Authored by Lance Roberts via RealInvestmentAdvice.com,

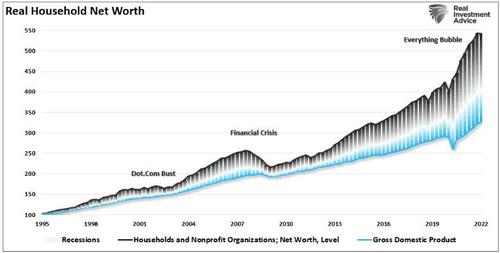

Pulling forward growth over the last decade remains the Federal Reserve’s primary tool for keeping financial markets stable while economic growth rates and inflation remained weak. From repeated rounds of monetary and fiscal interventions, asset markets surged, increasing investor wealth and confidence, which, as Ben Bernanke stated in 2010, would support economic growth. To wit:

“This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending.”

That certainly seemed to be the case as each time the economy stumbled; Federal Reserve interventions kept the financial markets and economy stable. However, there is sufficient evidence that “monetary policy” leads to other problems, most notably a surge in wealth inequality without a corresponding increase in economic growth.

As noted in the previous articles, current monetary policy has its roots in Keynesian economic theory. To wit:

“A general glut would occur when aggregate demand for goods was insufficient, leading to an economic downturn resulting in losses of potential output due to unnecessarily high unemployment, which results from the defensive (or reactive) decisions of the producers.”

In such a situation, Keynesian economics states that fiscal policies could increase aggregate demand, thus expanding economic activity and reducing unemployment.

The only problem is that it didn’t work as planned because “monetary policy” is NOT expansionary.

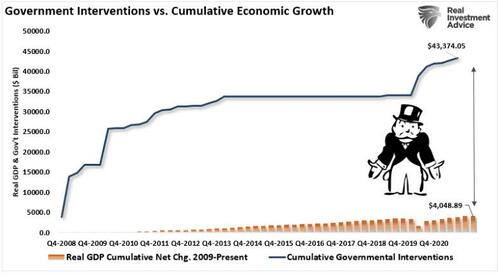

“Since 2008, the total cumulative growth of the economy is just $4.05 trillion. In other words, for each dollar of economic growth since 2008, it required nearly $11 of monetary stimulus. Such sounds okay until you realize it came solely from debt issuance.“

The question is whether pulling forward growth through monetary policy is sustainable.

The Unsustainability Of Monetary Policy

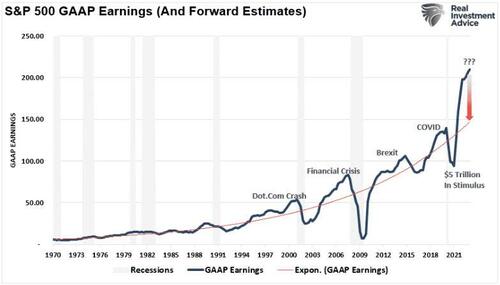

We have previously noted an inherent problem with ongoing monetary interventions. Notably, the fiscal policies implemented post the pandemic-driven economic shutdown created a surge in demand that created an unprecedented surge in corporate earnings.

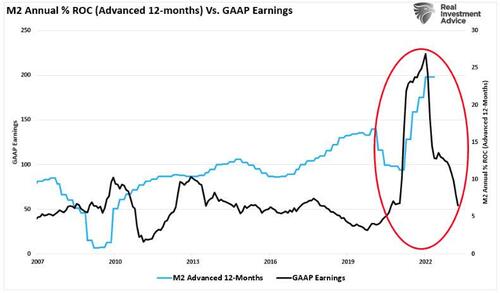

Here is the problem. As shown below, the surge in the M2 money supply is now over. Without further stimulus, earnings must eventually revert to economically sustainable levels.

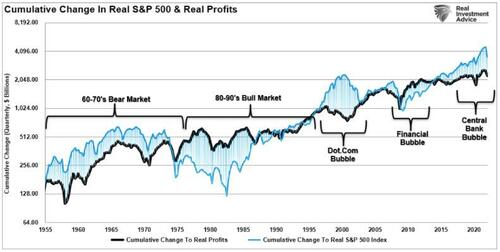

While the media often states that “stocks are not the economy,” economic activity creates corporate revenues and earnings. As such, stocks can not indefinitely grow faster than the economy over long periods.

