After the colossal disappointment last month (which BofA's omniscient analysts forewarned), February's consensus expects a considerable rebound in retail sales (though BofA's team - once again - are more downbeat)...

BofA retail sales preview based on real-time card spending data: not pretty pic.twitter.com/avlFVTHDe0

— zerohedge (@zerohedge) March 17, 2025

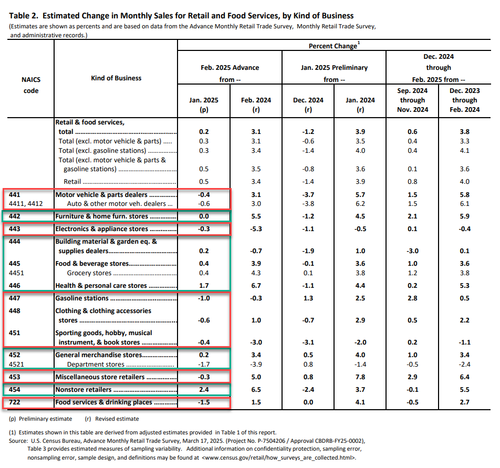

Following last month's 0.9% MoM plunge, which was revised down a 1.2% MoM drop, February saw retail sales disappoint (rising just 0.2% MoM vs +0.6% MoM exp)...

Source: Bloomberg

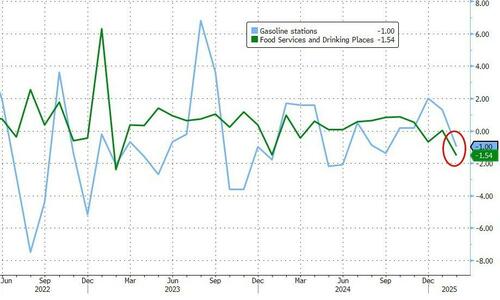

Food Services & Gas Stations saw the biggest drop in nominal sales...

Biggest drop in food services spending in two years...

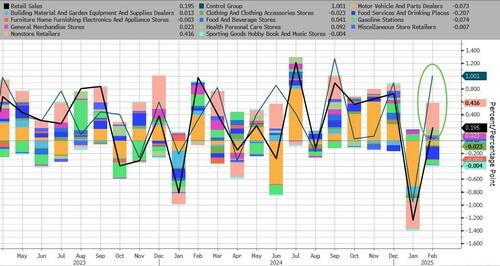

Non-store retailers (online) saw sales soar the most...

Core retail sales met expectations (+0.3% MoM) but also saw downward revisions...

Source: Bloomberg

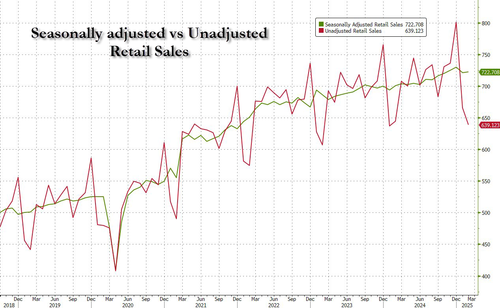

On a non-seasonally-adjusted basis, retail sales are actually down YoY...

Source: Bloomberg

Adjusted roughly for inflation,. real retail sales is basically flat year-over-year...

Source: Bloomberg

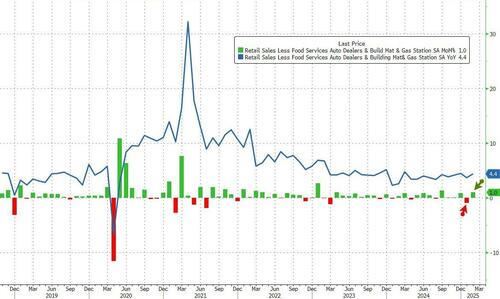

Finally, on the bright side, Retail Sales Control Group - which is used for GDP calculations - surged 1.0% MoM in February (more than double the 0.4% rise expected), after puking a revised lower 1.0% MoM in January...

Source: Bloomberg

So, while headline sentiment may be weak, this is a solid report for signaling economic growth.

Trump learning from Biden: January revised much lower, means lower base and can beat estimates

— zerohedge (@zerohedge) March 17, 2025

After the colossal disappointment last month (which BofA’s omniscient analysts forewarned), February’s consensus expects a considerable rebound in retail sales (though BofA’s team – once again – are more downbeat)…

BofA retail sales preview based on real-time card spending data: not pretty pic.twitter.com/avlFVTHDe0

— zerohedge (@zerohedge) March 17, 2025

Following last month’s 0.9% MoM plunge, which was revised down a 1.2% MoM drop, February saw retail sales disappoint (rising just 0.2% MoM vs +0.6% MoM exp)…

Source: Bloomberg

Food Services & Gas Stations saw the biggest drop in nominal sales…

Biggest drop in food services spending in two years…

Non-store retailers (online) saw sales soar the most…

Core retail sales met expectations (+0.3% MoM) but also saw downward revisions…

Source: Bloomberg

On a non-seasonally-adjusted basis, retail sales are actually down YoY…

Source: Bloomberg

Adjusted roughly for inflation,. real retail sales is basically flat year-over-year…

Source: Bloomberg

Finally, on the bright side, Retail Sales Control Group – which is used for GDP calculations – surged 1.0% MoM in February (more than double the 0.4% rise expected), after puking a revised lower 1.0% MoM in January…

Source: Bloomberg

So, while headline sentiment may be weak, this is a solid report for signaling economic growth.

Trump learning from Biden: January revised much lower, means lower base and can beat estimates

— zerohedge (@zerohedge) March 17, 2025

Loading…