For much of the waning days of 2022, the broader theme in markets was a downbeat one, especially for one group of habitual gamblers investors: after a stellar 2021 when nothing made sense and the junkiest of companies exploded higher steamrolling shorts, for retail investors 2022 felt like the polar opposite: a relentless series of gut punches which knocked the air out of basement dwelling daytraders and crushed some of the most popular retail names.

And indeed, a quick search of headlines from mid/late 2022 confirmed that the retail spirit had been broken:

- Did Retail Investors Boost The Broader Market During The "Most Hated Rally" - Aug 2022

- Retail Traders Throw In The Towel - Sept 2022

- Are Retail Investors Done? Biggest Liquidation Since 2020 As Retail Is Now 'Selling The Rally' - Oct 2022

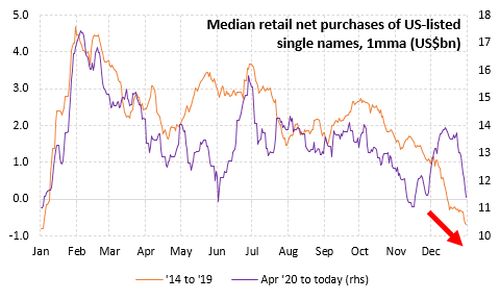

It all culminated with the near record year-end liquidation when in addition to momentum, tax loss selling prompted retail investors to dump single stocks at an unprecedented pace as described Retail Investors Slamming The Bid Amid Tax-Loss Selling Capitulation

However, this record selling flow would not last long, and indeed, just one month later, we wrote that with LO institutions and hedge funds extending their bearish positioning, it was retail investors that picked up the BTFD torch in January, adding that "if retail is once again a more powerful price setter than institutions and hedge funds (thank you zero market liquidity), and we are facing another Jan 2021-type meltup, then watch out above even if none of the abovementioned technicals go into play."

In retrospect we were right, but not even we had any idea just how much we were right.

That's because according to the latest report from retail orderflow specialist Vanda Research, January was a blowout, record month for retail buyers in the market.

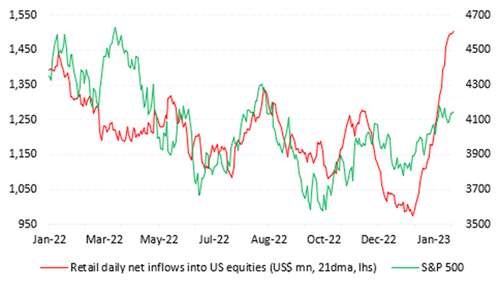

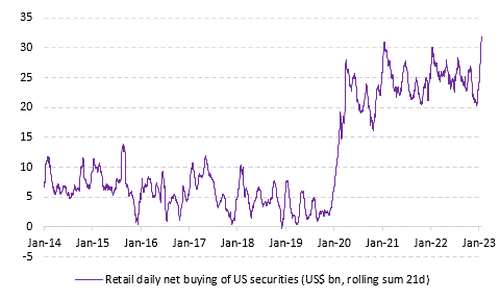

As Vanda's Mario Iachini writes, "in the last month, retail investors poured an average of $1.51bn/day into the US markets, the highest amount ever recorded." And as we expected, this group of investors "has continued driving US equity market swings since the second half of last year."

Echoing verbatim our own thoughts, Vanda writes that "with recent surveys showing the institutional investor community remaining broadly bearish on stocks, it would be unwise to underestimate the importance of the retail cohort" as so many bearish hedge funds learned the very hard way in early 2021. "That’s in keeping with retail sales and jobs data for January, suggesting that consumers retain impressive levels of buying power. While the jury is still out on whether that’s due to a robust job market or excess savings from pandemic stimulus, the bottom line is that investors should heed signals from the ‘unsophisticated money’ crowd."

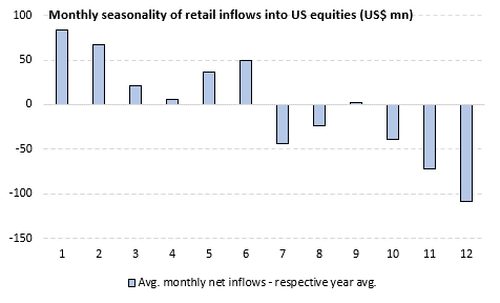

Having said that, seasonality suggests that flows could abate somewhat in the weeks ahead as earnings season falls in the rear-view mirror and investors start preparing for Tax Day in mid-April. However, if broad equity markets continue to perform well, we may instead see flows shifting towards smaller, more speculative companies (this is already occurring to an extent). And while the same could take place in the options market, especially with the dominance of 0DTE option activity, Vanda does not anticipate a repeat of the 2020-21 bubble, given that we are still in the late stages of the economic cycle.

