China's Q4 GDP and December industrial production reports beat market expectations meaningfully, with the 2024 full-year GDP growth target officially reached (what an amazing coincidence).

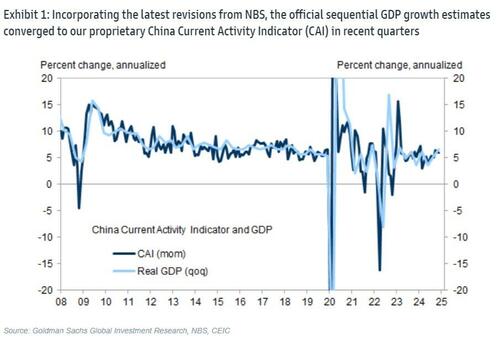

Real GDP growth rose notably to +5.4% yoy in Q4 from +4.6% yoy in Q3, driven by the acceleration of sequential growth on the back of more coordinated and forceful policy easing and export frontloading due to concerns about potential US tariff hikes.

“The biggest bright spot in the economy last year was exports, which was very strong especially if price factor was excluded,” Jacqueline Rong, chief China economist at BNP Paribas SA.

“That means the biggest problem this year will be US tariffs.”

Year-on-year industrial production growth rose meaningfully in December, led by faster output growth in the automobile and electric machinery industries.

Retail sales growth also accelerated, thanks mainly to the rebound in online goods sales growth as the distortions from an earlier-than-usual start of the Singles’ Day Shopping Festival last year subsided.

The ongoing consumer goods trade-in program continued to boost some durable goods sales, as evidenced by strong home appliance growth in December.

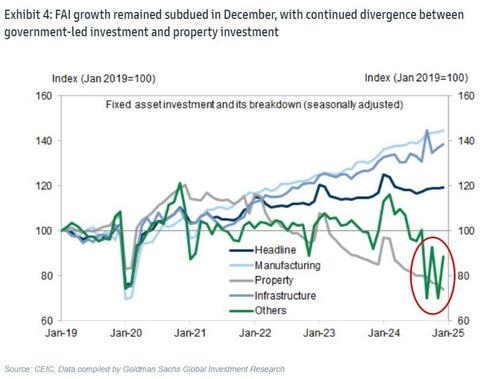

In comparison, fixed asset investment growth remained subdued despite strong local government bond net financing in recent months, as a large proportion of proceeds have been used for debt resolution, and it may take time for fiscal expansion and new project launches to follow suit.

Property-related activity continued to present wide divergence between sales and construction amid the ongoing efforts to support the housing market.

Goldman Sachs continues to expect real GDP growth to slow to 4.5% yoy in 2025 from 5.0% in 2024, as the growth drag from likely higher US tariffs may more than offset the ongoing policy easing amid the prolonged property downturn and still-weak consumer sentiment.

“Better data has likely reduced Beijing’s sense of urgency and policy may continue to undershoot on the housing and social welfare front,” Morgan Stanley economists including Robin Xing wrote in a note.

However, amid all this glorious economic strength, Chinese bond yields are at record lows...

...does the bond market know something about the impact of Trump's tariffs that Beijing would rather ignore for now?

“The recovery is tentatively sustained in a still fragile mode,” Societe Generale SA economists Wei Yao and Michelle Lam wrote in a note.

“Policymakers need to make a stronger fiscal boost in 2025 to ensure growth stability.”

The danger now is President Xi Jinping eases up on stimulus just as tariffs loom.

China’s Q4 GDP and December industrial production reports beat market expectations meaningfully, with the 2024 full-year GDP growth target officially reached (what an amazing coincidence).

Real GDP growth rose notably to +5.4% yoy in Q4 from +4.6% yoy in Q3, driven by the acceleration of sequential growth on the back of more coordinated and forceful policy easing and export frontloading due to concerns about potential US tariff hikes.

“The biggest bright spot in the economy last year was exports, which was very strong especially if price factor was excluded,” Jacqueline Rong, chief China economist at BNP Paribas SA.

“That means the biggest problem this year will be US tariffs.”

Year-on-year industrial production growth rose meaningfully in December, led by faster output growth in the automobile and electric machinery industries.

Retail sales growth also accelerated, thanks mainly to the rebound in online goods sales growth as the distortions from an earlier-than-usual start of the Singles’ Day Shopping Festival last year subsided.

The ongoing consumer goods trade-in program continued to boost some durable goods sales, as evidenced by strong home appliance growth in December.

In comparison, fixed asset investment growth remained subdued despite strong local government bond net financing in recent months, as a large proportion of proceeds have been used for debt resolution, and it may take time for fiscal expansion and new project launches to follow suit.

Property-related activity continued to present wide divergence between sales and construction amid the ongoing efforts to support the housing market.

Goldman Sachs continues to expect real GDP growth to slow to 4.5% yoy in 2025 from 5.0% in 2024, as the growth drag from likely higher US tariffs may more than offset the ongoing policy easing amid the prolonged property downturn and still-weak consumer sentiment.

“Better data has likely reduced Beijing’s sense of urgency and policy may continue to undershoot on the housing and social welfare front,” Morgan Stanley economists including Robin Xing wrote in a note.

However, amid all this glorious economic strength, Chinese bond yields are at record lows…

…does the bond market know something about the impact of Trump’s tariffs that Beijing would rather ignore for now?

“The recovery is tentatively sustained in a still fragile mode,” Societe Generale SA economists Wei Yao and Michelle Lam wrote in a note.

“Policymakers need to make a stronger fiscal boost in 2025 to ensure growth stability.”

The danger now is President Xi Jinping eases up on stimulus just as tariffs loom.

Loading…