Cooling inflation, easing COVID lockdowns (maybe), and chatter around Russia-Ukraine 'peace' hopes were the triumvirate of bullish themes that outweighed any contagion from the Sam Bankrun-Fraud shitshow that sparked carnage in crypto this week.

How trading this week felt like pic.twitter.com/pTgKceK89h

— Ash WSB (@Ashcryptoreal) November 11, 2022

Everything's awesome again, right?

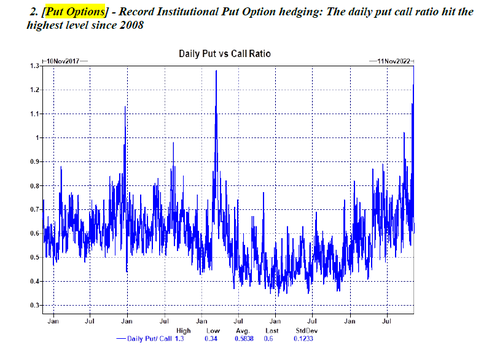

Because if everything was so frigging awesome, why did institutional put option hedging just hit a record high...

After yesterday's avalanche of less-hawkishness (none of them were actually dovish), today was a small flurry of FedSpeak from Boston Fed President Susan Collins said the central bank has more work to do to tame inflation, but the risks that the US central bank goes too far have increased after a string of large interest-rate increases.

“I think that as we have raised rates that the risk of over tightening has increased,” Collins said Thursday during an interview with Bloomberg. She added:

"I do think we’re going to need to raise rates further."

Collins said a smaller, more “deliberate” rate increase should not be confused for a sign that the Fed is backing down from the task of curbing price pressures.

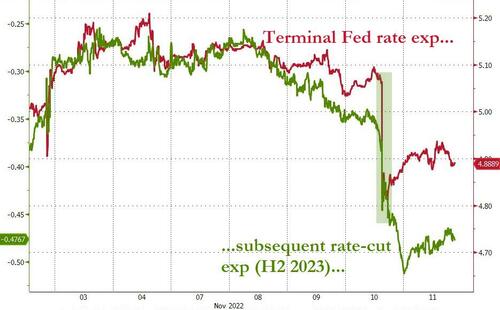

So the message seems to be uniform - more to come but slowing pace and overtightening risk is a thing (which is the EXACT OPPOSITE of what Powell said during the press conference). That FedSpeak on top of the cooling CPI sent Fed rate trajectory expectations dramatically dovishly lower on the week...

Source: Bloomberg

And that in turn sent stocks soaring to their best week since Nov 6th 2020, led by a 9% explosion in the Nasdaq. The Dow lagged, up "only 4%) on the week!

The S&P hit 4,000 today, breaking above the 50- and 100-DMAs on the week (200DMA is at 4080)...

On the week, tech (longest duration stocks) were the biggest gainers (up over 10%) while Utes lagged (up only 1.4%)...

Source: Bloomberg

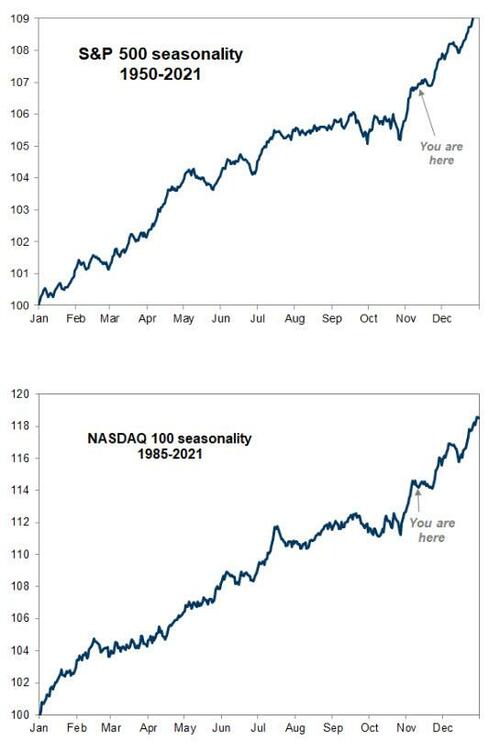

Seasonals are definitely in your favor...

The dash-for-trash exploded...

