Federal Reserve Chair Jerome Powell has been a serial bubble blower, only to later deflate bubbles through interest rate hikes and restrictive monetary policies. In this note, we'll examine the recreational vehicle industry's boom and bust and the current multi-year downturn.

In early 2020, a combination of factors sparked the RV boom, including Fed Powell's reduction of interest rates to the zero lower bound and Democratic cities that imposed tyrannical government-enforced lockdowns that caused folks to flee to rural America. To some extent, Starlink space internet made remote working from RVs possible in some of the most remote areas in the nation. However, as soon as Powell began to hike rates in response to inflationary forces in early 2022, the boom turned into a bust as the affordability of these homes on wheels collapsed.

The RV bust has now persisted beyond the two-year mark, and to understand the industry's current environment, look no further than Lazydays, an RV dealership with over two dozen locations nationwide, which bills itself as the world's largest. The company recently reported significant revenue declines and sluggish sales, with no immediate recovery.

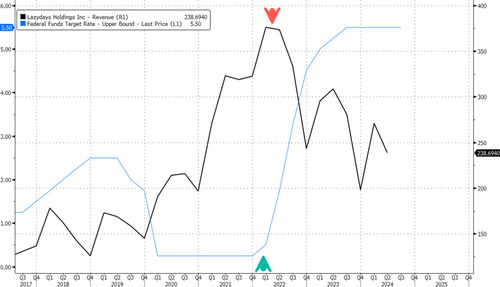

Powell slays the RV bubble with interest rate hikes. Notice how Lazydays' revenue began to slide shortly after the hikes started.

"Our best view is that the second quarter sales trajectory continued in July, and most industry experts are pointing to 2025 as the likely inflection for a meaningful industry recovery," Lazydays CEO John North told analysts in a recent call discussing second-quarter results.

North said, "So, facing that backdrop, we have continued to focus on the things we can control, maintaining healthy vehicle inventory, improving F&I per unit and achieving substantial total gross margin improvement sequentially from the first quarter."

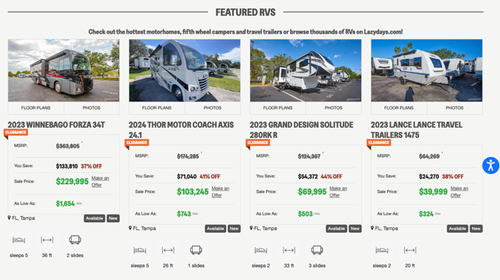

With discounts of up to 55% on RVs listed on the Lazydays website, North's remark about "maintaining healthy vehicle inventory" might hint at a different reality: way too much inventory...

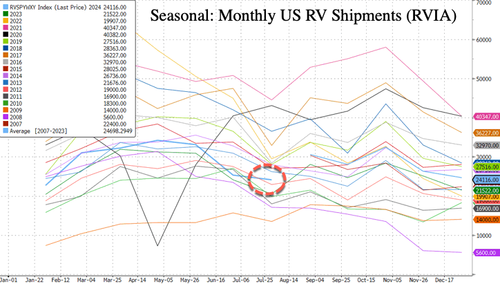

Across the industry, seasonal data from the RV Industry Association shows shipments are below a 16-year average for this time of year.

With Powell likely to embark on an interest rate-cutting cycle on Sept. 18, the question becomes if North's prediction of a bottom in the RV industry will be realized at some point in 2025. If so, Lazydays' shares are down 75% on the year, and it might be worth throwing this ticker on the bottoming watchlist.

Federal Reserve Chair Jerome Powell has been a serial bubble blower, only to later deflate bubbles through interest rate hikes and restrictive monetary policies. In this note, we’ll examine the recreational vehicle industry’s boom and bust and the current multi-year downturn.

In early 2020, a combination of factors sparked the RV boom, including Fed Powell’s reduction of interest rates to the zero lower bound and Democratic cities that imposed tyrannical government-enforced lockdowns that caused folks to flee to rural America. To some extent, Starlink space internet made remote working from RVs possible in some of the most remote areas in the nation. However, as soon as Powell began to hike rates in response to inflationary forces in early 2022, the boom turned into a bust as the affordability of these homes on wheels collapsed.

The RV bust has now persisted beyond the two-year mark, and to understand the industry’s current environment, look no further than Lazydays, an RV dealership with over two dozen locations nationwide, which bills itself as the world’s largest. The company recently reported significant revenue declines and sluggish sales, with no immediate recovery.

Powell slays the RV bubble with interest rate hikes. Notice how Lazydays’ revenue began to slide shortly after the hikes started.

“Our best view is that the second quarter sales trajectory continued in July, and most industry experts are pointing to 2025 as the likely inflection for a meaningful industry recovery,” Lazydays CEO John North told analysts in a recent call discussing second-quarter results.

North said, “So, facing that backdrop, we have continued to focus on the things we can control, maintaining healthy vehicle inventory, improving F&I per unit and achieving substantial total gross margin improvement sequentially from the first quarter.”

With discounts of up to 55% on RVs listed on the Lazydays website, North’s remark about “maintaining healthy vehicle inventory” might hint at a different reality: way too much inventory…

Across the industry, seasonal data from the RV Industry Association shows shipments are below a 16-year average for this time of year.

With Powell likely to embark on an interest rate-cutting cycle on Sept. 18, the question becomes if North’s prediction of a bottom in the RV industry will be realized at some point in 2025. If so, Lazydays’ shares are down 75% on the year, and it might be worth throwing this ticker on the bottoming watchlist.

Loading…