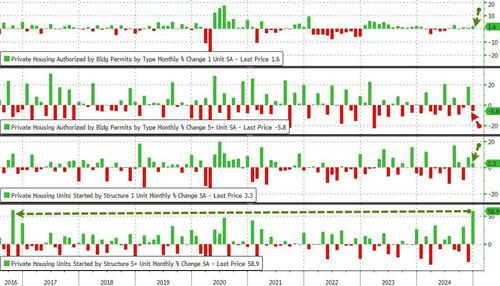

From a downwardly revised 3.7% MoM drop in November, Housing Starts exploded 15.8% higher MoM in December while Building Permits (more forward looking) fell 0.7% MoM (a smaller decline than expected)...

Source: Bloomberg

That is the biggest MoM jump in Starts since March 2021, dragging the total Starts SAAR to its highest since Feb 2024...

Source: Bloomberg

The dramatic surge in starts was driven by a ridiculous 58.9% MoM jump in multi-family units (while multi-family permits fell 5.8%).

Source: Bloomberg

This is the biggest MoM jump in multi-family starts since 2016, and the highest SAAR for 'renter nation' since Dec 2023...

Source: Bloomberg

The question is - with sales expectatins falling, will homebuilders keep building at this pace...

Source: Bloomberg

Despite the robust monthly advance, new home construction for all of 2024 was the slowest since 2019.

With mortgage rates now back above 7.00%, perhaps the homebuilders are betting on a return of inflation and growth meaning home-buying affordability will remain out of reach for most Americans.

However, we do note that the more forward-looking 'permits' headline data actually declined MoM.

Furthermore, as builders respond to more tepid demand, the number of homes under construction has been trending down in the past year and eased to the lowest since August 2021.

Completions also slowed further, hitting the slowest pace since March.

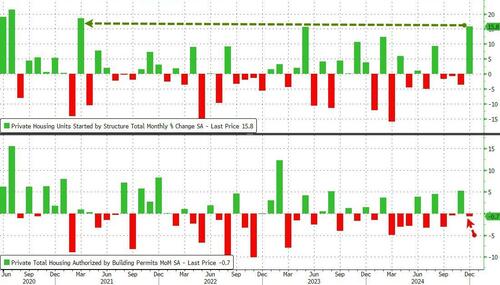

From a downwardly revised 3.7% MoM drop in November, Housing Starts exploded 15.8% higher MoM in December while Building Permits (more forward looking) fell 0.7% MoM (a smaller decline than expected)…

Source: Bloomberg

That is the biggest MoM jump in Starts since March 2021, dragging the total Starts SAAR to its highest since Feb 2024…

Source: Bloomberg

The dramatic surge in starts was driven by a ridiculous 58.9% MoM jump in multi-family units (while multi-family permits fell 5.8%).

Source: Bloomberg

This is the biggest MoM jump in multi-family starts since 2016, and the highest SAAR for ‘renter nation’ since Dec 2023…

Source: Bloomberg

The question is – with sales expectatins falling, will homebuilders keep building at this pace…

Source: Bloomberg

Despite the robust monthly advance, new home construction for all of 2024 was the slowest since 2019.

With mortgage rates now back above 7.00%, perhaps the homebuilders are betting on a return of inflation and growth meaning home-buying affordability will remain out of reach for most Americans.

However, we do note that the more forward-looking ‘permits’ headline data actually declined MoM.

Furthermore, as builders respond to more tepid demand, the number of homes under construction has been trending down in the past year and eased to the lowest since August 2021.

Completions also slowed further, hitting the slowest pace since March.

Loading…