekend: “The Fed is set to start shrinking its 9 trillion asset portfolio Their plan rhymes with the 2017-19 version. But this time will be different They’re going sooner and faster all while preparing a speedier pace of rate increases because inflation is high." WSJ Sunday.

Hilarious. The Fed went to 50BN a month in September of 2018 and had to stop five minutes later in December this was after promising Wall St economists they were on Auto pilot all the way up to a 2T reduction. Now, they are going to give it a try at 90B a month in May with back to back 50 bp hikes? Who are they kidding?

It's the worst start to a year for stocks in decades, consumer savings is down to the bone, GDP prints negative, and the Fed is going to kick off a record tightening cycle? It´s all a show. With conviction we see a near term top in the US dollar and another leg up for hard assets, value vs growth and emerging markets.

Humor aside, JPM concludes by noting that while the statement will be agnostic as to the size of future rate moves, Powell can use the press conference to refine this message and will likely indicate that hikes of 50bp or larger are fair game in coming meetings. More generally, both JPM - and the broader market - expects a sternly hawkish tone from the Chair. That said, considering the recent negative GDP print, even a modest trace of dovishness will send risk assets soaring.

Speaking of which, JPM is leaning on the dovish side, and the bank's chief economist Mike Feroli thinks the Fed will only deliver two 50bps rate hikes, well below the four 50bps rate hikes currently priced by the market; for those who agree, JPM urges putting on some long risk particularly in the Tech segment: "Our Derivatives team has seen some interest in bullish cash spreads on Nasdaq/QQQs... Separately, our Delta-One team has seen client interest in switching out of SPX/SPY hedges into something that shows more material downside if we have an extended rally that is similar to what we saw on Thursday."

To be sure, JPM admits that the above is the “glass is half full” argument. What would prevent this to coming to fruition? Well, according to Andrew Tyler from JPM's flow trading desk, "the reaction to Financials and MegaCap Tech tell us that investors have a base case that the Fed will tightening us into a recession which is exacerbated by commodity-based inflation that will increasingly hurt consumption."

Further, these risks are (i) magnified by China’s COVID-Zero policy, which has yet to be fully incorporated into economic forecast and could trigger another wave of earnings downgrades; and, (ii) Russia/Ukraine. The RU/UKR situation seems likely to extend longer than anticipated with the largest risks to the US coming via the Ags complex, driven by both a lack of fertilizer inducing a global redux in crop yield and reduced commodity exports from both countries.

As a result, the JPM trader warns that "it may be the case that any rally will be sold until the aforementioned risks are closer to being solved. If so, then remain tactical, remain market-neutral, and consider taking some swings using derivatives if your investment style permits."

In conclusion, all we can say is that what the Fed plans to do is one thing. What the market will let it do, is something else, and inflation or no inflation (expect the definition of CPI to be fully revised in a few months to exclude anything that is surging in price) we expect Powell will abort the Fed's tightening process early, just like it did in Q4 2018, with stocks cratering to drive the point home, and forcing the Fed to not only end its tightening but to fast forward to easing and even more QE.

At the conclusion of tomorrow’s FOMC meeting, consensus expects the Committee to raise the target range for the federal funds rate by 50bp to 0.75% to 1.0%, the first “double” rate hike since May 2000 (when the Fed definitively burst the dot com bubble)…

… and to announce the start of the reduction of the size of the Fed’s balance sheet, in line with the parameters set out in the March FOMC minutes, somewhere to the tune of $95BN-$100BN per month in bond maturities without active sales (for now).

As shown below, while a 50bps rate hike is fully priced in (and in fact, markets are pricing in a modest probability of a 75bps rate hike), rates traders price a roughly 35% chance of a 75bps rate hike in the June meeting. Overall, markets are expecting just over 10 rate hikes by year-end and just under 11 rate hikes through February 2023, at which point the Fed is expected to halt its tightening cycle and start easing.

In its FOMC preview, JPMorgan expects the most relevant part of the FOMC statement — the forward guidance on rates — to indicate an expectation that “ongoing increases” in the funds rate will be appropriate; in the post-meeting press conference the bank looks for Powell to convey the need to expeditiously return the funds rate to neutral, and the high likelihood that the funds rate will need to go into restrictive territory.

Notably, JPM believes that it is possible we could see a dissent or two for a larger 75bp move, and while the bank thinks there’s an outside chance (perhaps one-in-five) that the hawks persuade their colleagues to support this bigger move, it sees most of the Committee preferring moves in 50bp increments until they finally get the desired tightening in financial conditions.

Turning to the fundamentals, JPM notes that it’s pretty clear that this economy doesn’t need stimulative monetary policy. However, less clear are the speed at which this stimulus should be removed, and the reasons for choosing that speed. Whatever the reasons, almost all FOMC policymakers who spoke since the last meeting indicated varying degrees of comfort with hiking by 50bp at next week’s meeting. Notably, Bullard suggested 75bp might be more appropriate (and more “expeditious” than 50bp), though this seemed to receive little buy-in among other Fed officials. According to JPM, “the near-unanimity of this view suggests that perhaps this option has already been tacitly agreed upon, through either a conference call or bilateral calls.” Indeed, the Powell Fed has displayed a strong preference to telegraph its intentions ahead of meeting day, and for that reason 50bps is the most likely outcome . But if there is a time to break from habit it’s when the Fed’s inflation credibility is being called into question 0 like right now – and so don’t fully write off the possibility of a larger rate move.

