By Peter Tchir of Academy Securities

“Rotations”

We will use the term “rotation” a bit more broadly today. Yes, it will incorporate what we typically think of as rotations, but will be broadened to encompass “pivots” and “evolution” if not “rethinking.”

The areas of focus today will be:

- U.S. Equity Markets

- The Fed on Inflation

- Crypto

- Carry Trades

- Private Credit

Each of these is important for overall markets and represent, to some degree, “rotations.”

U.S. Equity Markets

I’ve been particularly bearish on the Nasdaq 100 which, despite all the hype, closed lower to end March than where it closed on March 1st. While I’ve liked energy, I have not committed to the “laggard” trade, like we did in late fall/early winter last year. Back then we were reduced to Wayne’s World and Beavis and Butt-Head to support what was a largely contrarian (and seemingly illogical) view.

While I’ve been struggling to become constructive on the Nasdaq 100 (IGIW in A Day for Acronyms), it certainly makes sense to revisit the broad market and the potential for another big rotation like we saw late last year.

I’m so sick of hearing about the Mag 7, Fab 4, or whatever (Time to Retire Mag 7 Moniker) and that it is at the 22nd all-time high on this run for the S&P 500, that I’m looking for anything to steer me away from that. The Russell 2000, suddenly outperforming, is interesting.

This has been a market driven by AI, AI proxies, and anything that has been “deputized” into the AI space. That is where the performance has been concentrated.

#AI at a reasonable price via Citi pic.twitter.com/shX7MokT20

— JE$US (@WallStJesus) March 31, 2024

That is where I question whether markets, investors, or even corporations have gotten ahead of themselves on what AI can deliver today, especially versus the costs of implementing it today.

It is refreshing to see a bounce in some other areas. Energy and mining have done well of late. The regional bank index seems to be trying to break back to levels last seen before some smaller banks faced pressure and required some immediate investments.

This is occurring while ARKK, one of my favorite proxies for “innovative” stocks, bounces around, roughly unchanged from the middle of February. That is even with a resumption of the IPO market, which I would have expected to provide a “knee jerk” bounce to that ETF. It didn’t, which is somewhat encouraging, as it could be taken (and I’m taking it this way) that there is a lot of thought going into picking stocks and sectors (yes, a LOT of the thought is to BUY AI) which seems healthy.

Is this rotation real?

Are we set for another period of significant outperformance by small caps? I could be convinced of that, quite easily, in fact. We’ve hit that point in the rally, where even some of the biggest bulls are seeing signs of excessive exuberance.

But (and this is a big but), will it occur like late last year, when the outperformance occurred in a very positive market, or will it occur in a decline?

I’m starting to eye outperformance for more sectors than just energy (which has been my focus), but while I can see energy going up, even amidst a decline in the Nasdaq 100, I’m not sure that I can see the same for the Russell 2000.

Leaning towards a rotation, but the outperformance seems likely to be losing less, rather than making more.

The Fed on Inflation

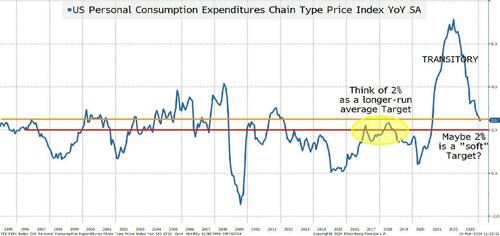

Clearly the Fed seems to be getting more comfortable with some level of inflation above 2%. While they haven’t officially changed their target, they seem to be willing to ease monetary policy, even while inflation remains closer to 3% than 2%.

The Fed’s “preferred” measure of inflation came in at 2.5% on Friday (core was slightly higher).

There are three things I think are worth pointing out:

-

The “favorite” measure, whether by design or coincidence, has struggled to be above 2% for extended periods. It is almost like you pick a favorite measure that lets you bias policy towards easing, since it doesn’t often or naturally get above 2%. Above 2.5% is almost an anomaly for this metric.

-

Remember back when we were finally getting above 2% inflation, and the Fed “rotated” from a sort of “hard target” to an “average target?” The Fed shouldn’t react to inflation above 2% after extended periods below 2% because they have to think in terms of averages, not absolutes. If that thinking was prominent today, we would need deflation for a year or two, to get averages back to below 2% (depending on whether you are thinking in terms of 1-to-3-year averages, or 5-to-10-year averages).