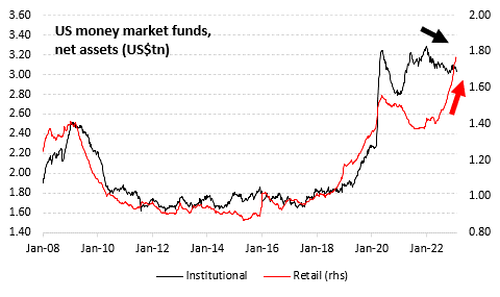

Finally, contrary to popular belief, retail money market funds' net assets at an all-time high suggest that retail investors still have plenty of capital to allocate to riskier investments, provided that market conditions remain supportive.

Vanda discusses this and other related topics in more detail below.

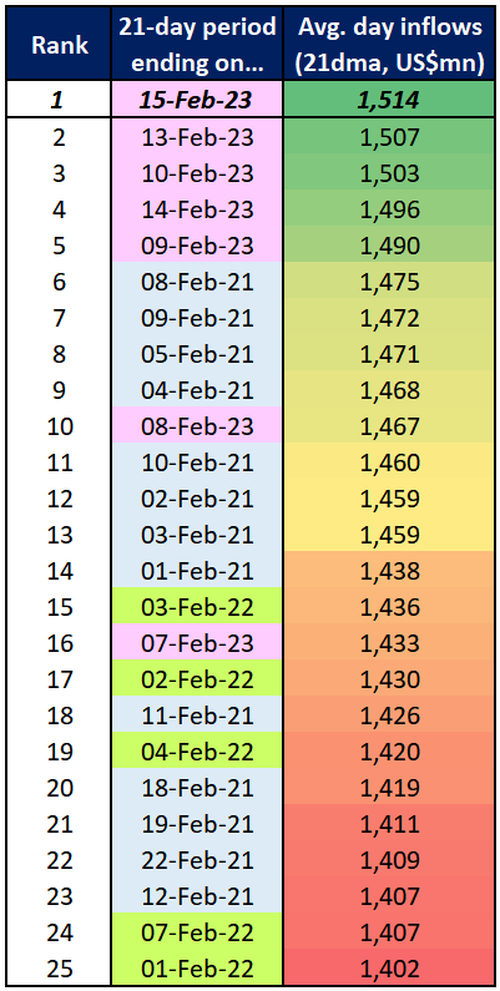

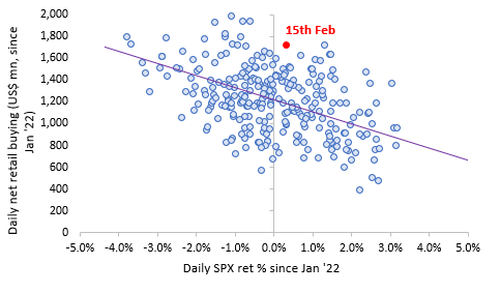

Total net purchases of US securities exceeded expectations by a significant margin on Wednesday. If we only consider periods when the S&P 500 closed in positive territory, Wednesday's aggregate purchases surpassed the previous record set on February 8th. Normally, Vanda would expect this this level of inflows on a day when the S&P 500 experiences a daily decline between -1% and -4%. Instead, "this type of behavior suggests retail traders are FOMO-ing more than any sentiment recent survey would show."

The flipside to the recent retail euphoria is that Vanda expects retail flows into cash equities to decrease in the weeks ahead, as seasonality suggests that March-April are typically middle-of-the-road months during the calendar year.

Furthermore, when looking at a rolling one-month period, inflows have never been higher since the dataset began in 2014 (second chart below). Sustaining such a robust daily pace will prove challenging but it won’t mean the end of the current bull market if institutional investors pick up the slack.

At the same time, and contrary to popular belief (especially among bears), the above doesn’t mean that retail investors are running out of capital to allocate to risky investments. Indeed, from a stock level perspective, the chart below suggests that retail investors have plenty of dry powder in the form of capital parked in money market funds that could be deployed in the equity space once confidence about future market returns increases more broadly.

