Goldman's trading desk summed up the market theme perfectly today: "sell tech and buy everything else"...

Energy and Regional Banks notably outperforming, while big-tech was trounced...

Source: Bloomberg

Since Juneteenth, we have seen AI-stocks monkey-hammered relative to Ai-at-Risk names...

Source: Bloomberg

With NVDA down over 16% from its highs on Thursday...

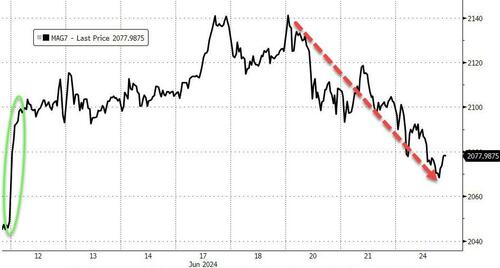

Dragging MAG7 stocks down to pre-CPI-spike levels...

Source: Bloomberg

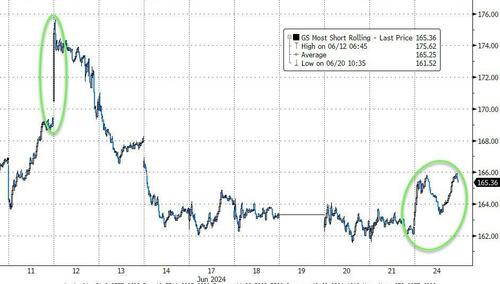

...as the 'most shorted' stocks saw a big squeeze today...

Source: Bloomberg

GLP-1 stocks ripped today on Sleep Apnea and some kidney disease studies... is there nothing these drugs can't cure? Or maybe Obesity is really the root of all healthcare after all (just don't say that during a pandemic)...

Source: Bloomberg

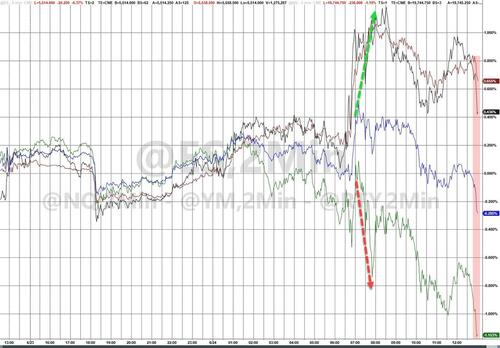

Which left Small Caps and The Dow outperforming; Nasdaq the biggest loser, and a late-day purge sent everything lower into the close, dragging the S&P 500 red...

And before we shift our gaze to non-equity markets, we note that the equal-weighted S&P 500 is back at its weakest level 'since Lehman' relative to the market-cap-weighted S&P 500...

Source: Bloomberg

Treasuries were modestly bid today with the long-end outperforming (sold during early Europe and bid during late US session). However, their general range was far less noticeable relative to equities...

Source: Bloomberg

The dollar dumped today back to last week's lows...

Source: Bloomberg

...and that helped support gold (which still remains well down from Friday's highs...

Source: Bloomberg

...and helped crude, with WTI pushing up against its highest levels since April......

Source: Bloomberg

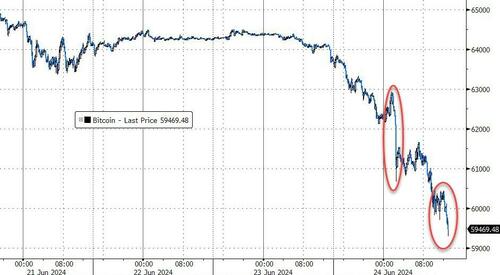

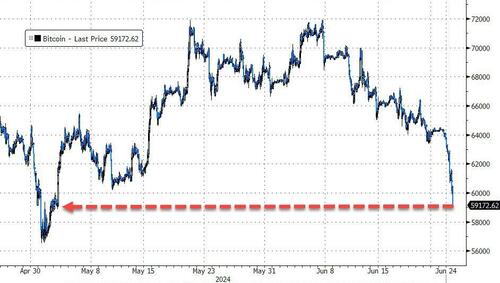

Bitcoin was not so lucky as FUD over Mt.Gox supply sent the largest crypto currency reeling back down below $60,000...

Source: Bloomberg

...its lowest since early May (as ETF outflows continue)...

Source: Bloomberg

Finally, amid all this malarkey, there is one more pillar of irrational support for sky-high valuations that is about to evaporate (albeit briefly)...

80% of the S&P has entered buyback blackout window: Goldman pic.twitter.com/cjJ3ARCWGd

— zerohedge (@zerohedge) June 24, 2024

After Friday's 'gamma unclenching', the death of the banal bid from corporates could just be the catalyst for some catch-down to reality.

Goldman’s trading desk summed up the market theme perfectly today: “sell tech and buy everything else”…

Energy and Regional Banks notably outperforming, while big-tech was trounced…

Source: Bloomberg

Since Juneteenth, we have seen AI-stocks monkey-hammered relative to Ai-at-Risk names…

Source: Bloomberg

With NVDA down over 16% from its highs on Thursday…

Dragging MAG7 stocks down to pre-CPI-spike levels…

Source: Bloomberg

…as the ‘most shorted’ stocks saw a big squeeze today…

Source: Bloomberg

GLP-1 stocks ripped today on Sleep Apnea and some kidney disease studies… is there nothing these drugs can’t cure? Or maybe Obesity is really the root of all healthcare after all (just don’t say that during a pandemic)…

Source: Bloomberg

Which left Small Caps and The Dow outperforming; Nasdaq the biggest loser, and a late-day purge sent everything lower into the close, dragging the S&P 500 red…

And before we shift our gaze to non-equity markets, we note that the equal-weighted S&P 500 is back at its weakest level ‘since Lehman’ relative to the market-cap-weighted S&P 500…

Source: Bloomberg

Treasuries were modestly bid today with the long-end outperforming (sold during early Europe and bid during late US session). However, their general range was far less noticeable relative to equities…

Source: Bloomberg

The dollar dumped today back to last week’s lows…

Source: Bloomberg

…and that helped support gold (which still remains well down from Friday’s highs…

Source: Bloomberg

…and helped crude, with WTI pushing up against its highest levels since April……

Source: Bloomberg

Bitcoin was not so lucky as FUD over Mt.Gox supply sent the largest crypto currency reeling back down below $60,000…

Source: Bloomberg

…its lowest since early May (as ETF outflows continue)…

Source: Bloomberg

Finally, amid all this malarkey, there is one more pillar of irrational support for sky-high valuations that is about to evaporate (albeit briefly)…

80% of the S&P has entered buyback blackout window: Goldman pic.twitter.com/cjJ3ARCWGd

— zerohedge (@zerohedge) June 24, 2024

After Friday’s ‘gamma unclenching’, the death of the banal bid from corporates could just be the catalyst for some catch-down to reality.

Loading…