-

Transitory. Enough said, other than that it highlights a propensity within the Fed towards easier money, rather than tighter fiscal policy.

The Fed has “rotated” into methodologies and views that let them be more dovish than might otherwise be expected. That is happening right now, but their thought process hasn’t always worked.

This “rotation” should largely be expected, but it is fully priced in. However, is the risk balanced appropriately if the data comes in “soft enough” (under their new “guidelines”) to allow for more cuts, or for it to be “inflationary enough” that the Fed winds up disappointing markets?

On the bright side, markets seem to be moving far more on economic data (which has been strong) than overreacting to Fed jawboning. The equity market rallied strongly even as multiple rate cuts were priced out of the market.

Really not sure what conclusion to draw from this latest “rotation” of Fed thinking, other than it seems to be their predilection to find ways to “pivot” to easier monetary policy. However, their track record for being able to follow through has been mixed.

Crypto

I remember back when Bitcoin was “better than money” and a mechanism for transacting (someone bought a pizza for 10 coins). I also remember when Bitcoin was an inflation hedge. I remember when Long Island Iced Tea became Long Blockchain Corp and rallied. I also vaguely remember things similar to this occurring regarding the metaverse, and of late, how everything suddenly has an “AI” component (either in its function or design).

One thing that has been consistent about crypto is that it has always been about adoption.

The reasons for adoption have changed, but the need for new adoption, and the ability to attract it, has been crucial to timing Bitcoin markets.

Now, as far as I can tell, the Bitcoin argument has simplified to:

- Scarcity. There is a limit to the number of ones and zeros that can be created. I rarely hear “use” cases any longer, so scarcity has bubbled to the surface.

- On a more technical note, we have the “halving.” The reward for mining is cut in half, as Bitcoin makes new supply more “scarce.” The halving has accompanied rallies in the past, therefore, it will again, especially since it is tied to “scarcity” which is now the main selling point.

So, the scarcity argument is now designed to drive RIAs into Bitcoin. Bitcoin was so “complex” that RIAs managing billions couldn’t figure out how to do it. But now, the ease of ETFs (which should be anathema to Bitcoin purists) is the ticket to adoption and success.

Bitcoin ETF assets grew to around $55 billion late last week.

- Bitcoin ETFs started with a massive head start as GBTC, formerly a Unit Trust, converted to an ETF.

- Bitcoin was around $40k when the ETFs were launched and is now at $70k, helping the asset size grow.

- So, there has been some adoption, but:

- It has been a drop in the bucket (somewhere around $10 billion in new money) for an “asset” worth $1.4 trillion.

- Even some big proponents have been commenting on how relatively small flows have outsized price moves associated with them.

Maybe the scarcity, halving, and “RIA adoption” story is enough? Certainly, Bitcoiners have been awesome at creating and evolving their rationale as to why you need to own Bitcoin.

This “pivot” or “rotation” on what is used to create FOMO is impressive, but I’m still not getting a strong sense of greater adoption. Yes, in our world, if it keeps going up, it will gather more adoption as FOMO kicks in. However, a decline seems unlikely to trigger a buying opportunity, at least in the minds of many RIAs who admit a 1% allocation is small, but also don’t see buying anything they don’t believe in.

Finally, on the theme of rotations, Gensler rotated into approval. Part of me now wonders if, in the back end, many will rue the day that the ETFs were created. One thing that seemed prevalent in the “old days” of crypto was the inability to substantiate claims, or even sue. I wonder if that is changing?

Wouldn’t short this here, but it seems incredibly overdone based on “scarcity,” the “halving,” and ETF adoption, which just doesn’t seem that great relative to the size of Bitcoin.

Ethereum, and some others that are still sticking to “use” cases other than scarcity, could be more interesting over time.

Carry Trades

So far, with the most dovish hike ever, the Japanese Yen has retained its use for funding carry trades. There has been some concern expressed that a hawkish Bank of Japan could upset the carry trade “apple cart” but yields are still a fraction of what

they are elsewhere in the world, they sound dovish, and the Yen is weakening, even with the potential for some intervention.

