By Russell Clark of Capital Flows and Asset Markets substack

For the past year or so, inflation trades have worked. Long commodities and short bonds. In the last month or so, commodities have seen a sizable sell off. Is the deflation trade back on?

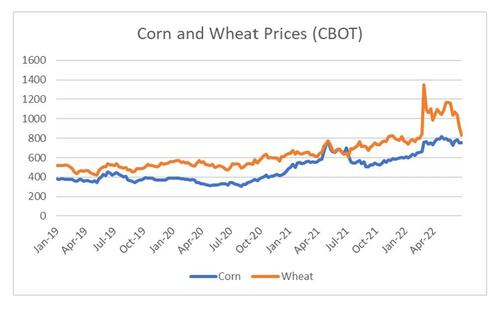

For me the biggest surprise for me in this sell off of in commodities is that it been driven by the commodities that should be most affected by the Russian/Ukrainian War. Russia and Ukraine are sizable wheat exporters, but the wheat price has fully reversed the spike that was first seen on the invasion. I have included corn (maize) where Ukraine is a smaller exporter for comparison.

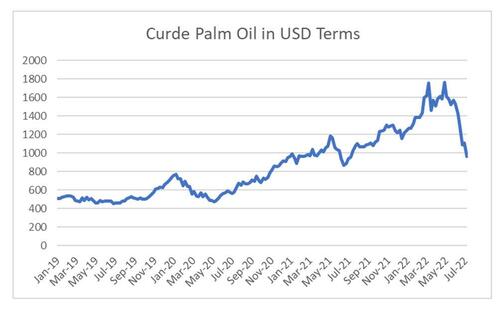

Even more surprising to me has been the oilseed market. Ukraine is a dominant exporter of sunflower oil, which has seen exports collapse. This should tighten up the export market for vegetable oil, which is dominated by palm oil. Palm oil did spike on the invasion, but has dropped by nearly half since its peak.

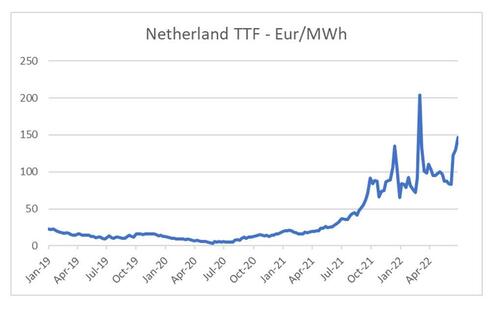

This would be suggestive that market was looking through Russian and Ukrainian supply issues, but the market for European gas shows no such look through. That is European gas prices are still at very high prices.

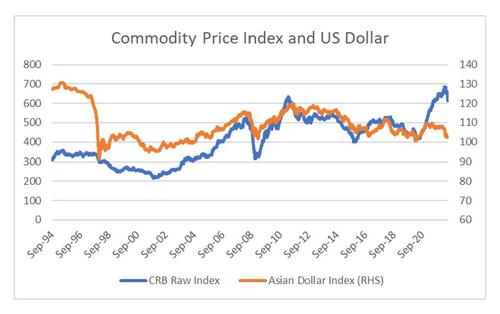

Old school macro analysis (or muscle memory) would suggest that commodities are done. Historically speaking the relationship between Asian currencies and commodities has been strong, until this year, implying considerable downside to commodities.

The problem I have with this analysis is that assumes that both the US and China are willing to either let unemployment rise, or real wages fall. Both politically and economically I see this as a non-starter. In fact, falling commodity prices are likely to allow governments to increase spending again, as demand management becomes more important.

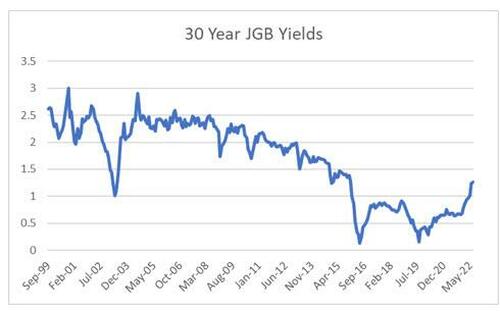

One risk is that I am too early, and we have one more deflationary cycle. There are two market indicators I am looking at that signal inflation rather than deflation to me. First, Japanese 30 year JGBs. Most people will think this is meaningless - but JGB investors understood the deflationary political arrangement of the world 30 years before the rest of the world. If they are not buying into deflation, then I am not either.

