Authored by Simon White, Bloomberg macro strategist,

A higher-for-longer Fed and a sharp increase in demand for VIX calls point to rising equity-market volatility, making downside hedges for a still-fragile stock market look undervalued.

Whisper it, but we may be close to peak Fed hawkishness. Fed officials have begun to discuss easing back on the pace of the rate hikes, with the market consensus coalescing around a tapered step-down over the next three meetings of 75, 50 then 25 bps.

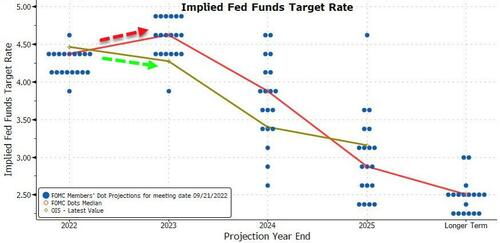

The view is forming that the Fed will try to hold rates at this level to gauge what happens to the economy, i.e. the peak rate will be maintained for an extended period. The rate cuts currently priced in between 2023 and 2024 should therefore come out.

I noted last month a quite extraordinary relationship - a strong association between Fed cuts priced in and the relative demand for deep out-of-the-money put options in the S&P, i.e. crash insurance.

Thus as the anticipated Fed cuts come out of the curve, the relative price of deep out-of-the-money equity protection is likely to rise.

The VIX is extremely low versus at-the-money volatility, suggesting it has been depressed by the relative cheapness of this deep out-of-the-money protection. The VIX should then rise as the market demands a higher premium to protect against tail-risks.

This concurs with VIX option traders’ expectations.

There has been a steady and sharp rise in call buying of the VIX this year and, as the chart below shows, this often precedes a sharp rise in the VIX itself.

Despite the recent bounce off the lows in equities, this remains an ill-functioning market suffering from poor liquidity. Deeper declines remain a risk while excess liquidity is poor, global financial conditions are extremely tight and global headwinds mount for US earnings, not least the increasing economic isolation of China.

Demand for downside equity protection is likely to rise, although paradoxically peak Fed hawkishness could lead to the VIX moving higher, making protection more expensive. Until the market sees a strong change of intent from the Fed and rate cuts, the downside risks endemic to a bear market remain.

Authored by Simon White, Bloomberg macro strategist,

A higher-for-longer Fed and a sharp increase in demand for VIX calls point to rising equity-market volatility, making downside hedges for a still-fragile stock market look undervalued.

Whisper it, but we may be close to peak Fed hawkishness. Fed officials have begun to discuss easing back on the pace of the rate hikes, with the market consensus coalescing around a tapered step-down over the next three meetings of 75, 50 then 25 bps.

The view is forming that the Fed will try to hold rates at this level to gauge what happens to the economy, i.e. the peak rate will be maintained for an extended period. The rate cuts currently priced in between 2023 and 2024 should therefore come out.

I noted last month a quite extraordinary relationship – a strong association between Fed cuts priced in and the relative demand for deep out-of-the-money put options in the S&P, i.e. crash insurance.

Thus as the anticipated Fed cuts come out of the curve, the relative price of deep out-of-the-money equity protection is likely to rise.

The VIX is extremely low versus at-the-money volatility, suggesting it has been depressed by the relative cheapness of this deep out-of-the-money protection. The VIX should then rise as the market demands a higher premium to protect against tail-risks.

This concurs with VIX option traders’ expectations.

There has been a steady and sharp rise in call buying of the VIX this year and, as the chart below shows, this often precedes a sharp rise in the VIX itself.

Despite the recent bounce off the lows in equities, this remains an ill-functioning market suffering from poor liquidity. Deeper declines remain a risk while excess liquidity is poor, global financial conditions are extremely tight and global headwinds mount for US earnings, not least the increasing economic isolation of China.

Demand for downside equity protection is likely to rise, although paradoxically peak Fed hawkishness could lead to the VIX moving higher, making protection more expensive. Until the market sees a strong change of intent from the Fed and rate cuts, the downside risks endemic to a bear market remain.