There has been no rotation in the carry trade, but that is something to watch.

Private Credit

I’m extremely comfortable with private credit, but we are running out of time and space today, so that will get its own piece later this week.

By Peter Tchir of Academy Securities

“Rotations”

We will use the term “rotation” a bit more broadly today. Yes, it will incorporate what we typically think of as rotations, but will be broadened to encompass “pivots” and “evolution” if not “rethinking.”

The areas of focus today will be:

- U.S. Equity Markets

- The Fed on Inflation

- Crypto

- Carry Trades

- Private Credit

Each of these is important for overall markets and represent, to some degree, “rotations.”

U.S. Equity Markets

I’ve been particularly bearish on the Nasdaq 100 which, despite all the hype, closed lower to end March than where it closed on March 1st. While I’ve liked energy, I have not committed to the “laggard” trade, like we did in late fall/early winter last year. Back then we were reduced to Wayne’s World and Beavis and Butt-Head to support what was a largely contrarian (and seemingly illogical) view.

While I’ve been struggling to become constructive on the Nasdaq 100 (IGIW in A Day for Acronyms), it certainly makes sense to revisit the broad market and the potential for another big rotation like we saw late last year.

I’m so sick of hearing about the Mag 7, Fab 4, or whatever (Time to Retire Mag 7 Moniker) and that it is at the 22nd all-time high on this run for the S&P 500, that I’m looking for anything to steer me away from that. The Russell 2000, suddenly outperforming, is interesting.

This has been a market driven by AI, AI proxies, and anything that has been “deputized” into the AI space. That is where the performance has been concentrated.

#AI at a reasonable price via Citi pic.twitter.com/shX7MokT20

— JE$US (@WallStJesus) March 31, 2024

That is where I question whether markets, investors, or even corporations have gotten ahead of themselves on what AI can deliver today, especially versus the costs of implementing it today.

It is refreshing to see a bounce in some other areas. Energy and mining have done well of late. The regional bank index seems to be trying to break back to levels last seen before some smaller banks faced pressure and required some immediate investments.

This is occurring while ARKK, one of my favorite proxies for “innovative” stocks, bounces around, roughly unchanged from the middle of February. That is even with a resumption of the IPO market, which I would have expected to provide a “knee jerk” bounce to that ETF. It didn’t, which is somewhat encouraging, as it could be taken (and I’m taking it this way) that there is a lot of thought going into picking stocks and sectors (yes, a LOT of the thought is to BUY AI) which seems healthy.

Is this rotation real?

Are we set for another period of significant outperformance by small caps? I could be convinced of that, quite easily, in fact. We’ve hit that point in the rally, where even some of the biggest bulls are seeing signs of excessive exuberance.

But (and this is a big but), will it occur like late last year, when the outperformance occurred in a very positive market, or will it occur in a decline?

I’m starting to eye outperformance for more sectors than just energy (which has been my focus), but while I can see energy going up, even amidst a decline in the Nasdaq 100, I’m not sure that I can see the same for the Russell 2000.

Leaning towards a rotation, but the outperformance seems likely to be losing less, rather than making more.

The Fed on Inflation

Clearly the Fed seems to be getting more comfortable with some level of inflation above 2%. While they haven’t officially changed their target, they seem to be willing to ease monetary policy, even while inflation remains closer to 3% than 2%.

The Fed’s “preferred” measure of inflation came in at 2.5% on Friday (core was slightly higher).

There are three things I think are worth pointing out:

-

The “favorite” measure, whether by design or coincidence, has struggled to be above 2% for extended periods. It is almost like you pick a favorite measure that lets you bias policy towards easing, since it doesn’t often or naturally get above 2%. Above 2.5% is almost an anomaly for this metric.

-

Remember back when we were finally getting above 2% inflation, and the Fed “rotated” from a sort of “hard target” to an “average target?” The Fed shouldn’t react to inflation above 2% after extended periods below 2% because they have to think in terms of averages, not absolutes. If that thinking was prominent today, we would need deflation for a year or two, to get averages back to below 2% (depending on whether you are thinking in terms of 1-to-3-year averages, or 5-to-10-year averages).