The statement’s forward guidance will be another critical channel by which to influence financial conditions. The Committee is expected to copy the guidance from the last meeting, that it “anticipates that ongoing increases in the target range will be appropriate.” If this phrase is used at meetings at which the FOMC hikes by 25bp (March) and 50bp (May, presumably), then it wouldn’t lock in expectations for a given size of future rate increases, only that more hikes are needed. The risks to this guidance skew very hawkish. However, something like “continue to expeditiously remove accommodation” might imply 50s until the funds rate gets to neutral, which may be too much for the majority of the Committee to stomach.

Other changes to the FOMC statement should be fairly modest. Given the contraction in GDP in 1Q, the upbeat phrase about economic activity could be replaced with an upbeat phrase about domestic demand (more particularly about consumer and business spending).

Turning to QT, the statement will almost certainly indicate the start of balance sheet reduction (QT), though most of the details of that decision will be relegated to an accompanying “implementation note.” Those details will stick closely to the plan spelled out in the March FOMC meeting minutes: monthly runoff caps of $60bn for Treasuries and $35bn for mortgages, and will likely be phased in over a period of three months.

As per recent public remarks, actual asset run-off will likely begin at the start of June. Fed officials have indicated that they expect the balance sheet reduction will be a set-it-and-forget-it process, although that’s what Yellen said back before the previous QT and we all know how that ended. JPM thinks there is a chance in coming months that the Committee could revisit their decision to subject T-bill runoff to the monthly caps for Treasuries. That said, don’t expect to hear anything further on asset sales in the implementation note.

Needless to say, QT matters: as these charts from Crossborder Capital’s from Mike Howell show, the S&P 500 reacts in real time to rises and falls in the balance sheet. The Fed has already made some liquidity reductions since the turn of the year, and they coincided more or less exactly with the beginning of the trouble for the stock market:

As Bloomberg’s John Authers adds, a further factor is QT’s effect on collateral, or on the ability to roll over or refinance investments: it leaves less cash in markets, and make it harder to find collateral when it is needed (this is what triggered the infamous repo crash of Sept 2019 which then led to the even more infamous “NOT QE” QE episode of late 2019. Sharp QT implies a drastic tightening of conditions and the risk of financial accidents. For an analogy, Authers writes, “remember the subprime debacle. That was based on the assumption that adjustable-rate mortgages with low teaser rates could swiftly be refinanced before higher rates bit. It was when borrowers found that they couldn’t refinance, and then started to default, that the crisis set in.”

It is the the risk of such accidents, which will first and foremost hit the same tech stocks that benefited greatly from the Fed’s balance sheet expansion in the past decade…

… that leaves many in the market still deeply skeptical that QT will happen as scheduled. The following comment from Bear Traps Report author Larry McDonald captures this reality best:

The beast inside the market has Chair Powell in his sights for the 2nd time since Q 4 2018. Once again it was the Fed whispering into the ear of a journalist over the weekend: “The Fed is set to start shrinking its 9 trillion asset portfolio Their plan rhymes with the 2017-19 version. But this time will be different They’re going sooner and faster all while preparing a speedier pace of rate increases because inflation is high.” WSJ Sunday.

Hilarious. The Fed went to 50BN a month in September of 2018 and had to stop five minutes later in December this was after promising Wall St economists they were on Auto pilot all the way up to a 2T reduction. Now, they are going to give it a try at 90B a month in May with back to back 50 bp hikes? Who are they kidding?

It’s the worst start to a year for stocks in decades, consumer savings is down to the bone, GDP prints negative, and the Fed is going to kick off a record tightening cycle? It´s all a show. With conviction we see a near term top in the US dollar and another leg up for hard assets, value vs growth and emerging markets.

Humor aside, JPM concludes by noting that while the statement will be agnostic as to the size of future rate moves, Powell can use the press conference to refine this message and will likely indicate that hikes of 50bp or larger are fair game in coming meetings. More generally, both JPM – and the broader market – expects a sternly hawkish tone from the Chair. That said, considering the recent negative GDP print, even a modest trace of dovishness will send risk assets soaring.

Speaking of which, JPM is leaning on the dovish side, and the bank’s chief economist Mike Feroli thinks the Fed will only deliver two 50bps rate hikes, well below the four 50bps rate hikes currently priced by the market; for those who agree, JPM urges putting on some long risk particularly in the Tech segment: “Our Derivatives team has seen some interest in bullish cash spreads on Nasdaq/QQQs… Separately, our Delta-One team has seen client interest in switching out of SPX/SPY hedges into something that shows more material downside if we have an extended rally that is similar to what we saw on Thursday.”

To be sure, JPM admits that the above is the “glass is half full” argument. What would prevent this to coming to fruition? Well, according to Andrew Tyler from JPM’s flow trading desk, “the reaction to Financials and MegaCap Tech tell us that investors have a base case that the Fed will tightening us into a recession which is exacerbated by commodity-based inflation that will increasingly hurt consumption.”

Further, these risks are (i) magnified by China’s COVID-Zero policy, which has yet to be fully incorporated into economic forecast and could trigger another wave of earnings downgrades; and, (ii) Russia/Ukraine. The RU/UKR situation seems likely to extend longer than anticipated with the largest risks to the US coming via the Ags complex, driven by both a lack of fertilizer inducing a global redux in crop yield and reduced commodity exports from both countries.

As a result, the JPM trader warns that “it may be the case that any rally will be sold until the aforementioned risks are closer to being solved. If so, then remain tactical, remain market-neutral, and consider taking some swings using derivatives if your investment style permits.”

In conclusion, all we can say is that what the Fed plans to do is one thing. What the market will let it do, is something else, and inflation or no inflation (expect the definition of CPI to be fully revised in a few months to exclude anything that is surging in price) we expect Powell will abort the Fed’s tightening process early, just like it did in Q4 2018, with stocks cratering to drive the point home, and forcing the Fed to not only end its tightening but to fast forward to easing and even more QE.