The jury is still out on how the global economy is expected to perform in 2024, but as seen during the pandemic, economic turmoil sometimes provides opportunities for the wealthy.

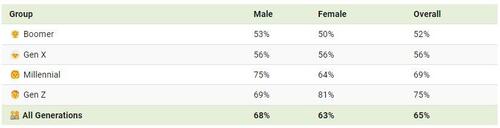

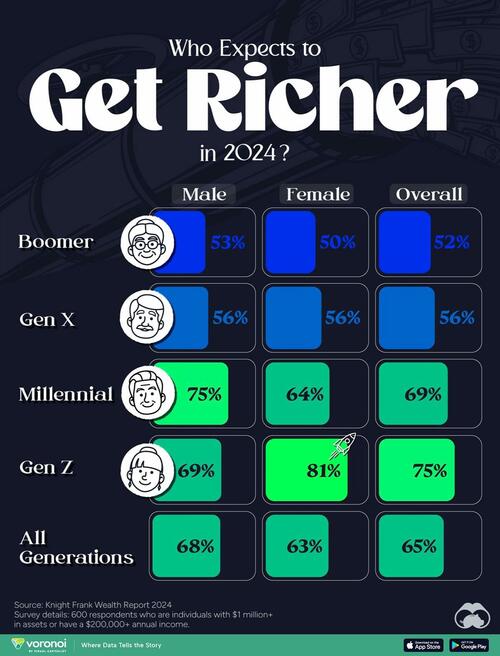

Visual Capitalist's Marcus Lu visualizes the percentage of high net worth individual (HNWI) respondents who expect their wealth to increase in 2024, categorized by generation and gender, from the Knight Frank Next Gen Survey, accessible in their latest wealth report.

The survey covered 600 global HNWIs, who are individuals with more than $1 million in assets or make more than $200,000 a year, and then categorized their responses by gender and generation.

Affluent Gen Z Women Eye Financial Gains in 2024

At a glance, there’s a very apparent generational difference in the expectations of getting richer in 2024.

About half (52%) of the surveyed Baby Boomers think their assets will grow, compared to Gen X (56%), Millennials, (69%), and Gen Z (75%).

Note: Percentage of respondents who said they expect their wealth will increase in 2024.

There’s also a noticeable gender difference. Men tend to be more optimistic than women, with one glaring exception.

A staggering 81% of the surveyed high net worth Gen Z women expect to make hay this year, making them the most optimistic of all the groups.

This corroborates a trend where Gen Z women were also the most optimistic in retirement planning. As CNBC reports, a combination of newer avenues of financial resources, and an openness towards advice, has given them a more optimistic attitude than their older counterparts.

Meanwhile, American Millennials are expected to become the richest generation ever as a $90 trillion asset transfer between Boomer parents and Millennial children begins to take place over the next two decades.

A huge percentage of that wealth comes in the form of property assets accumulated by generations before them. This especially includes houses, whose prices have skyrocketed over the last two decades.

The jury is still out on how the global economy is expected to perform in 2024, but as seen during the pandemic, economic turmoil sometimes provides opportunities for the wealthy.

Visual Capitalist’s Marcus Lu visualizes the percentage of high net worth individual (HNWI) respondents who expect their wealth to increase in 2024, categorized by generation and gender, from the Knight Frank Next Gen Survey, accessible in their latest wealth report.

The survey covered 600 global HNWIs, who are individuals with more than $1 million in assets or make more than $200,000 a year, and then categorized their responses by gender and generation.

Affluent Gen Z Women Eye Financial Gains in 2024

At a glance, there’s a very apparent generational difference in the expectations of getting richer in 2024.

About half (52%) of the surveyed Baby Boomers think their assets will grow, compared to Gen X (56%), Millennials, (69%), and Gen Z (75%).

Note: Percentage of respondents who said they expect their wealth will increase in 2024.

There’s also a noticeable gender difference. Men tend to be more optimistic than women, with one glaring exception.

A staggering 81% of the surveyed high net worth Gen Z women expect to make hay this year, making them the most optimistic of all the groups.

This corroborates a trend where Gen Z women were also the most optimistic in retirement planning. As CNBC reports, a combination of newer avenues of financial resources, and an openness towards advice, has given them a more optimistic attitude than their older counterparts.

Meanwhile, American Millennials are expected to become the richest generation ever as a $90 trillion asset transfer between Boomer parents and Millennial children begins to take place over the next two decades.

A huge percentage of that wealth comes in the form of property assets accumulated by generations before them. This especially includes houses, whose prices have skyrocketed over the last two decades.

Loading…