Authored by Michael Maharrey via SchiffGold.com,

The Federal Reserve just surrendered to inflation.

Fed officials won’t call it a surrender.

They’re claiming victory. But surrender is the effect of the policy trajectory laid out by the Federal Open Market Committee (FOMC) at its December meeting.

As expected, the FOMC held rates steady at the December meeting extending the rate hike pause into its fourth month. But during his press conference, Powell confirmed that the recent rate hike pause was actually the end of tightening, saying it is “not likely” that the central bank will hike rates again.

While participants do not view it as likely to be appropriate to raise interest rates further, neither do they want to take the possibility off the table.”

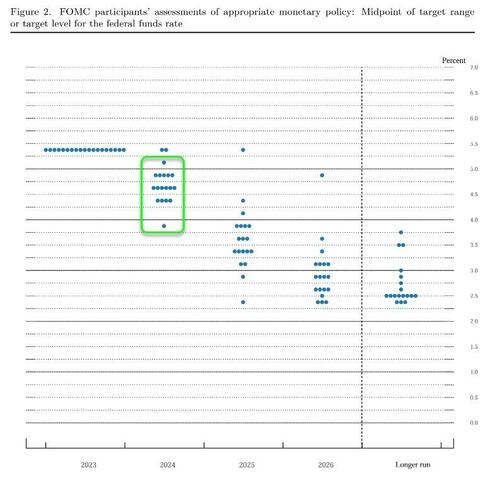

There was little change to the official FOMC statement. The real news was the “dot plot” showing the expected trajectory of interest rates. The Fed has penciled in three rate cuts for 2024 with another four cuts in 2025. That would lower rates to between 2 and 2.5%.

Keep in mind that last month, Federal Reserve Chairman Jerome Powell claimed rate cuts weren’t even on the table.

“The fact is the committee is not thinking about rate cuts right now at all,” Powell said during his press conference after the November FOMC meeting.

As Peter Schiff said in a post on X, it’s pretty clear Fed officials have been thinking about rate cuts for a long time. Policy pivots like this don’t happen in a vacuum.

During his press conference, Powell emphasized that the central bank doesn’t need a recession to cut rates.

“It could just be a sign that the economy is normalizing and doesn’t need the tight policy,” he said.

For the time being, the Fed plans to continue balance sheet reduction. But Powell said if the economy slips into a recession, quantitative tightening will no longer be appropriate.

Inflation Isn’t Beat

It seems a little early to put price inflation in its grave.

The mainstream hyped the November CPI report as another positive sign that price inflation is easing, but the only number that dropped was the annual rate (from 3.2% to 3.1%.) Every other metric was up month on month, and core CPI remains mired at 4%, double the Fed’s mythical 2% target.

Even Powell admits that price inflation isn’t dead.

Inflation has eased from its highs, and this has come without a significant increase in unemployment. That’s very good news. But inflation is still too high. Ongoing progress in bringing it down is not assured and the path forward is uncertain.”

He also conceded that the FOMC doesn’t see the Personal Expenditure Index (PCE) dropping to 2% until 2026. As Schiff pointed out, the PCE is not the CPI, and it is the official measure that most understates the true inflation rate.

Powell is using the PCE as his benchmark as he likely knows the CPI will never return to 2%.”

While recent CPI data may reflect a slowdown in rising prices and create a sense of optimism, the victory dance is a bit premature.

Monetary Policy Isn’t Tight

The Federal Reserve raised interest rates from zero to 5.5% relatively quickly, and Powell claims that rates are now “well into” restrictive territory.

They aren’t.

The Chicago Fed’s own Financial Conditions Index confirms this. As of the week ending December 8, the index stood at -0.51. A negative number indicates loose financial conditions.

And financial conditions are trending looser, not tighter. The index was at -0.46 the prior week.

