Authored by Simon White, Bloomberg macro strategist,

The economy and markets are giving divergent views on US recession risk, with the recent performance of several assets sending out a more negative message than justified by the economic data. Oil, copper, some cyclical sectors and yields look among the most mispriced if — as looks more likely than not — a slump is avoided.

Price is the primary driver of narratives in markets. This week’s CPI miss in the US is a case in point: the steep positioning-led drop in bond yields fed a narrative that inflation is over and the Federal Reserve is done hiking rates. However, it’s highly doubtful that core CPI coming in a tenth of a percent less than expected is enough to justify such an assertive change to the outlook.

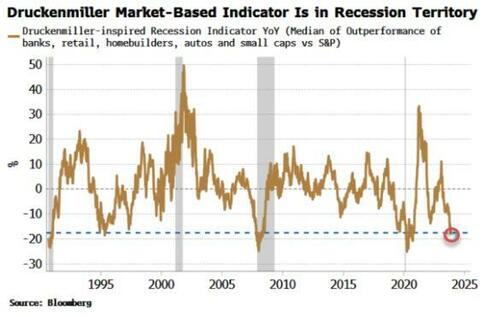

Still, it underpinned a burgeoning recession narrative in markets. Most stark has been the underperformance of some of the most cyclical sectors. An indicator based on the methodology of Stanley Druckenmiller — who has said “the inside” of the stock market is the best economist he knows — is at levels that have previously coincided with a recession.

Also oil has slumped, copper is weak and US rates markets now expect almost 100 bps of cuts next year. But this is all contrary to a surfeit of economic data that indicates the risk of an NBER recession is in fact receding.

Which one is right then, the market or economic data

That’s a knotty question, as I’ll explain, but the short answer is the market looks too pessimistic on the outlook, meaning if a recession is sidestepped, there are potential mispricings in bond yields, some commodities, and in cyclical sectors such as energy, retail and banks.

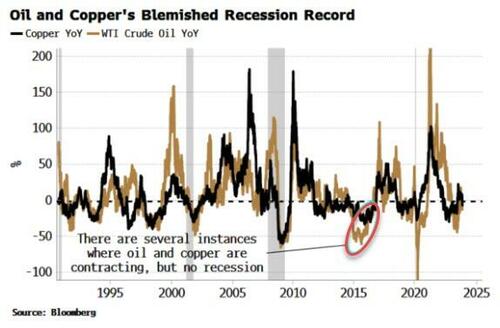

Markets are not always right. Certainly when it comes to using copper or oil as recession indicators, they are no better than economists, predicting more slumps than have actually occurred. As the chart below shows, there are multiple times where oil and copper have been contracting on an annual basis, but there has been no recession.

So how should we think about markets and economies in relation to recessions?

Economic contractions are regime shifts that occur when hard, real-economy data and soft, market and survey-based data reinforce one other negatively. Weaker than expected economic data feeds negatively into markets. Weaker markets, in turn, negatively affect the real economy through channels such as widening credit spreads.

A deterioration in the real economy is reflected back once again to market prices. Wash, rinse, repeat, and a recession rapidly occurs.

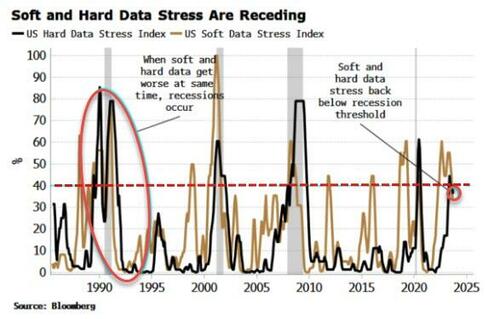

The chart below shows how hard and soft data interact. Soft data becomes stressed fairly regularly, but unless the hard data becomes likewise, a recession is avoided. Recently, hard and soft-data stress levels were at a level that has previously meant a recession, but both are now falling.

What happened differently this time?

Tight financial conditions are the grist to the mill of fomenting the pernicious feedback loops between hard and soft data that catalyze a recession. But for the last year or so, financial conditions have on net been loosening, whereas previously when both hard and soft data were significantly stressed they were tightening. Contained credit spreads, subdued equity vol (the two are linked) and a surprisingly resilient stock market have all conspired to keep financial conditions looser than they otherwise would have been, keeping a recession at bay.