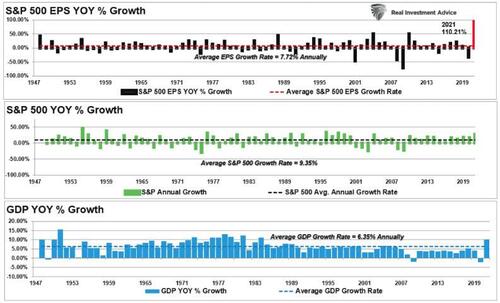

When stocks deviate from the underlying economy, the eventual resolution is lower stock prices. Over time, there is a close relationship between the economy, earnings, and asset prices. For example, the chart below compares the three from 1947 through 2021.

Since 1947, earnings per share have grown at 7.72%, while the economy has expanded by 6.35% annually. That close relationship in growth rates is logical given the significant role that consumer spending has in the GDP equation.

The slight differentials are due to periods where earnings can grow faster than the economy. Such a period occurs when the economy is emerging from a recession. However, while nominal stock prices have averaged 9.35% (including dividends), reversions to actual economic growth eventually occur. Such is because corporate earnings are a function of consumptive spending, corporate investments, imports, and exports.

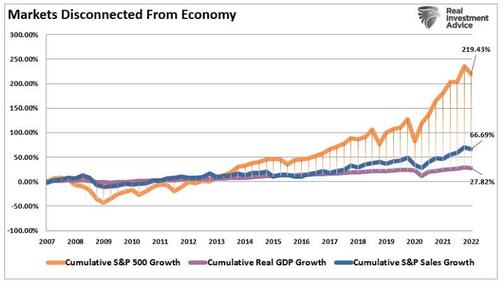

The market disconnect from underlying economic activity is apparent in the chart below. Since the peak in 2007, successive rounds of monetary interventions led to a cumulative increase of 219% for the stock market. However, real economic growth grew only 28% as corporate revenue rose by just 67%. In other words, stock prices rose nearly 8x more than the economy and 3.2x corporate revenue.

There is a problem in pulling forward economic activity.

The Fed Is Investors Biggest Problem

For investors, the most significant risk remains the Fed. Many hope the Fed will “pivot” from its battle against surging inflation to support stocks. However, such is unlikely in the near term, with inflation running at the highest level in 40 years.

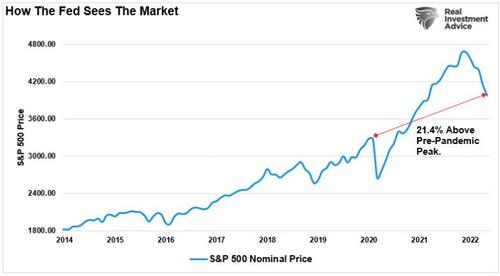

However, even if the Fed does give up its fight against inflation in terms of hiking interest rates, it is unlikely they will immediately return to successive rounds of monetary policy without financial instability. So far, in 2022, markets are down, but not violently so. As we discussed previously, the Fed views markets very differently from investors. To wit:

“While the market has declined this year, the market remains higher than in 2020. To reduce excess market speculations, the Fed doesn’t mind some ‘disinflation’ in asset prices. Furthermore, the market decline also contributes to its tightening monetary policy to mitigate inflationary pressures.”

Absent a disorderly meltdown; the Fed will remain focused on stocks being still above their pre-crisis peak. As BofA notes:

“Since in a typical consumption model, households react to sustained changes in prices over a period of three years or so, the Fed is convinced the wealth effect is still positive.”

As noted above, the deviation from long-term growth trends is unsustainable. Repeated financial interventions were the cause. Therefore, unless the Federal Reverse is committed to a never-ending program of zero interest rates and quantitative easing, the eventual reversion of returns to their long-term means is inevitable.

Such will solely result in profit margins and earnings returning to levels that align with actual economic activity. As Jeremy Grantham once noted:

“Profit margins are probably the most mean-reverting series in finance. And if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system, and it is not functioning properly.” – Jeremy Grantham

Authored by Lance Roberts via RealInvestmentAdvice.com,

Pulling forward growth over the last decade remains the Federal Reserve’s primary tool for keeping financial markets stable while economic growth rates and inflation remained weak. From repeated rounds of monetary and fiscal interventions, asset markets surged, increasing investor wealth and confidence, which, as Ben Bernanke stated in 2010, would support economic growth. To wit:

“This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending.”