The last two days have seen the biggest short-squeeze on record, based on Goldman's "Most Shorted" basket. The 19% surge from Wednesday's close is bigger than March 2020's rebound surge and Jan 2021's meltup to the highs...

Source: Bloomberg

That's nothing compared to 'unprofitable tech' stocks which exploded over 26% higher in the last two days...

Source: Bloomberg

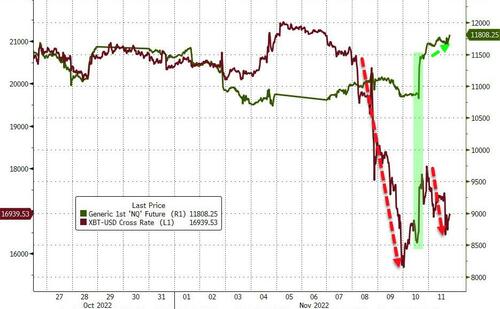

While stocks and crypto have become increasingly correlated once again in recent weeks, the last two days, thanks to FTX contagion, have sparked a major decoupling...

Source: Bloomberg

US Treasuries were also aggressively bid this week with the belly down a stunning 45bps at the Thursday close (30Y -30bps)...

Source: Bloomberg

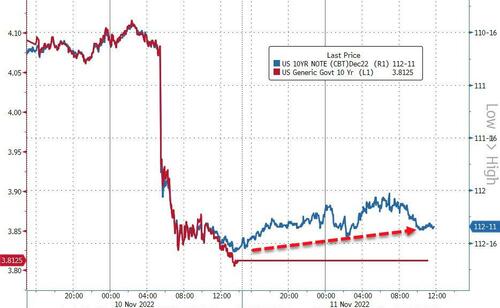

Cash bonds were closed today but futures indicate some modest giveback with 10Y yields up around 4bps...

Source: Bloomberg

The dollar extended yesterday's plunge today for the biggest 2-day drop since March 2009. Down 5 of the last 6 days, the world's reserve currency has lost over 5% against its fiat peers to 3-month lows, breaking below its 50- and 100-DMAs...

Source: Bloomberg

With the dollar tumbling, China's yuan surged to one month highs...

Source: Bloomberg

Japan's yen exploded higher, up 6 big figures in 2 days and dramatically off the intervention lows in October...

Source: Bloomberg

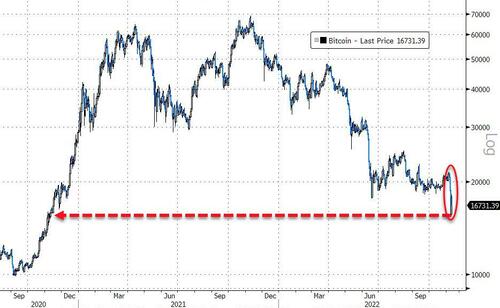

Cryptos were a bloodbath this week after SBF and his girlfriend were exposed. Bitcoin & Ethereum were down over 20% on the week...

Source: Bloomberg

Bitcoin puked to a $15k handle at its lows this week, the lowest since Nov 2020...

Source: Bloomberg

Gold soared this week, topping $1770 - its highest in 3 months. This was gold's best week since March 2020...

Oil ended the week lower, despite gains in the last couple of days on the back of China possibly easing its Zero-COVID strategy...

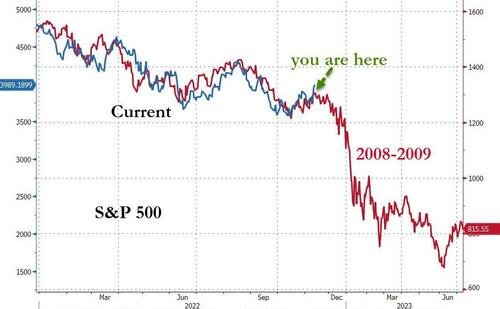

Finally, we have seen these bear market rallies before...

Source: Bloomberg

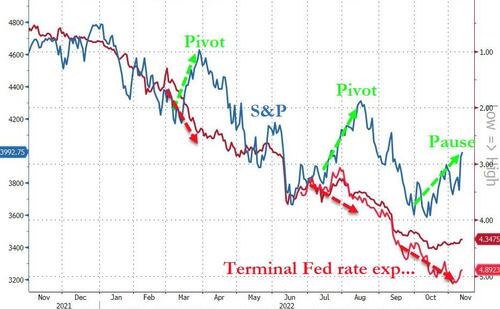

And stocks appear to have priced in a dovish Fed without considering that a dovish Fed will only be that way if the economy shits the bed... and while the terminal rate is lower (back below 5%), it is still very high...