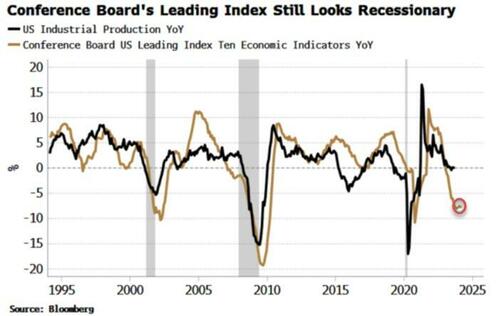

Nonetheless, some leading economic indicators are still signaling a recession is on the way. The most widely followed is the Conference Board’s Leading Index (CBLI), composed of 10 indicators.

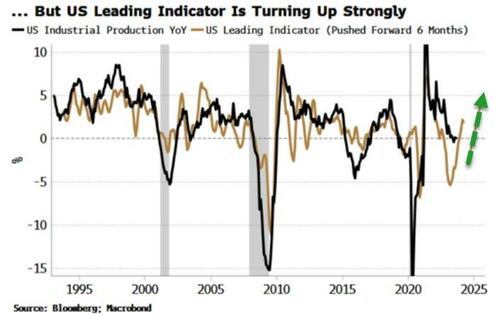

It stands in stark contrast to my own US leading indicator, which is turning up strongly (right chart below).

The difference in the two comes from how the indicators are constructed. The US leading indicator is more reactive to changes than the CBLI as its inputs are based on 6-month rather than 12-month changes. Leading economic data is in fact improving, as reflected in my US leading indicator — but this has not yet been picked up by the CBLI.

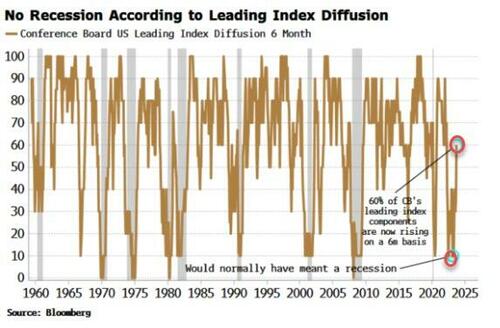

However, if we look under the hood of the CBLI then it too is looking decidedly non-recessionary. The 6-month diffusion of the CBLI (i.e. a count of how many of its ten inputs are rising on a 6-month basis), is turning up strongly.

It reached a low of 10% in May - which would normally have almost guaranteed a recession — but has since risen to 60%, a level more compatible with an economic expansion. (The reason why the CBLI gave a false positive for a recession this time is due to the bifurcation in the recoveries in the goods and services economies after the pandemic.)

In fact, if we look at a larger set of leading data, as I did in last week’s column, the odds of the NBER declaring a recession over the next approximately six to nine months is looking less likely than so.

A deterioration in the credit market — the biggest non-geopolitical risk to the economy — would significantly worsen the outlook through tightening financial conditions. Credit is vulnerable to weakening underlying fundamentals and the murkiness of the risks in the now sizable private-credit market. A credit downturn would be prone to rapidly setting off a negative feedback loop between markets and the economy, resulting in a recession.

Absent that, in the coming months it should become clearer that the US will not experience a full-blown recession in the near future. That would make, for example, oil start to look too pessimistically priced, especially as excess liquidity remains a tailwind. Yields would also be biased higher as rate-cut expectations are pared back, and poor Treasury-market liquidity remains a negative risk for bonds. Also some cyclical sectors should outperform, such as energy, as commodity prices rise; retail, as leading indicators point to a continued recovery in consumption; and banks.

Price can create its own reality, but this time around the recessionary pricing in markets is not currently grave enough to make one so.

Authored by Simon White, Bloomberg macro strategist,

The economy and markets are giving divergent views on US recession risk, with the recent performance of several assets sending out a more negative message than justified by the economic data. Oil, copper, some cyclical sectors and yields look among the most mispriced if — as looks more likely than not — a slump is avoided.

Price is the primary driver of narratives in markets. This week’s CPI miss in the US is a case in point: the steep positioning-led drop in bond yields fed a narrative that inflation is over and the Federal Reserve is done hiking rates. However, it’s highly doubtful that core CPI coming in a tenth of a percent less than expected is enough to justify such an assertive change to the outlook.

