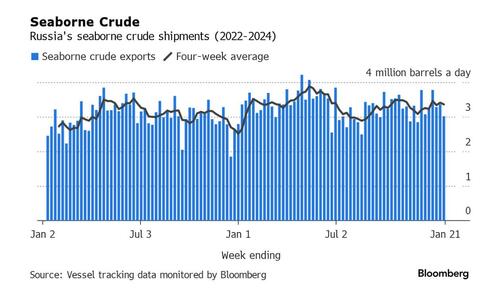

After it appeared that Russia was flooding the world with its oil exports, things reversed sharply in recent weeks when Russia’s seaborne crude shipments fell to the lowest in almost two months, undermined by adverse weather and a Ukrainian drone strike that briefly halted flows from a key Baltic export terminal.

According to tanker-tracking data monitored by Bloomberg, about 3.36 million barrels a day of crude were shipped from Russian ports in the four weeks to Jan. 21, a drop of 50,000 barrels/day from the revised figure for the period to Jan. 14. The more volatile weekly average fell by 340,000 barrels a day to a seven-week low of 3.02 million, the lowest since early December.

Exports were hit by continuing bad weather at some ports and a Ukrainian drone strike on the condensate processing facility adjacent to the Ust-Luga crude export terminal, which interrupted loading on Sunday, pushing one shipment from the week ending Jan. 21 into the following week.

As Bloomberg notes, continued port maintenance and more poor weather may depress shipments again this week, while the drone attack has opened up a new front in Moscow’s war on Ukraine that highlights the vulnerability of oil exports from Russia’s western ports (even if port use has resumed).

While Russia has said it will cut oil exports by 500,000 barrels a day below the May-June average during the first quarter, after several other members of the OPEC+ group agreed to make further output curbs, it now appears that Moscow will actually be forced to do so even if it did not actually plan it. The Russian cut will be shared between crude shipments, which will be reduced by 300,000 barrels a day, and refined products. The four-week average crude measure was about 220,000 barrels a day below the May-June level, so it's one snowstorm away from catching down to the quota.

Meanwhile, all Russian crude destined for Asian buyers from western ports continues to pass through the Red Sea, despite attacks on merchant vessels from Yemen-based Houthi rebels. As reported previously, the militants have assured Russia and China that the group is “ready to ensure the safe passage of their ships in the Red Sea.”

Ironically, the only oil tanker reported to have been struck off Yemen was carrying Russian crude. The Sai Baba, carrying a cargo of Russian Urals, was hit by a drone off Yemen on Dec. 23, according to a post by the US Central Command.

Russia still appears to be struggling to place cargoes of its Sokol crude. Seventeen cargoes, totaling almost 12 million barrels, are sitting on tankers that appear to be going nowhere. Another two cargoes are on shuttle tankers anchored off the South Korean port of Yeosu, where they are typically transferred to other vessels for onward delivery to India.

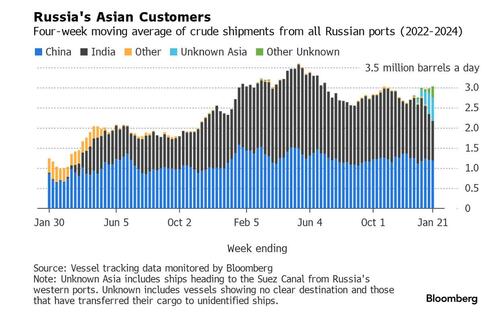

As usual, the biggest customer of Russia remains Asia, mostly China and India. Observed shipments to Russia’s Asian customers, including those showing no final destination, edged above 3 million barrels a day in the four weeks to Jan. 21. Flows increased to 3.03 million barrels a day from a revised 2.98 million in the period to Jan. 14, reaching their highest since July.

- About 1.19 million barrels a day of crude was loaded onto tankers heading to China in the four weeks to Jan. 21. China’s seaborne imports are boosted by about 800,000 barrels a day of crude delivered directly from Russia by pipeline, either directly, or via Kazakhstan.

- Flows on ships signaling destinations in India averaged about 990,000 barrels a day in the four weeks to Jan. 21.

