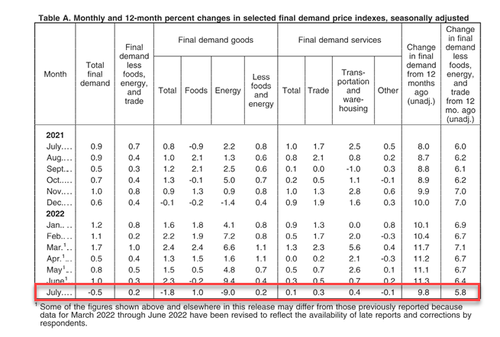

After 27 straight monthly increases, Producer Prices dropped in July (-0.5%), notably colder than the +0.2% expected - the biggest drop since April 2020. But on a YoY basis, PPI remains up a shocking 9.8%...

Source: Bloomberg

However, Core PPI rose 0.4% MoM, which means on a YoY basis core producer prices are up 7.6% (lower than June's +8.2% but still near record highs).

Goods PPI fell 1.8%, dominated by a 9.0% drop in Energy.

Eighty percent of the July decline in the index for final demand goods is attributable to gasoline prices, which fell 16.7 percent.

The indexes for diesel fuel, gas fuels, oilseeds, iron and steel scrap, and grains also moved lower.

In contrast, prices for chicken eggs jumped 43.1 percent.

The indexes for industrial chemicals and for electric power also increased.

Conversely, the indexes for final demand foods and for final demand goods less foods and energy rose 1.0 percent and 0.2 percent, respectively.

The index for final demand services inched up 0.1 percent in July, the third consecutive increase.

Leading the July advance, margins for final demand trade services rose 0.3 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.) Prices for final demand transportation and warehousing services moved up 0.4 percent. Conversely, final demand services less trade, transportation, and warehousing decreased 0.1 percent.

Leading the July increase in prices for final demand services, margins for fuels and lubricants retailing rose 12.3 percent. The indexes for services related to securities brokerage and dealing (partial), hospital outpatient care, automobiles and automobile parts retailing, and transportation of passengers (partial) also moved higher. In contrast, prices for portfolio management declined 7.9 percent. The indexes for securities brokerage, dealing, and investment advice; food and alcohol retailing; and long-distance motor carrying also fell.

Somewhat confirming this drop, we note that secondary demand PPI is tumbling...

Source: Bloomberg

That is the biggest drop in intermediate demand PPI since Lehman...

As Stephanie Pomboy noted yesterday, while markets celebrating softer CPI as meaning less Fed rate hikes, they are missing a critical part of the story. What does it mean for margins?

For the 19th straight month, PPI has exceeded CPI, implying significant margin pressure on American businesses...

Source: Bloomberg

So judging by yesterday's euphoria over CPI, will we now hear celebrations for the MoM deflation? And will we need a "Deflationary Reduction Bill"?

After 27 straight monthly increases, Producer Prices dropped in July (-0.5%), notably colder than the +0.2% expected – the biggest drop since April 2020. But on a YoY basis, PPI remains up a shocking 9.8%…

Source: Bloomberg

However, Core PPI rose 0.4% MoM, which means on a YoY basis core producer prices are up 7.6% (lower than June’s +8.2% but still near record highs).

Goods PPI fell 1.8%, dominated by a 9.0% drop in Energy.

Eighty percent of the July decline in the index for final demand goods is attributable to gasoline prices, which fell 16.7 percent.

The indexes for diesel fuel, gas fuels, oilseeds, iron and steel scrap, and grains also moved lower.

In contrast, prices for chicken eggs jumped 43.1 percent.

The indexes for industrial chemicals and for electric power also increased.

Conversely, the indexes for final demand foods and for final demand goods less foods and energy rose 1.0 percent and 0.2 percent, respectively.

The index for final demand services inched up 0.1 percent in July, the third consecutive increase.

Leading the July advance, margins for final demand trade services rose 0.3 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.) Prices for final demand transportation and warehousing services moved up 0.4 percent. Conversely, final demand services less trade, transportation, and warehousing decreased 0.1 percent.

Leading the July increase in prices for final demand services, margins for fuels and lubricants retailing rose 12.3 percent. The indexes for services related to securities brokerage and dealing (partial), hospital outpatient care, automobiles and automobile parts retailing, and transportation of passengers (partial) also moved higher. In contrast, prices for portfolio management declined 7.9 percent. The indexes for securities brokerage, dealing, and investment advice; food and alcohol retailing; and long-distance motor carrying also fell.

Somewhat confirming this drop, we note that secondary demand PPI is tumbling…

Source: Bloomberg

That is the biggest drop in intermediate demand PPI since Lehman…

As Stephanie Pomboy noted yesterday, while markets celebrating softer CPI as meaning less Fed rate hikes, they are missing a critical part of the story. What does it mean for margins?

For the 19th straight month, PPI has exceeded CPI, implying significant margin pressure on American businesses…

Source: Bloomberg

So judging by yesterday’s euphoria over CPI, will we now hear celebrations for the MoM deflation? And will we need a “Deflationary Reduction Bill”?