Meanwhile, the Fed managed to shrink its balance sheet from $8.965 trillion at the peak of COVID-era quantitative easing to $7.737 trillion today. That seems impressive until you consider that the Fed added $4.8 trillion to the balance sheet during the pandemic alone. At the current rate of balance sheet reduction, it would take about 7 years just to remove all of the liquidity (inflation) added to the economy during COVID. That doesn’t even begin to touch the trillions added to the balance sheet in the wake of the 2008 financial crisis.

All of the money that the Fed created both during the pandemic and the Great Recession is inflation and it is still sloshing around out there in the economy.

Victory Means Defeat

The mainstream financial media is framing this as a victory. The Fed won the inflation fight and that’s why it doesn’t have to hike rates anymore. In his podcast, Schiff had a different take.

This was not the Fed winning its inflation fight. That’s not what happened. The Fed surrendered. Inflation won the fight.”

Schiff went on to say this wasn’t a pivot in victory. It was a pivot in defeat.

The Fed stopped hiking rates because it can’t hike them anymore. It’s worried about the consequences of these hikes — particularly how it’s going to impact the federal budget and all of the debt that is maturing and needs to be rolled over in 2024.”

It’s important to understand that by declaring victory and pivoting to rate cuts, the Fed is returning to the very policies that caused price inflation to begin with. Schiff said, “If people thought inflation was bad before the Fed declared victory, wait until they see how much worse it’s going to get now that they’ve declared it.”

Now that the Fed has said, ‘Mission accomplished!’ the dollar is going to tank. Commodity prices should soar. And that is going to reinvigorate inflation. It’s not dead. It’s alive and well. As much as the financial world wants to bury it, it’s going to resurrect. It’s going to rise like a Phoenix from a pile of fake ashes.”

Powell’s overall message was that the Fed managed to take out price inflation without any significant damage to the economy. In effect, Powell is saying “We stuck the landing!” But Schiff said the only reason the Fed hasn’t killed the economy and the labor market is because it hasn’t killed inflation.

Inflation is alive and well. That’s the reason. If the Fed really did what it took, if it was going to continue to hike rates like it should, if it was going to force the government to cut spending, which is the purpose of a lot of these rate hikes, then we would have seen the damage to the economy. We would have seen the damage in the labor market. It’s only because the Fed surrendered and that inflation has won that we didn’t see that type of damage.”

Schiff provided a detailed breakdown of the Fed meeting and Powell’s comments on his podcast.

Authored by Michael Maharrey via SchiffGold.com,

The Federal Reserve just surrendered to inflation.

Fed officials won’t call it a surrender.

They’re claiming victory. But surrender is the effect of the policy trajectory laid out by the Federal Open Market Committee (FOMC) at its December meeting.

As expected, the FOMC held rates steady at the December meeting extending the rate hike pause into its fourth month. But during his press conference, Powell confirmed that the recent rate hike pause was actually the end of tightening, saying it is “not likely” that the central bank will hike rates again.

While participants do not view it as likely to be appropriate to raise interest rates further, neither do they want to take the possibility off the table.”

There was little change to the official FOMC statement. The real news was the “dot plot” showing the expected trajectory of interest rates. The Fed has penciled in three rate cuts for 2024 with another four cuts in 2025. That would lower rates to between 2 and 2.5%.

Keep in mind that last month, Federal Reserve Chairman Jerome Powell claimed rate cuts weren’t even on the table.

“The fact is the committee is not thinking about rate cuts right now at all,” Powell said during his press conference after the November FOMC meeting.

As Peter Schiff said in a post on X, it’s pretty clear Fed officials have been thinking about rate cuts for a long time. Policy pivots like this don’t happen in a vacuum.

During his press conference, Powell emphasized that the central bank doesn’t need a recession to cut rates.

“It could just be a sign that the economy is normalizing and doesn’t need the tight policy,” he said.

For the time being, the Fed plans to continue balance sheet reduction. But Powell said if the economy slips into a recession, quantitative tightening will no longer be appropriate.