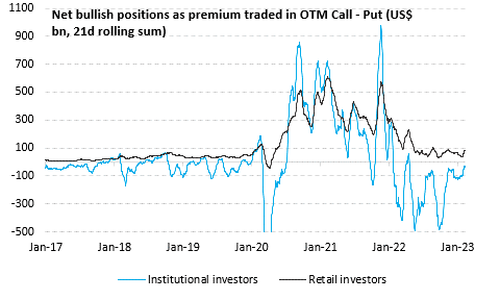

Adding insult to injury for the institutional bears - of which there is plenty - there is potential for bullish positions to be added in the options market. However, it is uncertain to what extent retail investors are willing to participate in the rally with leverage, given they’re still sitting on significant losses (-25% on average). In any case, nobody expects that the level of speculation observed during the 2020-2021 period will be replicated as we’re still in the later stages of the market cycle. Those dynamics are more likely to take hold during the early recovery phases after a recession has occurred.

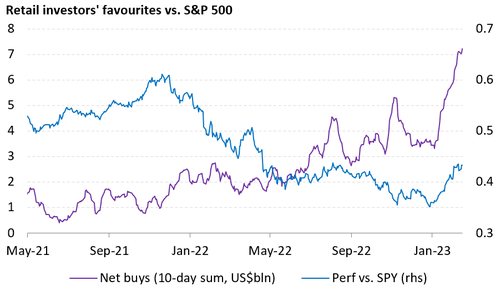

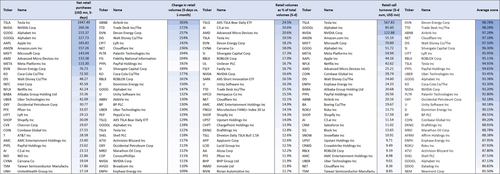

The soaring retail investor flows underpin the outperformance of their favorite stocks. A basket of the top 10 most-purchased retail stocks over recent months is experiencing a strong rebound relative to the SPX in 2023. Retail flows have accounted for a +US$18.5bn capital injection YTD in these names (listed below the chart). Should positive momentum in the broad equity market persist, it could push retail investors toward more speculative names, which are more susceptible to such flows given their smaller market cap.

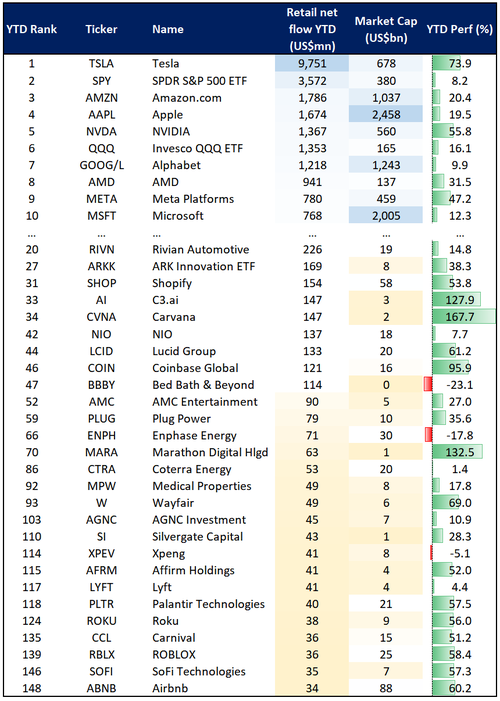

Many smaller-cap single stocks are also beginning to populate the top part of the retail leaderboard so far in 2023. Indeed, the first table below shows that beyond the top 10 most-bought securities, there’s a host of smaller-cap names that have attracted significant inflows this year (~US$2.23bn in total). Moreover, the weighted average performance of this group of stocks is roughly +50%, which is widely outpacing the S&P500 total return of 8.2%.

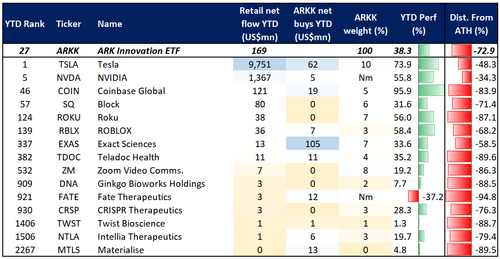

The other outcome of this dynamic is a pick-up in retail purchases in the ARKK ETF and some of its underlying holdings. It was common back in 2020-21 for retail investors to buy ARK ETFs while at the same time piling in some of their more hyped underlyings. While we don’t expect retail speculation to reach those levels for the reasons discussed above, it is noteworthy that retail investors are vastly outpacing Cathie Wood and Co. regarding purchases across some of these names.

