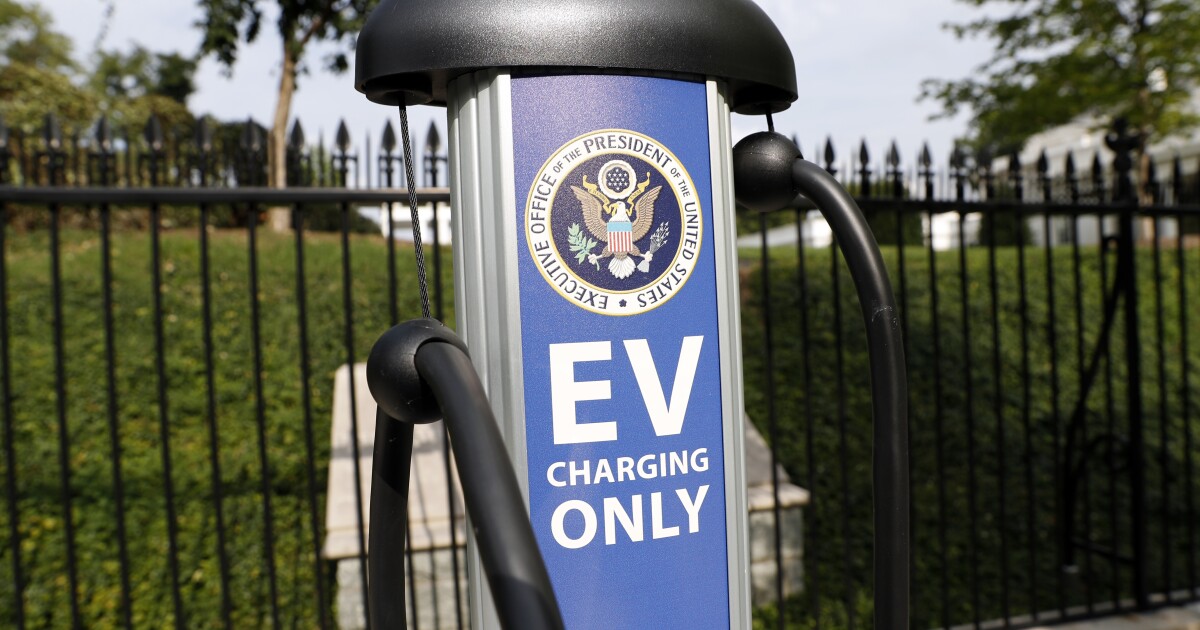

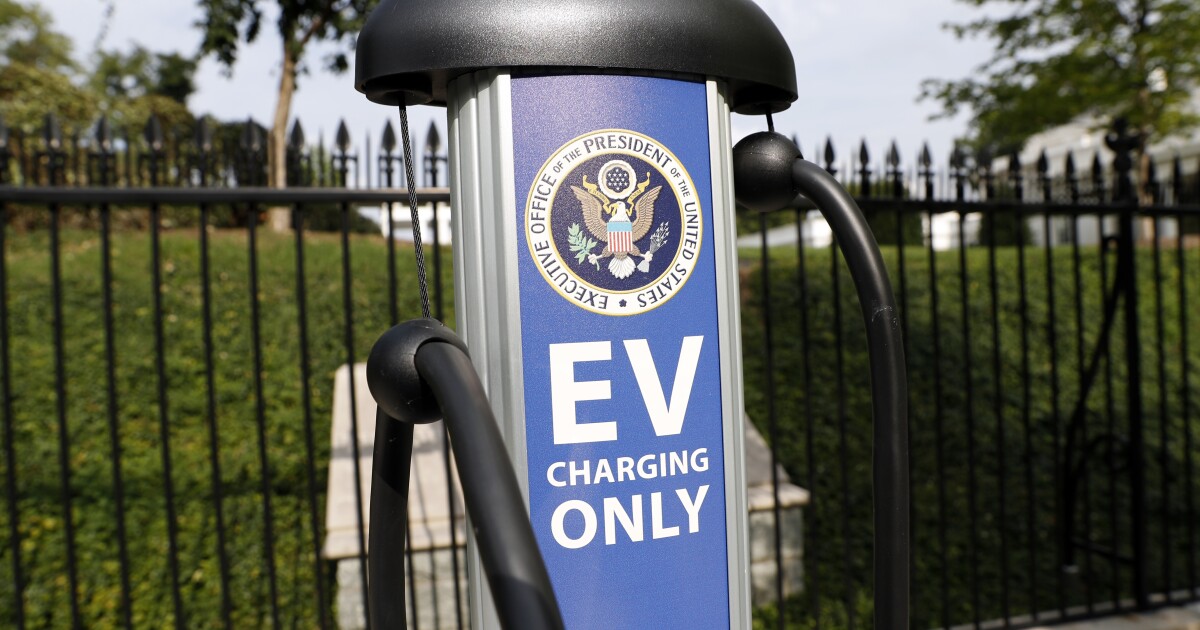

Electric vehicle sales increased significantly in the United States in 2023, but they are still not on track to meet the Biden administration’s ambitious targets by the end of the decade, and range anxiety and limited access to charging infrastructure are some of the primary hurdles to adoption.

To be sure, EV sales have seen strong growth in 2023, passing the 1 million mark for the first time in November, according to data from the National Automobile Dealer Association. That’s a major milestone and a more than 50% sales increase compared to the same point in 2022.

NEW YORK BILL WOULD REQUIRE SOME CHICK-FIL-A LOCATIONS TO REMAIN OPEN ON SUNDAYS

EVs are also on track to make up 9% of all new passenger vehicles sold in the U.S. in 2023, up from 7% in 2022, according to data from the Atlas Public Policy group.

While the sales numbers are encouraging, they still remain well below the Biden administration’s goal of 50% new EV sales by 2030 — a target that the Environmental Protection Agency’s proposed 2027-2032 vehicle emissions targets would sharpen further, aiming for 60% new EV sales by 2030, and 67% new EV sales by 2032.

That target has also come under harsh criticism from U.S. auto manufacturers and trade groups in recent months, including the Alliance for Automotive Innovation, which represents nearly all major U.S. auto manufacturers besides Tesla.

The group warned in a new letter to the Biden administration this week that the proposed rules “could prematurely force abandonment of many internal combustion engine vehicles and their associated revenue, reducing the availability of capital necessary for automakers to fund the EV transition.”

In the letter, AAI CEO John Bozzella said the final rules, expected in early 2024, would “effectively lock in the pace of automotive electrification.”

That would be a problem, because manufacturers and dealers have already complained about an oversupply of electric vehicles in their warehouses and on their lots, noting that consumer demand is not matching production.

Last month, a group of nearly 4,000 U.S. auto dealers asked the Biden administration in a letter to ease up on his EV sales target, which they described as unrealistic.

The letter, signed by dealers in all 50 states, called on the administration to allow additional time for public charging infrastructure to be built, and time for consumers to “get comfortable” with EV technology.

In October, Ford announced plans to slash EV investments by $12 billion due to slower-than-expected consumer demand — including postponing the construction of a planned battery factory in Kentucky and scaling back its $3.5 billion investment in a planned EV battery plant in Michigan.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

The lack of access to charging infrastructure is unlikely to be resolved quickly in the new year. There are currently roughly 130,000 public charging stations in the U.S. to date, amounting to around one for every 29 EVs.

McKinsey has estimated that even reaching 50% of new EV sale penetration by 2030 will require an additional 1.2 million public charging stations, and 28 million private EV stations, illustrating the sheer scale of infrastructure needed to support the transition.