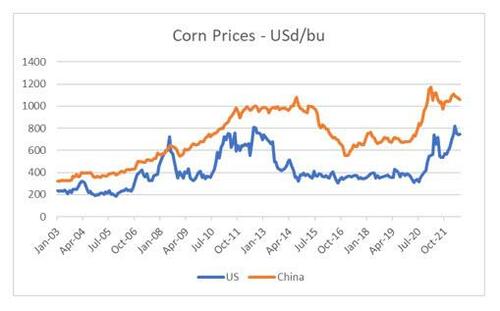

Why are the Japanese not buying into deflation? Probably because we are not really seeing much commodity deflation in China (although plenty of asset deflation). LNG prices in Asia are following European gas prices higher. Chinese corn prices (and China remains the world’s largest importer of corn) still remain well above US prices.

My base case remains that China has an explicit policy of reducing income inequality through raising wages, and reducing asset prices. This will continue to put upward pressure on commodity prices, which is now leading to strong pressure on governments to raise wages for workers. However I cut it, the world needs higher wages to deal with the extreme debt loads of governments, as well as the extreme valuations of housing to wages. Rising wages will actually drive very significant growth in GDP, and should continue to be bearish bonds, and bullish commodities.

The risk is a policy change out of China, but given that a Chinese devaluation would likely be met with tariff increases, all roads lead to inflation for me.

By Russell Clark of Capital Flows and Asset Markets substack

For the past year or so, inflation trades have worked. Long commodities and short bonds. In the last month or so, commodities have seen a sizable sell off. Is the deflation trade back on?

For me the biggest surprise for me in this sell off of in commodities is that it been driven by the commodities that should be most affected by the Russian/Ukrainian War. Russia and Ukraine are sizable wheat exporters, but the wheat price has fully reversed the spike that was first seen on the invasion. I have included corn (maize) where Ukraine is a smaller exporter for comparison.

Even more surprising to me has been the oilseed market. Ukraine is a dominant exporter of sunflower oil, which has seen exports collapse. This should tighten up the export market for vegetable oil, which is dominated by palm oil. Palm oil did spike on the invasion, but has dropped by nearly half since its peak.

This would be suggestive that market was looking through Russian and Ukrainian supply issues, but the market for European gas shows no such look through. That is European gas prices are still at very high prices.

Old school macro analysis (or muscle memory) would suggest that commodities are done. Historically speaking the relationship between Asian currencies and commodities has been strong, until this year, implying considerable downside to commodities.

The problem I have with this analysis is that assumes that both the US and China are willing to either let unemployment rise, or real wages fall. Both politically and economically I see this as a non-starter. In fact, falling commodity prices are likely to allow governments to increase spending again, as demand management becomes more important.

One risk is that I am too early, and we have one more deflationary cycle. There are two market indicators I am looking at that signal inflation rather than deflation to me. First, Japanese 30 year JGBs. Most people will think this is meaningless – but JGB investors understood the deflationary political arrangement of the world 30 years before the rest of the world. If they are not buying into deflation, then I am not either.

Why are the Japanese not buying into deflation? Probably because we are not really seeing much commodity deflation in China (although plenty of asset deflation). LNG prices in Asia are following European gas prices higher. Chinese corn prices (and China remains the world’s largest importer of corn) still remain well above US prices.

My base case remains that China has an explicit policy of reducing income inequality through raising wages, and reducing asset prices. This will continue to put upward pressure on commodity prices, which is now leading to strong pressure on governments to raise wages for workers. However I cut it, the world needs higher wages to deal with the extreme debt loads of governments, as well as the extreme valuations of housing to wages. Rising wages will actually drive very significant growth in GDP, and should continue to be bearish bonds, and bullish commodities.

The risk is a policy change out of China, but given that a Chinese devaluation would likely be met with tariff increases, all roads lead to inflation for me.