Authored by Michael Shellenberger via Substack,

Manchin-Schumer is projected to increase taxes $11 billion more on Americans earning below $200,000 than those earning over $400,000...

Senate Majority Leader Chuck Schumer (left) and Senator Joe Manchin (right) are trying to persuade Senator Krysten Sinema to support a tax increase.

When Senator Joe Manchin (D-WV) went on NBC’s “Meet the Press” yesterday he said that the $700 billion climate change, energy, and health care proposal he announced last week with Senate Majority Leader Chuck Schumer would not raise taxes. “We should not increase taxes, and we did not increase taxes,” he told NBC’s “Meet the Press.”

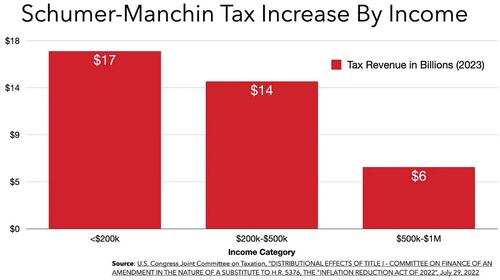

But a new study by the U.S. Congress’s nonpartisan Joint Committee on Taxation has found that not only would the legislation increase taxes, it would increase taxes by $11 billion more on Americans earning below $200,000 per year than on Americans earning between $500,000 and $1 million, in 2023.

And the legislation would increase taxes by $3 billion more on Americans earning below $200,000 per year than on Americans earning between $200,000 and $500,000 per year

As such, if Democrats pass the legislation, and President Joe Biden signs it into law, it would violate the promise President Joe Biden made not to raise taxes on Americans earning less than $400,000 per year. Biden reaffirmed this promise during his State of the Union Address in March of this Year. “And under my plan, nobody earning less than $400,000 a year will pay an additional penny in new taxes. Nobody.

Democrats say that Schumer-Manchin isn’t really a tax increase because the higher taxes would be indirectly passed on to employees by corporations required to pay the new 15% minimum tax by reducing their after-tax wages.

It’s a “bogus argument,” said Steve Rosenthal, senior fellow at the Tax Policy Center, of the tax increase.

Rosenthal said that anybody pointing it out was engaging in “a gotcha kind of thing.”

But neither Rosenthal nor anybody else is questioning the assumptions made by the Joint Committee on Taxation, which calculated the tax increases. It is standard economic practice to assume that companies would pass along at least some of their tax increase to employees.

And the Joint Committee is a widely respected and nonpartisan committee that is staffed by Ph.D economists, accountants, and attorneys and has been in existence for nearly 100 years and is trusted by members of Congress from both parties. Moreover, its analyses is supported by a calculation by the National Association of Manufacturers, which calculates that the higher taxes would reduce reduce workers’ income income by $17 billion and GDP by $69 billion.

Economists have long observed that taxes on corporations are passed on to workers, customers, and shareholders. If the goal is to reduce income disparities then one must raise taxes more on people earning higher incomes than on people earning lower ones, and the Schumer-Manchin legislation does not do this.

Democrats argue that the legislation will save lower-income people money by reducing energy costs, but there are good reasons to doubt this.

Authored by Michael Shellenberger via Substack,

Manchin-Schumer is projected to increase taxes $11 billion more on Americans earning below $200,000 than those earning over $400,000…

Senate Majority Leader Chuck Schumer (left) and Senator Joe Manchin (right) are trying to persuade Senator Krysten Sinema to support a tax increase.

When Senator Joe Manchin (D-WV) went on NBC’s “Meet the Press” yesterday he said that the $700 billion climate change, energy, and health care proposal he announced last week with Senate Majority Leader Chuck Schumer would not raise taxes. “We should not increase taxes, and we did not increase taxes,” he told NBC’s “Meet the Press.”

But a new study by the U.S. Congress’s nonpartisan Joint Committee on Taxation has found that not only would the legislation increase taxes, it would increase taxes by $11 billion more on Americans earning below $200,000 per year than on Americans earning between $500,000 and $1 million, in 2023.

And the legislation would increase taxes by $3 billion more on Americans earning below $200,000 per year than on Americans earning between $200,000 and $500,000 per year

As such, if Democrats pass the legislation, and President Joe Biden signs it into law, it would violate the promise President Joe Biden made not to raise taxes on Americans earning less than $400,000 per year. Biden reaffirmed this promise during his State of the Union Address in March of this Year. “And under my plan, nobody earning less than $400,000 a year will pay an additional penny in new taxes. Nobody.

Democrats say that Schumer-Manchin isn’t really a tax increase because the higher taxes would be indirectly passed on to employees by corporations required to pay the new 15% minimum tax by reducing their after-tax wages.

It’s a “bogus argument,” said Steve Rosenthal, senior fellow at the Tax Policy Center, of the tax increase.

Rosenthal said that anybody pointing it out was engaging in “a gotcha kind of thing.”

But neither Rosenthal nor anybody else is questioning the assumptions made by the Joint Committee on Taxation, which calculated the tax increases. It is standard economic practice to assume that companies would pass along at least some of their tax increase to employees.

And the Joint Committee is a widely respected and nonpartisan committee that is staffed by Ph.D economists, accountants, and attorneys and has been in existence for nearly 100 years and is trusted by members of Congress from both parties. Moreover, its analyses is supported by a calculation by the National Association of Manufacturers, which calculates that the higher taxes would reduce reduce workers’ income income by $17 billion and GDP by $69 billion.

Economists have long observed that taxes on corporations are passed on to workers, customers, and shareholders. If the goal is to reduce income disparities then one must raise taxes more on people earning higher incomes than on people earning lower ones, and the Schumer-Manchin legislation does not do this.

Democrats argue that the legislation will save lower-income people money by reducing energy costs, but there are good reasons to doubt this.