Meanwhile, Russia’s seaborne crude exports to European countries have collapsed since Moscow’s troops invaded Ukraine in February 2022. A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

Combined flows to Turkey and Bulgaria, Russia’s only two remaining buyers close to its western ports, fell to about 330,000 barrels a day in the four weeks to Jan. 21, tanker-tracking data show. That’s down from about 430,000 barrels a day in the period to Jan. 14 and the lowest since September.

In total, the gross value of Russia’s crude exports fell to a five-week low of $1.38 billion in the seven days to Jan. 21 from $1.52 billion the previous week. The four-week average income also slipped, down by $25 million to $1.52 billion a week.

After it appeared that Russia was flooding the world with its oil exports, things reversed sharply in recent weeks when Russia’s seaborne crude shipments fell to the lowest in almost two months, undermined by adverse weather and a Ukrainian drone strike that briefly halted flows from a key Baltic export terminal.

According to tanker-tracking data monitored by Bloomberg, about 3.36 million barrels a day of crude were shipped from Russian ports in the four weeks to Jan. 21, a drop of 50,000 barrels/day from the revised figure for the period to Jan. 14. The more volatile weekly average fell by 340,000 barrels a day to a seven-week low of 3.02 million, the lowest since early December.

Exports were hit by continuing bad weather at some ports and a Ukrainian drone strike on the condensate processing facility adjacent to the Ust-Luga crude export terminal, which interrupted loading on Sunday, pushing one shipment from the week ending Jan. 21 into the following week.

As Bloomberg notes, continued port maintenance and more poor weather may depress shipments again this week, while the drone attack has opened up a new front in Moscow’s war on Ukraine that highlights the vulnerability of oil exports from Russia’s western ports (even if port use has resumed).

While Russia has said it will cut oil exports by 500,000 barrels a day below the May-June average during the first quarter, after several other members of the OPEC+ group agreed to make further output curbs, it now appears that Moscow will actually be forced to do so even if it did not actually plan it. The Russian cut will be shared between crude shipments, which will be reduced by 300,000 barrels a day, and refined products. The four-week average crude measure was about 220,000 barrels a day below the May-June level, so it’s one snowstorm away from catching down to the quota.

Meanwhile, all Russian crude destined for Asian buyers from western ports continues to pass through the Red Sea, despite attacks on merchant vessels from Yemen-based Houthi rebels. As reported previously, the militants have assured Russia and China that the group is “ready to ensure the safe passage of their ships in the Red Sea.”

Ironically, the only oil tanker reported to have been struck off Yemen was carrying Russian crude. The Sai Baba, carrying a cargo of Russian Urals, was hit by a drone off Yemen on Dec. 23, according to a post by the US Central Command.

Russia still appears to be struggling to place cargoes of its Sokol crude. Seventeen cargoes, totaling almost 12 million barrels, are sitting on tankers that appear to be going nowhere. Another two cargoes are on shuttle tankers anchored off the South Korean port of Yeosu, where they are typically transferred to other vessels for onward delivery to India.

As usual, the biggest customer of Russia remains Asia, mostly China and India. Observed shipments to Russia’s Asian customers, including those showing no final destination, edged above 3 million barrels a day in the four weeks to Jan. 21. Flows increased to 3.03 million barrels a day from a revised 2.98 million in the period to Jan. 14, reaching their highest since July.

- About 1.19 million barrels a day of crude was loaded onto tankers heading to China in the four weeks to Jan. 21. China’s seaborne imports are boosted by about 800,000 barrels a day of crude delivered directly from Russia by pipeline, either directly, or via Kazakhstan.

- Flows on ships signaling destinations in India averaged about 990,000 barrels a day in the four weeks to Jan. 21.

Meanwhile, Russia’s seaborne crude exports to European countries have collapsed since Moscow’s troops invaded Ukraine in February 2022. A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

Combined flows to Turkey and Bulgaria, Russia’s only two remaining buyers close to its western ports, fell to about 330,000 barrels a day in the four weeks to Jan. 21, tanker-tracking data show. That’s down from about 430,000 barrels a day in the period to Jan. 14 and the lowest since September.

In total, the gross value of Russia’s crude exports fell to a five-week low of $1.38 billion in the seven days to Jan. 21 from $1.52 billion the previous week. The four-week average income also slipped, down by $25 million to $1.52 billion a week.

Loading…