A new report from the International Coffee Organization reveals an alarming situation in the coffee market. Robusta coffee prices have skyrocketed to a 45-year high, a clear indication of the severity of the supply crunch and the rampant bean hoarding that is gripping the world's largest bean producer.

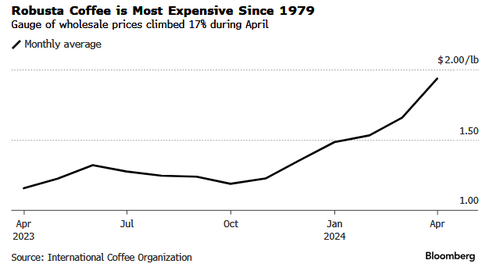

The London-based group, in their monthly report, delivered a sobering update. ICO's gauge of wholesale prices, based on spot prices across key markets, surged 17% in April to the highest level since 1979. The report also highlighted Vietnam's struggles in its coffee belt, enduring several years of poor harvests.

Bloomberg notes, "Farmers and middlemen continue to hold onto beans so they don't miss out on better deals after a weak 2023-24 harvest." This has sparked a tidal wave of exporters defaulting on their contracts due to lack of supply.

A long El Niño-induced drought in Vietnam has been the main culprit behind a decline in bean production. Robusta beans are typically used for instant drinks and espresso coffee. Vietnam accounts for about a third of the world's bean supply.

"We can't tell when prices will peak," said Tran Thi Lan Anh, deputy director of Vinh Hiep Co., a major Vietnamese exporter.

Mid-last month, we pointed out robusta bean prices were "hyperinflation' in a note titled "This Next Bean Is Hyperinflating, And It's Not Cocoa."

Bloomberg noted, "Vietnam's coffee belt could start to recover from drought this month, and hedge funds are placing bets on further price gains."

Soaring bean prices could eventually affect retail coffee prices at the supermarket. And it's not just going to be coffee. Cocoa prices have hyperinflated in recent months but have recently declined.

A new report from the International Coffee Organization reveals an alarming situation in the coffee market. Robusta coffee prices have skyrocketed to a 45-year high, a clear indication of the severity of the supply crunch and the rampant bean hoarding that is gripping the world’s largest bean producer.

The London-based group, in their monthly report, delivered a sobering update. ICO’s gauge of wholesale prices, based on spot prices across key markets, surged 17% in April to the highest level since 1979. The report also highlighted Vietnam’s struggles in its coffee belt, enduring several years of poor harvests.

Bloomberg notes, “Farmers and middlemen continue to hold onto beans so they don’t miss out on better deals after a weak 2023-24 harvest.” This has sparked a tidal wave of exporters defaulting on their contracts due to lack of supply.

A long El Niño-induced drought in Vietnam has been the main culprit behind a decline in bean production. Robusta beans are typically used for instant drinks and espresso coffee. Vietnam accounts for about a third of the world’s bean supply.

“We can’t tell when prices will peak,” said Tran Thi Lan Anh, deputy director of Vinh Hiep Co., a major Vietnamese exporter.

Mid-last month, we pointed out robusta bean prices were “hyperinflation’ in a note titled “This Next Bean Is Hyperinflating, And It’s Not Cocoa.”

Bloomberg noted, “Vietnam’s coffee belt could start to recover from drought this month, and hedge funds are placing bets on further price gains.”

Soaring bean prices could eventually affect retail coffee prices at the supermarket. And it’s not just going to be coffee. Cocoa prices have hyperinflated in recent months but have recently declined.

Loading…