A new reading from the Purdue University-CME Group Ag Economy Barometer Index shows sentiment across the Heartland, more specifically, on America's farms, has tumbled to the lowest levels since 2016 as incomes pressured lower on concerns of "commodity prices, input costs, and future of trade after upcoming elections."

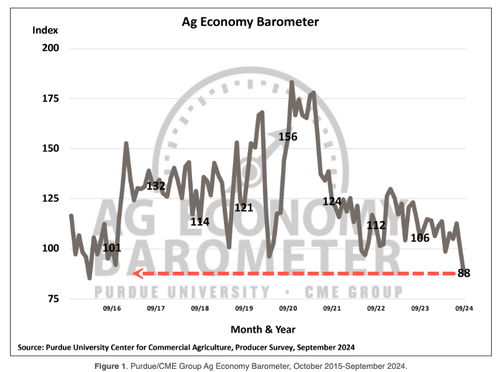

In September, the Ag Economy Barometer, a survey of 400 farmers across America, plunged 12 points to 88, the lowest reading since March 2016, or around the time former president Trump began his first term.

"These were the weakest barometer and future expectations readings since March 2016, when the farm economy was in the throes of an economic downturn," James Mintert and Michael Langemeier of the Purdue Center for Commercial Agriculture wrote in the report.

They noted, "The current conditions assessment very nearly matched that of April 2020, when COVID concerns were top of mind for US farmers. Weak output prices combined with high input costs were key problems cited by survey respondents in September."

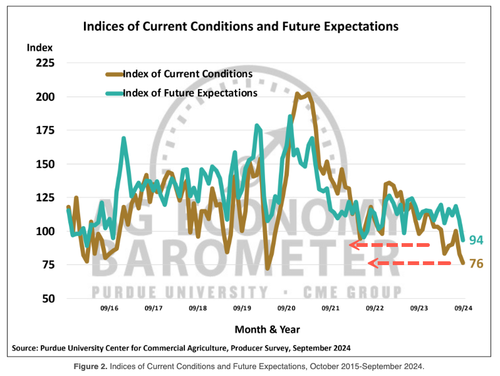

Both of the Ag Economy Barometer's sub-indices, the Index of Current Conditions and the Index of Future Expectations, tumbled as the farming industry has been battered by backfiring Bidenomics policies.

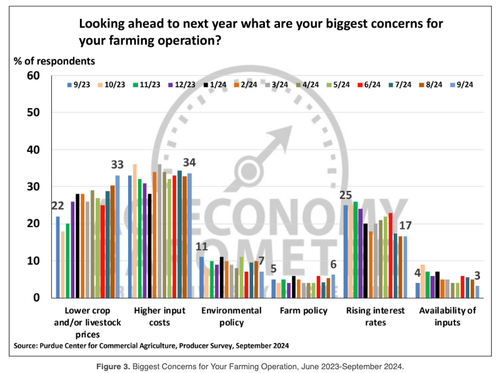

"Farmers are concerned about commodity prices, input costs, the future of agricultural trade and how the upcoming election could affect their farm operation," the authors of the report explained.

Here's the conclusion from the report:

Concerns about low commodity prices coupled with high input costs leading to poor financial performance expectations weakened farmer sentiment for the second month in a row. This month's sentiment decline pushed the Ag Economy Barometer index below 100, indicating farmer sentiment is lower than during the barometer's base period of late 2015-early 2016 when farm incomes were very weak. Producers expect markedly worse financial performance for their farms in the upcoming year compared to their expectations at this time last year. Weak farm income expectations combined with lingering interest rate concerns and a pessimistic agricultural export outlook helped push the Short-Term Farmland Value Expectations Index below 100 for the first time since 2020.

In a separate note, researchers at the University of Missouri expect farm income to plunge 35% next year, compared to a high in 2022. The good news is that incomes are above what farmers made in 2015-20, yet the drop is steep, given elevated input costs.

