The 'higher-for-longer' soft landing economy may be transitioning back to a 'Goldilocks' economy of not-too-hot/not-too-cold activity and inflation, that this week, at least, created a particularly attractive backdrop for stocks, but realistically everything just traded together like the 'QE trade' - stock sup, bonds (prices) up, gold up, dollar down...

Source: Bloomberg

In fact, as one traders was overheard commenting on the ease with which the markets shrugged off geopolitical fears, a clearly retracting US consumer, and cracks in the labor market, "it's as if Santa married Goldilocks... everyone's drinking that kool-aid..."

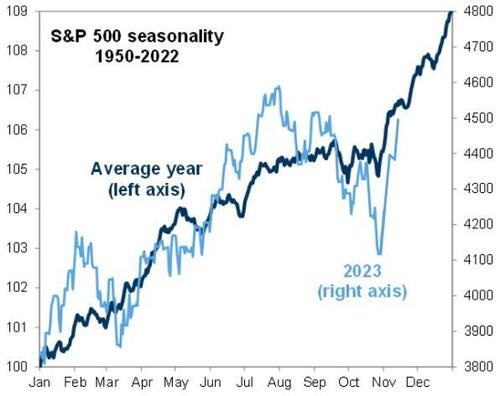

The 'seasonal' ramp arrived right on time...

Source: Goldman Sachs

As Goldman's Chris Hussey noted, the principal concern of a successfully soft landing economy is that growth takes off again, triggers renewed inflation, and the Fed is compelled to respond with more rate hikes. But this week, that scenario began to look less likely as the latest CPI inflation reading dipped, suggesting that the trajectory for inflation remains benign.

Additionally, on the growth side,

-

Housing Starts came in stronger than expected;

-

the Philly Fed improved from a month earlier;

-

retail sales declined by less than expected;

-

weekly jobless claims edged up but remain far from any level of pressure; and

-

Congress passed measures to avert a government shutdown.

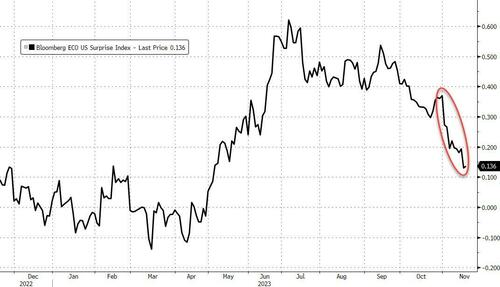

All of which saw the macro surprise index trending down...

Source: Bloomberg

...and at the same time, financial conditions getting dramatically looser...

Source: Bloomberg

This helped lift stocks dramatically higher on the week with most of the majors moving systemically higher (S&P, Nasdaq, Dow all up around 2% on the week - but notice basically unch since the CPI spike). Small Caps (Russell 2000) were big winners on the week amid a major squeeze, up over 5% on the week (it second best week of the year)...

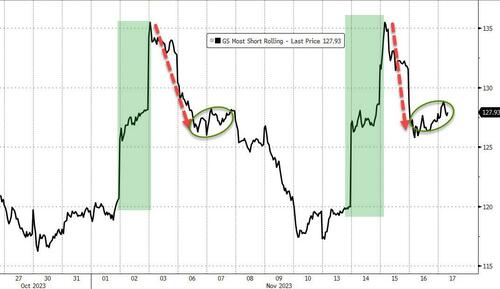

The gains - especially in Small Caps - were helped by a massive short-squeeze. 'Most Shorted' stocks exploded higher on the CPI print but have faded a biut since in a pattern that looks very familiar...

Source: Bloomberg

We do note that the CPI ramp lifted the Russell above its 50DMA and the the follow-thru pushed it up to its 200DMA which acted as resistance and the index faded from there...

Source: Bloomberg

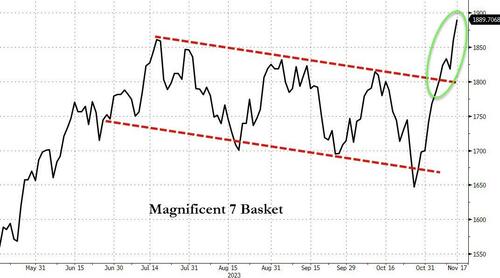

The Magnificent 7 stocks soared this week breaking out of their down-trending range...

Source: Bloomberg

It was a very mixed week for sectors with Energy swinging around. Everything was higher on the week but Real Estate led while Staples were the ugliest horse in the glue factory...

Source: Bloomberg

It will come as no surprise given the extremely high correlation regime we are in...

Source: Bloomberg

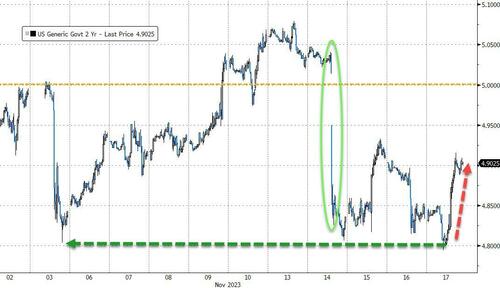

...that bonds were also bid this week with TSY yields tumbling around 20bps as the belly outperformed the wings (notice that today saw a big pivot/curve flattener with 2Y+7bps and 30Y -2bps)...