That certainly seemed to be the case as each time the economy stumbled; Federal Reserve interventions kept the financial markets and economy stable. However, there is sufficient evidence that “monetary policy” leads to other problems, most notably a surge in wealth inequality without a corresponding increase in economic growth.

As noted in the previous articles, current monetary policy has its roots in Keynesian economic theory. To wit:

“A general glut would occur when aggregate demand for goods was insufficient, leading to an economic downturn resulting in losses of potential output due to unnecessarily high unemployment, which results from the defensive (or reactive) decisions of the producers.”

In such a situation, Keynesian economics states that fiscal policies could increase aggregate demand, thus expanding economic activity and reducing unemployment.

The only problem is that it didn’t work as planned because “monetary policy” is NOT expansionary.

“Since 2008, the total cumulative growth of the economy is just $4.05 trillion. In other words, for each dollar of economic growth since 2008, it required nearly $11 of monetary stimulus. Such sounds okay until you realize it came solely from debt issuance.“

The question is whether pulling forward growth through monetary policy is sustainable.

The Unsustainability Of Monetary Policy

We have previously noted an inherent problem with ongoing monetary interventions. Notably, the fiscal policies implemented post the pandemic-driven economic shutdown created a surge in demand that created an unprecedented surge in corporate earnings.

Here is the problem. As shown below, the surge in the M2 money supply is now over. Without further stimulus, earnings must eventually revert to economically sustainable levels.

While the media often states that “stocks are not the economy,” economic activity creates corporate revenues and earnings. As such, stocks can not indefinitely grow faster than the economy over long periods.

When stocks deviate from the underlying economy, the eventual resolution is lower stock prices. Over time, there is a close relationship between the economy, earnings, and asset prices. For example, the chart below compares the three from 1947 through 2021.

Since 1947, earnings per share have grown at 7.72%, while the economy has expanded by 6.35% annually. That close relationship in growth rates is logical given the significant role that consumer spending has in the GDP equation.

The slight differentials are due to periods where earnings can grow faster than the economy. Such a period occurs when the economy is emerging from a recession. However, while nominal stock prices have averaged 9.35% (including dividends), reversions to actual economic growth eventually occur. Such is because corporate earnings are a function of consumptive spending, corporate investments, imports, and exports.

The market disconnect from underlying economic activity is apparent in the chart below. Since the peak in 2007, successive rounds of monetary interventions led to a cumulative increase of 219% for the stock market. However, real economic growth grew only 28% as corporate revenue rose by just 67%. In other words, stock prices rose nearly 8x more than the economy and 3.2x corporate revenue.

There is a problem in pulling forward economic activity.

The Fed Is Investors Biggest Problem

For investors, the most significant risk remains the Fed. Many hope the Fed will “pivot” from its battle against surging inflation to support stocks. However, such is unlikely in the near term, with inflation running at the highest level in 40 years.

However, even if the Fed does give up its fight against inflation in terms of hiking interest rates, it is unlikely they will immediately return to successive rounds of monetary policy without financial instability. So far, in 2022, markets are down, but not violently so. As we discussed previously, the Fed views markets very differently from investors. To wit:

“While the market has declined this year, the market remains higher than in 2020. To reduce excess market speculations, the Fed doesn’t mind some ‘disinflation’ in asset prices. Furthermore, the market decline also contributes to its tightening monetary policy to mitigate inflationary pressures.”

Absent a disorderly meltdown; the Fed will remain focused on stocks being still above their pre-crisis peak. As BofA notes:

“Since in a typical consumption model, households react to sustained changes in prices over a period of three years or so, the Fed is convinced the wealth effect is still positive.”

As noted above, the deviation from long-term growth trends is unsustainable. Repeated financial interventions were the cause. Therefore, unless the Federal Reverse is committed to a never-ending program of zero interest rates and quantitative easing, the eventual reversion of returns to their long-term means is inevitable.

Such will solely result in profit margins and earnings returning to levels that align with actual economic activity. As Jeremy Grantham once noted:

“Profit margins are probably the most mean-reverting series in finance. And if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system, and it is not functioning properly.” – Jeremy Grantham