Inflation Isn’t Beat

It seems a little early to put price inflation in its grave.

The mainstream hyped the November CPI report as another positive sign that price inflation is easing, but the only number that dropped was the annual rate (from 3.2% to 3.1%.) Every other metric was up month on month, and core CPI remains mired at 4%, double the Fed’s mythical 2% target.

Even Powell admits that price inflation isn’t dead.

Inflation has eased from its highs, and this has come without a significant increase in unemployment. That’s very good news. But inflation is still too high. Ongoing progress in bringing it down is not assured and the path forward is uncertain.”

He also conceded that the FOMC doesn’t see the Personal Expenditure Index (PCE) dropping to 2% until 2026. As Schiff pointed out, the PCE is not the CPI, and it is the official measure that most understates the true inflation rate.

Powell is using the PCE as his benchmark as he likely knows the CPI will never return to 2%.”

While recent CPI data may reflect a slowdown in rising prices and create a sense of optimism, the victory dance is a bit premature.

Monetary Policy Isn’t Tight

The Federal Reserve raised interest rates from zero to 5.5% relatively quickly, and Powell claims that rates are now “well into” restrictive territory.

They aren’t.

The Chicago Fed’s own Financial Conditions Index confirms this. As of the week ending December 8, the index stood at -0.51. A negative number indicates loose financial conditions.

And financial conditions are trending looser, not tighter. The index was at -0.46 the prior week.

Meanwhile, the Fed managed to shrink its balance sheet from $8.965 trillion at the peak of COVID-era quantitative easing to $7.737 trillion today. That seems impressive until you consider that the Fed added $4.8 trillion to the balance sheet during the pandemic alone. At the current rate of balance sheet reduction, it would take about 7 years just to remove all of the liquidity (inflation) added to the economy during COVID. That doesn’t even begin to touch the trillions added to the balance sheet in the wake of the 2008 financial crisis.

All of the money that the Fed created both during the pandemic and the Great Recession is inflation and it is still sloshing around out there in the economy.

Victory Means Defeat

The mainstream financial media is framing this as a victory. The Fed won the inflation fight and that’s why it doesn’t have to hike rates anymore. In his podcast, Schiff had a different take.

This was not the Fed winning its inflation fight. That’s not what happened. The Fed surrendered. Inflation won the fight.”

Schiff went on to say this wasn’t a pivot in victory. It was a pivot in defeat.

The Fed stopped hiking rates because it can’t hike them anymore. It’s worried about the consequences of these hikes — particularly how it’s going to impact the federal budget and all of the debt that is maturing and needs to be rolled over in 2024.”

It’s important to understand that by declaring victory and pivoting to rate cuts, the Fed is returning to the very policies that caused price inflation to begin with. Schiff said, “If people thought inflation was bad before the Fed declared victory, wait until they see how much worse it’s going to get now that they’ve declared it.”

Now that the Fed has said, ‘Mission accomplished!’ the dollar is going to tank. Commodity prices should soar. And that is going to reinvigorate inflation. It’s not dead. It’s alive and well. As much as the financial world wants to bury it, it’s going to resurrect. It’s going to rise like a Phoenix from a pile of fake ashes.”

Powell’s overall message was that the Fed managed to take out price inflation without any significant damage to the economy. In effect, Powell is saying “We stuck the landing!” But Schiff said the only reason the Fed hasn’t killed the economy and the labor market is because it hasn’t killed inflation.

Inflation is alive and well. That’s the reason. If the Fed really did what it took, if it was going to continue to hike rates like it should, if it was going to force the government to cut spending, which is the purpose of a lot of these rate hikes, then we would have seen the damage to the economy. We would have seen the damage in the labor market. It’s only because the Fed surrendered and that inflation has won that we didn’t see that type of damage.”

Schiff provided a detailed breakdown of the Fed meeting and Powell’s comments on his podcast.

[embedded content]

Loading…