Wikideas

A fiscal responsibility amendment to the U.S. Constitution is our best hope in restoring a Great Moderation in fiscal policy and avoiding a debt crisis.For centuries, the commonsense notion of balanced budgets served our nation well. Elected officials as well as citizens accepted the discipline of balanced budgets as the basis for fiscal policy at all levels of government. At the federal level, this did not require annually balanced budgets. In periods of war and emergency, the federal government might incur deficits and accumulate debt. However, in peacetime, the deficits were offset with surplus revenue.

One of the most remarkable achievements of the twentieth century was the ease with which our market system transitioned from wartime to a peacetime economy. After World War II, many feared that cuts in defense spending would plunge the nation into another Great Depression. But after a brief recession, the economy recovered and a golden era of economic growth began.

At the end of the Cold War in the 1990s, major cuts in defense spending were again accompanied by rapid economic growth. The decade of the 1990s is referred to as the Great Moderation in fiscal and monetary policy. By the end of that decade, the federal government balanced the budget and stabilized debt. The challenge now is to restore a Great Moderation in fiscal and monetary policy.

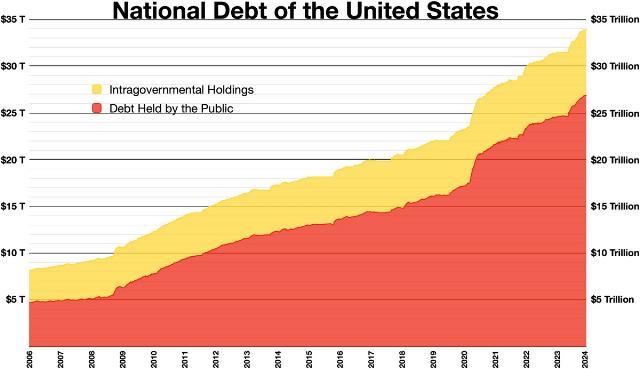

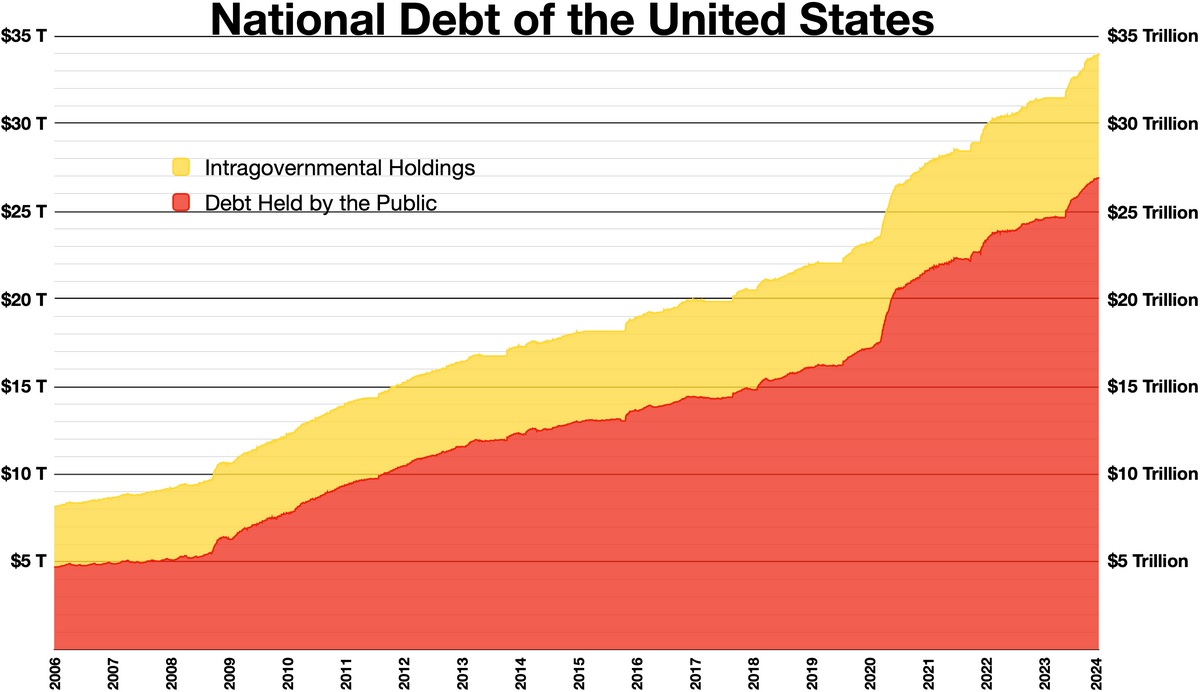

Over the past two decades, we have abandoned balanced budgets. The federal government has incurred deficits and accumulated debt at an unsustainable rate. While defense spending has again increased in response to military conflicts, almost all the increase in spending and debt is to fund transfer programs. An increasing share of the federal budget involves transfers of funds through entitlement programs such as Social Security and Medicare. A wide range of new entitlement programs, such as student debt forgiveness, has increased these transfers.

The growth of our transfer society will make it impossible to restore a Great Moderation under current law. Unlike defense spending, entitlement spending is permanently embedded in the budget. Indeed, trends such as an aging population will expand these transfers, making it more difficult to impose fiscal discipline in coming years. Neither political party is now willing to reform entitlement programs, such as the reforms enacted in Social Security during the Reagan years.