Source: Bloomberg

Is the third time the charm? Or will Powell piss in the punchbowl again next week?

Cooling inflation, easing COVID lockdowns (maybe), and chatter around Russia-Ukraine ‘peace’ hopes were the triumvirate of bullish themes that outweighed any contagion from the Sam Bankrun-Fraud shitshow that sparked carnage in crypto this week.

How trading this week felt like pic.twitter.com/pTgKceK89h

— Ash WSB (@Ashcryptoreal) November 11, 2022

Everything’s awesome again, right?

[embedded content]

Because if everything was so frigging awesome, why is Goldman’s trading desk pointing out that institutional put option hedging just hit a record high…

After yesterday’s avalanche of less-hawkishness (none of them were actually dovish), today was a small flurry of FedSpeak from Boston Fed President Susan Collins said the central bank has more work to do to tame inflation, but the risks that the US central bank goes too far have increased after a string of large interest-rate increases.

“I think that as we have raised rates that the risk of over tightening has increased,” Collins said Thursday during an interview with Bloomberg. She added:

“I do think we’re going to need to raise rates further.”

Collins said a smaller, more “deliberate” rate increase should not be confused for a sign that the Fed is backing down from the task of curbing price pressures.

So the message seems to be uniform – more to come but slowing pace and overtightening risk is a thing (which is the EXACT OPPOSITE of what Powell said during the press conference). That FedSpeak on top of the cooling CPI sent Fed rate trajectory expectations dramatically dovishly lower on the week…

Source: Bloomberg

And that in turn sent stocks soaring to their best week since Nov 6th 2020, led by a 9% explosion in the Nasdaq. The Dow lagged, up “only 4%) on the week!

The S&P hit 4,000 today, breaking above the 50- and 100-DMAs on the week (200DMA is at 4080)…

On the week, tech (longest duration stocks) were the biggest gainers (up over 10%) while Utes lagged (up only 1.4%)…

Source: Bloomberg

Seasonals are definitely in your favor…

The dash-for-trash exploded…

The last two days have seen the biggest short-squeeze on record, based on Goldman’s “Most Shorted” basket. The 19% surge from Wednesday’s close is bigger than March 2020’s rebound surge and Jan 2021’s meltup to the highs…

Source: Bloomberg

That’s nothing compared to ‘unprofitable tech’ stocks which exploded over 26% higher in the last two days…

Source: Bloomberg

While stocks and crypto have become increasingly correlated once again in recent weeks, the last two days, thanks to FTX contagion, have sparked a major decoupling…

Source: Bloomberg

US Treasuries were also aggressively bid this week with the belly down a stunning 45bps at the Thursday close (30Y -30bps)…

Source: Bloomberg

Cash bonds were closed today but futures indicate some modest giveback with 10Y yields up around 4bps…

Source: Bloomberg

The dollar extended yesterday’s plunge today for the biggest 2-day drop since March 2009. Down 5 of the last 6 days, the world’s reserve currency has lost over 5% against its fiat peers to 3-month lows, breaking below its 50- and 100-DMAs…

Source: Bloomberg

With the dollar tumbling, China’s yuan surged to one month highs…

Source: Bloomberg

Japan’s yen exploded higher, up 6 big figures in 2 days and dramatically off the intervention lows in October…

Source: Bloomberg

Cryptos were a bloodbath this week after SBF and his girlfriend were exposed. Bitcoin & Ethereum were down over 20% on the week…

Source: Bloomberg

Bitcoin puked to a $15k handle at its lows this week, the lowest since Nov 2020…

Source: Bloomberg

Gold soared this week, topping $1770 – its highest in 3 months. This was gold’s best week since March 2020…

Oil ended the week lower, despite gains in the last couple of days on the back of China possibly easing its Zero-COVID strategy…

Finally, we have seen these bear market rallies before…

Source: Bloomberg

And stocks appear to have priced in a dovish Fed without considering that a dovish Fed will only be that way if the economy shits the bed… and while the terminal rate is lower (back below 5%), it is still very high…

Source: Bloomberg

Is the third time the charm? Or will Powell piss in the punchbowl again next week?