Source: Bloomberg

2Y yields plunged back below 5.00%...

Source: Bloomberg

The dollar plunged on the week (2nd biggest weekly drop of the year), extending Tuesday's losses today, and falling into the red for 2023...

Source: Bloomberg

Bitcoin ended the week lower (by around 2%) after once again testng $38,000 ad failing to hold

Source: Bloomberg

WTI ripped higher today after an ugly week (today was the 5th biggest rally day for crude this year as it tried to get back up to its 200DMA), but could not stop oil being down (albeit only modestly) for the 4th straight week (and closing in a bear market, down over 20% from its recent highs)...

After the ramp, Bloomberg headlined that a 1mm barrel production cut is on the table for next week's meeting. This raises the question - who was front-running that news (and leaked the comment to the FT)?

Gold jumped over 2% higher this week, bouncing perfectly off its 200DMA...

Source: Bloomberg

Finally, could we be heading towards this?

Source: Bloomberg

Squeeze and Seasonals support it, but OpEx gamma unclench could delay the ramp.

The ‘higher-for-longer’ soft landing economy may be transitioning back to a ‘Goldilocks’ economy of not-too-hot/not-too-cold activity and inflation, that this week, at least, created a particularly attractive backdrop for stocks, but realistically everything just traded together like the ‘QE trade’ – stock sup, bonds (prices) up, gold up, dollar down…

Source: Bloomberg

In fact, as one traders was overheard commenting on the ease with which the markets shrugged off geopolitical fears, a clearly retracting US consumer, and cracks in the labor market, “it’s as if Santa married Goldilocks… everyone’s drinking that kool-aid…”

The ‘seasonal’ ramp arrived right on time…

Source: Goldman Sachs

As Goldman’s Chris Hussey noted, the principal concern of a successfully soft landing economy is that growth takes off again, triggers renewed inflation, and the Fed is compelled to respond with more rate hikes. But this week, that scenario began to look less likely as the latest CPI inflation reading dipped, suggesting that the trajectory for inflation remains benign.

Additionally, on the growth side,

-

Housing Starts came in stronger than expected;

-

the Philly Fed improved from a month earlier;

-

retail sales declined by less than expected;

-

weekly jobless claims edged up but remain far from any level of pressure; and

-

Congress passed measures to avert a government shutdown.

All of which saw the macro surprise index trending down…

Source: Bloomberg

…and at the same time, financial conditions getting dramatically looser…

Source: Bloomberg

This helped lift stocks dramatically higher on the week with most of the majors moving systemically higher (S&P, Nasdaq, Dow all up around 2% on the week – but notice basically unch since the CPI spike). Small Caps (Russell 2000) were big winners on the week amid a major squeeze, up over 5% on the week (it second best week of the year)…

The gains – especially in Small Caps – were helped by a massive short-squeeze. ‘Most Shorted’ stocks exploded higher on the CPI print but have faded a biut since in a pattern that looks very familiar…

Source: Bloomberg

We do note that the CPI ramp lifted the Russell above its 50DMA and the the follow-thru pushed it up to its 200DMA which acted as resistance and the index faded from there…

Source: Bloomberg

The Magnificent 7 stocks soared this week breaking out of their down-trending range…

Source: Bloomberg

It was a very mixed week for sectors with Energy swinging around. Everything was higher on the week but Real Estate led while Staples were the ugliest horse in the glue factory…

Source: Bloomberg

It will come as no surprise given the extremely high correlation regime we are in…

Source: Bloomberg

…that bonds were also bid this week with TSY yields tumbling around 20bps as the belly outperformed the wings (notice that today saw a big pivot/curve flattener with 2Y+7bps and 30Y -2bps)…

Source: Bloomberg

2Y yields plunged back below 5.00%…

Source: Bloomberg

The dollar plunged on the week (2nd biggest weekly drop of the year), extending Tuesday’s losses today, and falling into the red for 2023…

Source: Bloomberg

Bitcoin ended the week lower (by around 2%) after once again testng $38,000 ad failing to hold

Source: Bloomberg

WTI ripped higher today after an ugly week (today was the 5th biggest rally day for crude this year as it tried to get back up to its 200DMA), but could not stop oil being down (albeit only modestly) for the 4th straight week (and closing in a bear market, down over 20% from its recent highs)…

After the ramp, Bloomberg headlined that a 1mm barrel production cut is on the table for next week’s meeting. This raises the question – who was front-running that news (and leaked the comment to the FT)?

Gold jumped over 2% higher this week, bouncing perfectly off its 200DMA…

Source: Bloomberg

Finally, could we be heading towards this?

Source: Bloomberg

Squeeze and Seasonals support it, but OpEx gamma unclench could delay the ramp.

Loading…