-

Transitory. Enough said, other than that it highlights a propensity within the Fed towards easier money, rather than tighter fiscal policy.

The Fed has “rotated” into methodologies and views that let them be more dovish than might otherwise be expected. That is happening right now, but their thought process hasn’t always worked.

This “rotation” should largely be expected, but it is fully priced in. However, is the risk balanced appropriately if the data comes in “soft enough” (under their new “guidelines”) to allow for more cuts, or for it to be “inflationary enough” that the Fed winds up disappointing markets?

On the bright side, markets seem to be moving far more on economic data (which has been strong) than overreacting to Fed jawboning. The equity market rallied strongly even as multiple rate cuts were priced out of the market.

Really not sure what conclusion to draw from this latest “rotation” of Fed thinking, other than it seems to be their predilection to find ways to “pivot” to easier monetary policy. However, their track record for being able to follow through has been mixed.

Crypto

I remember back when Bitcoin was “better than money” and a mechanism for transacting (someone bought a pizza for 10 coins). I also remember when Bitcoin was an inflation hedge. I remember when Long Island Iced Tea became Long Blockchain Corp and rallied. I also vaguely remember things similar to this occurring regarding the metaverse, and of late, how everything suddenly has an “AI” component (either in its function or design).

One thing that has been consistent about crypto is that it has always been about adoption.

The reasons for adoption have changed, but the need for new adoption, and the ability to attract it, has been crucial to timing Bitcoin markets.

Now, as far as I can tell, the Bitcoin argument has simplified to:

- Scarcity. There is a limit to the number of ones and zeros that can be created. I rarely hear “use” cases any longer, so scarcity has bubbled to the surface.

- On a more technical note, we have the “halving.” The reward for mining is cut in half, as Bitcoin makes new supply more “scarce.” The halving has accompanied rallies in the past, therefore, it will again, especially since it is tied to “scarcity” which is now the main selling point.

So, the scarcity argument is now designed to drive RIAs into Bitcoin. Bitcoin was so “complex” that RIAs managing billions couldn’t figure out how to do it. But now, the ease of ETFs (which should be anathema to Bitcoin purists) is the ticket to adoption and success.

Bitcoin ETF assets grew to around $55 billion late last week.

- Bitcoin ETFs started with a massive head start as GBTC, formerly a Unit Trust, converted to an ETF.

- Bitcoin was around $40k when the ETFs were launched and is now at $70k, helping the asset size grow.

- So, there has been some adoption, but:

- It has been a drop in the bucket (somewhere around $10 billion in new money) for an “asset” worth $1.4 trillion.

- Even some big proponents have been commenting on how relatively small flows have outsized price moves associated with them.

Maybe the scarcity, halving, and “RIA adoption” story is enough? Certainly, Bitcoiners have been awesome at creating and evolving their rationale as to why you need to own Bitcoin.

This “pivot” or “rotation” on what is used to create FOMO is impressive, but I’m still not getting a strong sense of greater adoption. Yes, in our world, if it keeps going up, it will gather more adoption as FOMO kicks in. However, a decline seems unlikely to trigger a buying opportunity, at least in the minds of many RIAs who admit a 1% allocation is small, but also don’t see buying anything they don’t believe in.

Finally, on the theme of rotations, Gensler rotated into approval. Part of me now wonders if, in the back end, many will rue the day that the ETFs were created. One thing that seemed prevalent in the “old days” of crypto was the inability to substantiate claims, or even sue. I wonder if that is changing?

Wouldn’t short this here, but it seems incredibly overdone based on “scarcity,” the “halving,” and ETF adoption, which just doesn’t seem that great relative to the size of Bitcoin.

Ethereum, and some others that are still sticking to “use” cases other than scarcity, could be more interesting over time.

Carry Trades

So far, with the most dovish hike ever, the Japanese Yen has retained its use for funding carry trades. There has been some concern expressed that a hawkish Bank of Japan could upset the carry trade “apple cart” but yields are still a fraction of what

they are elsewhere in the world, they sound dovish, and the Yen is weakening, even with the potential for some intervention.

There has been no rotation in the carry trade, but that is something to watch.

Private Credit

I’m extremely comfortable with private credit, but we are running out of time and space today, so that will get its own piece later this week.

Loading…