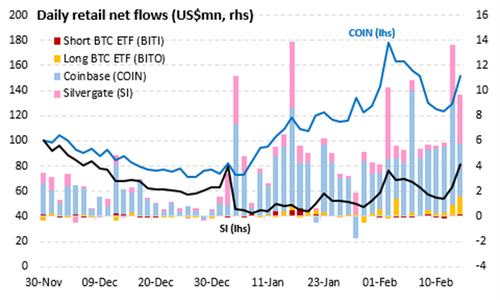

Vanda concludes its weekly retail tracking by pointing out that crypto TradFi proxies are among some of the best performers week-to-date.

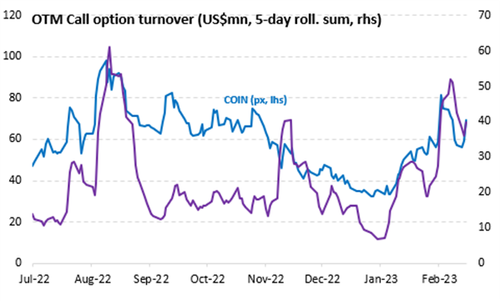

Silvergate Capital (SI) shares were up 28.6% at the end of trading Wednesday after Citadel Securities announced that it had taken a stake in the company. Indeed, 13F filings show Citadel Securities bought 5.5% in the digital currency banking company. The shares are up 69% over the past month but remain 91% below their all-time high. With the latest data showing 67% of SI’s shares held short it is likely that retail purchases have helped fuel a short-squeeze over the last three trading days. Given the size of the short book, we wouldn’t be surprised to see retail traders attempt to push the stock further in the coming days, although flows over the past three months show that interest in this name tends to be sporadic and short-lived. In contrast, Coinbase (COIN) seems to enjoy stronger retail tailwinds as bullish activity in the options space is surging as well (second chart).

Finally, here is the aggregate retail flow tracker"

For much of the waning days of 2022, the broader theme in markets was a downbeat one, especially for one group of habitual gamblers investors: after a stellar 2021 when nothing made sense and the junkiest of companies exploded higher steamrolling shorts, for retail investors 2022 felt like the polar opposite: a relentless series of gut punches which knocked the air out of basement dwelling daytraders and crushed some of the most popular retail names.

And indeed, a quick search of headlines from mid/late 2022 confirmed that the retail spirit had been broken:

It all culminated with the near record year-end liquidation when in addition to momentum, tax loss selling prompted retail investors to dump single stocks at an unprecedented pace as described Retail Investors Slamming The Bid Amid Tax-Loss Selling Capitulation

However, this record selling flow would not last long, and indeed, just one month later, we wrote that with LO institutions and hedge funds extending their bearish positioning, it was retail investors that picked up the BTFD torch in January, adding that “if retail is once again a more powerful price setter than institutions and hedge funds (thank you zero market liquidity), and we are facing another Jan 2021-type meltup, then watch out above even if none of the abovementioned technicals go into play.”

In retrospect we were right, but not even we had any idea just how much we were right.

That’s because according to the latest report from retail orderflow specialist Vanda Research, January was a blowout, record month for retail buyers in the market.

As Vanda’s Mario Iachini writes, “in the last month, retail investors poured an average of $1.51bn/day into the US markets, the highest amount ever recorded.” And as we expected, this group of investors “has continued driving US equity market swings since the second half of last year.”

Echoing verbatim our own thoughts, Vanda writes that “with recent surveys showing the institutional investor community remaining broadly bearish on stocks, it would be unwise to underestimate the importance of the retail cohort” as so many bearish hedge funds learned the very hard way in early 2021. “That’s in keeping with retail sales and jobs data for January, suggesting that consumers retain impressive levels of buying power. While the jury is still out on whether that’s due to a robust job market or excess savings from pandemic stimulus, the bottom line is that investors should heed signals from the ‘unsophisticated money’ crowd.”