<img alt captext="Wikideas” class=”post-image-right” src=”https://conservativenewsbriefing.com/wp-content/uploads/2024/07/restoring-moderation-in-fiscal-policy.jpg” width=”450″>The United States has reached an important inflection point in which the prospect for a debt crisis must be addressed. The solution to the debt crisis will require fundamental reforms in the fiscal rules of the game. Private organizations have launched a new tax revolt to right the fiscal ship. These groups ae attempting to incorporate a fiscal responsibility amendment in the U.S. Constitution. Article V gives citizens as well as Congress the power to propose amendments. Over the years, the states have submitted many resolutions proposing a fiscal responsibility amendment to the Constitution, but Congress has failed to record these state resolutions. Recent evidence compiled by the Article V Library reveals that in 1979 the requisite two-thirds of the states had submitted resolutions calling for a fiscal responsibility amendment to the Constitution, but Congress failed to count the resolutions and call the convention.

Incorporating a fiscal responsibility amendment in the Constitution through an Article V amendment convention may seem like an impossible task. Private organizations will soon file a petition with the Supreme Court to issue a Declaratory Judgement requiring Congress to count the state resolutions and to call the amendment convention. Such a Declaratory Judgment is unprecedented; we should expect Congress to resist any Declaratory Judgement, and especially one that would curb discretionary fiscal policy. Assuming that an amendment convention is called, a majority of the states must agree on a fiscal responsibility amendment to the Constitution. An amendment submitted to the states must then be ratified by three-fourths of the states.

Many citizens will perceive this to be an impossible task in restoring a great Moderation in fiscal policy. Assuming that a fiscal responsibility amendment is incorporated in the Constitution, Congress must learn to live with the fiscal discipline imposed by the amendment. This would require fundamental reforms in our transfer society. All spending, including spending on entitlements, must be constrained by the fiscal rule. If Congress attempts to circumvent or suspend the fiscal rule, citizens would have legal recourse through the Supreme Court to enforce the rule.

There are important precedents for incorporating fiscal rules in the Constitution. For centuries, our state and local governments have incorporated fiscal rules in their constitutions and have learned to live with the fiscal discipline imposed by those rules. Most developed countries have in fact incorporated fiscal rules in their constitution at both the state and federal level. The European Union has incorporated fiscal rules in the constitution at the supranational level. Constitutional fiscal rules, such as the Swiss debt brake, have proven to be effective in balancing budgets and stabilizing debt in the long term. A fiscal responsibility amendment to the U.S. Constitution is our best hope in restoring a Great Moderation in fiscal policy and avoiding a debt crisis.

Barry Poulson ([email protected]) is a policy advisor with The Heartland Institute.

Image: Wikideas1