When you sleep with the boss, break up, and then go on to help him orchestrate one of the biggest financial frauds in U.S. history, things can get a little awkward around the water cooler, Caroline Ellison, the former CEO of Alameda Research, testified Thursday.

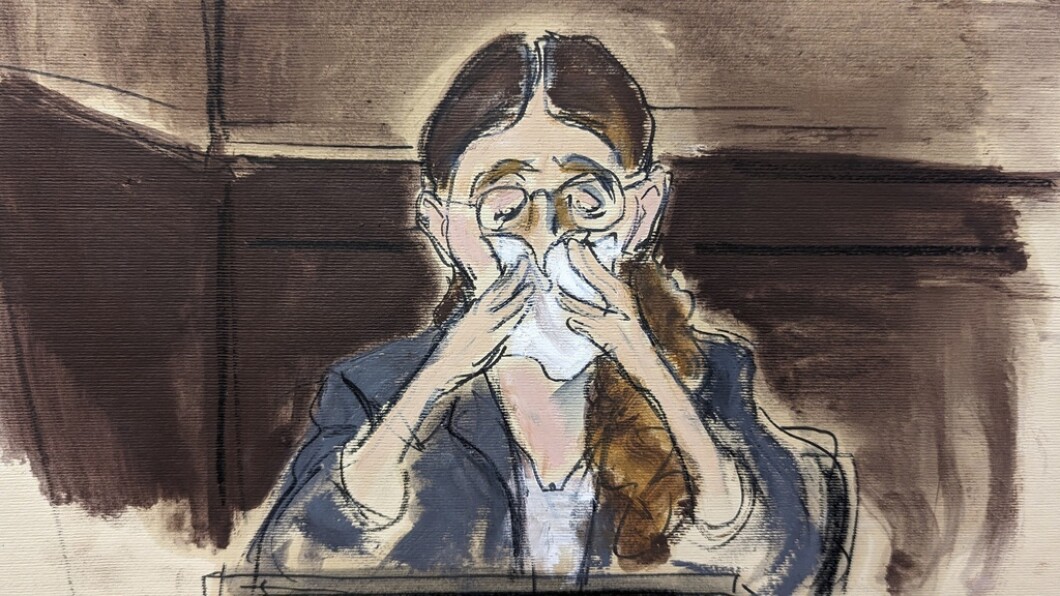

Ellison’s third day on the witness stand as the government’s star witness against FTX founder Sam Bankman-Fried revealed some of the ugly details of her painful split and lopsided power dynamic with her onetime boss-boyfriend.

AMERICAN HONEYMOONERS REVEAL MAD SCRAMBLE TO ESCAPE ISRAEL AFTER HAMAS TERROR ATTACK

The duo, along with other high-ranking officials at the crypto hedge fund and crypto exchange, are accused of tricking investors and customers into thinking their funds were safe and secure and that both businesses were doing well when in fact they were hemorrhaging money and about to implode. They are also accused of using investor funds to live a lavish lifestyle which included private jets, impressive real estate, and partying with celebrities.

Ellison’s testimony is crucial in the case against Bankman-Fried, who is facing seven criminal charges and could find himself behind bars for the rest of his life if he is convicted on all of the counts against him.

Prosecutors accused the former crypto king of trying to tap into the hold he once had over Ellison in an attempt to deride her testimony.

They claimed the 31-year-old was purposely laughing, making noises, and visibly shaking his head when Ellison recounted how they carried out their crypto con, according to a transcript released Thursday of a sidebar that took place Wednesday in federal court.

Bankman-Fried’s defense attorney called the allegations ridiculous, but Judge Lewis Kaplan told him to “have a word” with his client.

Ellison told jurors Thursday that it became difficult to talk to Bankman-Fried after they broke up for good in April 2022 and that he avoided one-on-one conversations. The uncomfortable situation spilled over to their home life because the two shared a penthouse apartment in the Bahamas, where FTX and Alameda were based. Even though Ellison moved on and found love with a new co-worker, the weight of the broken relationship hung in the air.

She told jurors she considered resigning from her position at Alameda multiple times but never followed through.

She claimed Bankman-Fried tried messing with her head and brought up the idea of promoting another person to co-CEO in August 2022 but that Ellison pushed back. In the end, she was the sole CEO of the hedge fund when it and FTX collapsed three months later.

Ellison testified Wednesday that she and other members of Bankman-Fried’s inner circle started panicking in June 2022 when multiple lenders asked to see the crypto trading firm’s balance sheets. Bankman-Fried ordered her to doctor seven different balance sheets that made Alameda’s losses look less significant, she said under oath.

On Nov. 2, CoinDesk, an online publication that covers cryptocurrencies, sounded the alarm that Alameda Research was on shaky ground, prompting Binance CEO Changpeng Zhao to announce he would be selling $580 million worth of FTX tokens. His action led to public speculation that FTX was insolvent, and other customers started to follow suit.

By Nov. 6, FTX customers were withdrawing $100 million every hour, exposing the multibillion-dollar hole created by Alameda’s use of FTX customer funds.

Ellison, Bankman-Fried, and several FTX executives went into crisis mode, hatching a plan to tweet misleading comments to trick investors into thinking their crypto was safe and secure, she said, adding that Bankman-Fried also told Alameda to spend $100 million to buy FTT, the cryptocurrency of FTX, to maintain its price.

“Money that could have been used for customer withdrawals,” she said.

Ellison also pulled back the curtain on Bankman-Fried’s signature scruffy look and claimed the onetime billionaire purposely dressed down during interviews and went to work with wild, frizzy hair to make himself appear humble and down to earth. She also told jurors he once told her there was a “5% chance” he would become president of the United States.

CLICK HERE FOR MORE FROM THE WASHINGTON EXAMINER

Ellison put the lion’s share of the blame on Bankman-Fried, though she admitted to going along with his outlandish plans to keep the companies solvent, which included bribing Chinese officials $100 million to regain access to more than $1 billion in frozen cryptocurrency.

Another scheme considered involved hiring Thai prostitutes using their accounts to arrange trades with Alameda that they knew would be bad and therefore would transfer value away from Alameda’s accounts and to the sex workers. Alameda would then reclaim the assets from the prostitutes through non-frozen accounts.