Having said that, seasonality suggests that flows could abate somewhat in the weeks ahead as earnings season falls in the rear-view mirror and investors start preparing for Tax Day in mid-April. However, if broad equity markets continue to perform well, we may instead see flows shifting towards smaller, more speculative companies (this is already occurring to an extent). And while the same could take place in the options market, especially with the dominance of 0DTE option activity, Vanda does not anticipate a repeat of the 2020-21 bubble, given that we are still in the late stages of the economic cycle.

Finally, contrary to popular belief, retail money market funds’ net assets at an all-time high suggest that retail investors still have plenty of capital to allocate to riskier investments, provided that market conditions remain supportive.

Vanda discusses this and other related topics in more detail below.

Total net purchases of US securities exceeded expectations by a significant margin on Wednesday. If we only consider periods when the S&P 500 closed in positive territory, Wednesday’s aggregate purchases surpassed the previous record set on February 8th. Normally, Vanda would expect this this level of inflows on a day when the S&P 500 experiences a daily decline between -1% and -4%. Instead, “this type of behavior suggests retail traders are FOMO-ing more than any sentiment recent survey would show.”

The flipside to the recent retail euphoria is that Vanda expects retail flows into cash equities to decrease in the weeks ahead, as seasonality suggests that March-April are typically middle-of-the-road months during the calendar year.

Furthermore, when looking at a rolling one-month period, inflows have never been higher since the dataset began in 2014 (second chart below). Sustaining such a robust daily pace will prove challenging but it won’t mean the end of the current bull market if institutional investors pick up the slack.

At the same time, and contrary to popular belief (especially among bears), the above doesn’t mean that retail investors are running out of capital to allocate to risky investments. Indeed, from a stock level perspective, the chart below suggests that retail investors have plenty of dry powder in the form of capital parked in money market funds that could be deployed in the equity space once confidence about future market returns increases more broadly.

Adding insult to injury for the institutional bears – of which there is plenty – there is potential for bullish positions to be added in the options market. However, it is uncertain to what extent retail investors are willing to participate in the rally with leverage, given they’re still sitting on significant losses (-25% on average). In any case, nobody expects that the level of speculation observed during the 2020-2021 period will be replicated as we’re still in the later stages of the market cycle. Those dynamics are more likely to take hold during the early recovery phases after a recession has occurred.

The soaring retail investor flows underpin the outperformance of their favorite stocks. A basket of the top 10 most-purchased retail stocks over recent months is experiencing a strong rebound relative to the SPX in 2023. Retail flows have accounted for a +US$18.5bn capital injection YTD in these names (listed below the chart). Should positive momentum in the broad equity market persist, it could push retail investors toward more speculative names, which are more susceptible to such flows given their smaller market cap.

Many smaller-cap single stocks are also beginning to populate the top part of the retail leaderboard so far in 2023. Indeed, the first table below shows that beyond the top 10 most-bought securities, there’s a host of smaller-cap names that have attracted significant inflows this year (~US$2.23bn in total). Moreover, the weighted average performance of this group of stocks is roughly +50%, which is widely outpacing the S&P500 total return of 8.2%.

The other outcome of this dynamic is a pick-up in retail purchases in the ARKK ETF and some of its underlying holdings. It was common back in 2020-21 for retail investors to buy ARK ETFs while at the same time piling in some of their more hyped underlyings. While we don’t expect retail speculation to reach those levels for the reasons discussed above, it is noteworthy that retail investors are vastly outpacing Cathie Wood and Co. regarding purchases across some of these names.

Vanda concludes its weekly retail tracking by pointing out that crypto TradFi proxies are among some of the best performers week-to-date.

Silvergate Capital (SI) shares were up 28.6% at the end of trading Wednesday after Citadel Securities announced that it had taken a stake in the company. Indeed, 13F filings show Citadel Securities bought 5.5% in the digital currency banking company. The shares are up 69% over the past month but remain 91% below their all-time high. With the latest data showing 67% of SI’s shares held short it is likely that retail purchases have helped fuel a short-squeeze over the last three trading days. Given the size of the short book, we wouldn’t be surprised to see retail traders attempt to push the stock further in the coming days, although flows over the past three months show that interest in this name tends to be sporadic and short-lived. In contrast, Coinbase (COIN) seems to enjoy stronger retail tailwinds as bullish activity in the options space is surging as well (second chart).

Finally, here is the aggregate retail flow tracker”

Loading…