Still, it underpinned a burgeoning recession narrative in markets. Most stark has been the underperformance of some of the most cyclical sectors. An indicator based on the methodology of Stanley Druckenmiller — who has said “the inside” of the stock market is the best economist he knows — is at levels that have previously coincided with a recession.

Also oil has slumped, copper is weak and US rates markets now expect almost 100 bps of cuts next year. But this is all contrary to a surfeit of economic data that indicates the risk of an NBER recession is in fact receding.

Which one is right then, the market or economic data?

That’s a knotty question, as I’ll explain, but the short answer is the market looks too pessimistic on the outlook, meaning if a recession is sidestepped, there are potential mispricings in bond yields, some commodities, and in cyclical sectors such as energy, retail and banks.

Markets are not always right. Certainly when it comes to using copper or oil as recession indicators, they are no better than economists, predicting more slumps than have actually occurred. As the chart below shows, there are multiple times where oil and copper have been contracting on an annual basis, but there has been no recession.

So how should we think about markets and economies in relation to recessions?

Economic contractions are regime shifts that occur when hard, real-economy data and soft, market and survey-based data reinforce one other negatively. Weaker than expected economic data feeds negatively into markets. Weaker markets, in turn, negatively affect the real economy through channels such as widening credit spreads.

A deterioration in the real economy is reflected back once again to market prices. Wash, rinse, repeat, and a recession rapidly occurs.

The chart below shows how hard and soft data interact. Soft data becomes stressed fairly regularly, but unless the hard data becomes likewise, a recession is avoided. Recently, hard and soft-data stress levels were at a level that has previously meant a recession, but both are now falling.

What happened differently this time?

Tight financial conditions are the grist to the mill of fomenting the pernicious feedback loops between hard and soft data that catalyze a recession. But for the last year or so, financial conditions have on net been loosening, whereas previously when both hard and soft data were significantly stressed they were tightening. Contained credit spreads, subdued equity vol (the two are linked) and a surprisingly resilient stock market have all conspired to keep financial conditions looser than they otherwise would have been, keeping a recession at bay.

Nonetheless, some leading economic indicators are still signaling a recession is on the way. The most widely followed is the Conference Board’s Leading Index (CBLI), composed of 10 indicators.

It stands in stark contrast to my own US leading indicator, which is turning up strongly (right chart below).

The difference in the two comes from how the indicators are constructed. The US leading indicator is more reactive to changes than the CBLI as its inputs are based on 6-month rather than 12-month changes. Leading economic data is in fact improving, as reflected in my US leading indicator — but this has not yet been picked up by the CBLI.

However, if we look under the hood of the CBLI then it too is looking decidedly non-recessionary. The 6-month diffusion of the CBLI (i.e. a count of how many of its ten inputs are rising on a 6-month basis), is turning up strongly.

It reached a low of 10% in May – which would normally have almost guaranteed a recession — but has since risen to 60%, a level more compatible with an economic expansion. (The reason why the CBLI gave a false positive for a recession this time is due to the bifurcation in the recoveries in the goods and services economies after the pandemic.)

In fact, if we look at a larger set of leading data, as I did in last week’s column, the odds of the NBER declaring a recession over the next approximately six to nine months is looking less likely than so.

A deterioration in the credit market — the biggest non-geopolitical risk to the economy — would significantly worsen the outlook through tightening financial conditions. Credit is vulnerable to weakening underlying fundamentals and the murkiness of the risks in the now sizable private-credit market. A credit downturn would be prone to rapidly setting off a negative feedback loop between markets and the economy, resulting in a recession.

Absent that, in the coming months it should become clearer that the US will not experience a full-blown recession in the near future. That would make, for example, oil start to look too pessimistically priced, especially as excess liquidity remains a tailwind. Yields would also be biased higher as rate-cut expectations are pared back, and poor Treasury-market liquidity remains a negative risk for bonds. Also some cyclical sectors should outperform, such as energy, as commodity prices rise; retail, as leading indicators point to a continued recovery in consumption; and banks.

Price can create its own reality, but this time around the recessionary pricing in markets is not currently grave enough to make one so.

Loading…