"Farmers will have a tighter situation … than they experienced in the last three years, and they'll have to be much more cognizant about having a very strategic marketing plan in order to make a good cash flow," said Bob Maltsburger, a senior research economist at the Food & Agricultural Policy Research Institute at the university.

Seems like farmers want...

President Trump will stand up for American farmers & ranchers 🇺🇸 pic.twitter.com/bDzkDJJtH7

— Mammoth Nation (@MammothNationUS) September 26, 2024

I’m ready for harvest

— Glen (@oldfarmer92) October 1, 2024

Farmers stand with TRUMP 24 🇺🇸🇺🇸🇺🇸 pic.twitter.com/NXbbJm4Kb9

UDDER TRUTH: "Thanks to [Trump's] efforts to open new markets, use effective tariffs to force fair competition, and lower costs to make farming profitable again." How the former president is fighting for American farmers: https://t.co/gKW8upmvaf pic.twitter.com/AVQPoBAQGn

— FOX Business (@FoxBusiness) September 26, 2024

A new reading from the Purdue University-CME Group Ag Economy Barometer Index shows sentiment across the Heartland, more specifically, on America’s farms, has tumbled to the lowest levels since 2016 as incomes pressured lower on concerns of “commodity prices, input costs, and future of trade after upcoming elections.”

In September, the Ag Economy Barometer, a survey of 400 farmers across America, plunged 12 points to 88, the lowest reading since March 2016, or around the time former president Trump began his first term.

“These were the weakest barometer and future expectations readings since March 2016, when the farm economy was in the throes of an economic downturn,” James Mintert and Michael Langemeier of the Purdue Center for Commercial Agriculture wrote in the report.

They noted, “The current conditions assessment very nearly matched that of April 2020, when COVID concerns were top of mind for US farmers. Weak output prices combined with high input costs were key problems cited by survey respondents in September.”

Both of the Ag Economy Barometer’s sub-indices, the Index of Current Conditions and the Index of Future Expectations, tumbled as the farming industry has been battered by backfiring Bidenomics policies.

“Farmers are concerned about commodity prices, input costs, the future of agricultural trade and how the upcoming election could affect their farm operation,” the authors of the report explained.

Here’s the conclusion from the report:

Concerns about low commodity prices coupled with high input costs leading to poor financial performance expectations weakened farmer sentiment for the second month in a row. This month’s sentiment decline pushed the Ag Economy Barometer index below 100, indicating farmer sentiment is lower than during the barometer’s base period of late 2015-early 2016 when farm incomes were very weak. Producers expect markedly worse financial performance for their farms in the upcoming year compared to their expectations at this time last year. Weak farm income expectations combined with lingering interest rate concerns and a pessimistic agricultural export outlook helped push the Short-Term Farmland Value Expectations Index below 100 for the first time since 2020.

In a separate note, researchers at the University of Missouri expect farm income to plunge 35% next year, compared to a high in 2022. The good news is that incomes are above what farmers made in 2015-20, yet the drop is steep, given elevated input costs.

“Farmers will have a tighter situation … than they experienced in the last three years, and they’ll have to be much more cognizant about having a very strategic marketing plan in order to make a good cash flow,” said Bob Maltsburger, a senior research economist at the Food & Agricultural Policy Research Institute at the university.

Seems like farmers want…

President Trump will stand up for American farmers & ranchers 🇺🇸 pic.twitter.com/bDzkDJJtH7

— Mammoth Nation (@MammothNationUS) September 26, 2024

I’m ready for harvest

Farmers stand with TRUMP 24 🇺🇸🇺🇸🇺🇸 pic.twitter.com/NXbbJm4Kb9— Glen (@oldfarmer92) October 1, 2024

UDDER TRUTH: “Thanks to [Trump’s] efforts to open new markets, use effective tariffs to force fair competition, and lower costs to make farming profitable again.” How the former president is fighting for American farmers: https://t.co/gKW8upmvaf pic.twitter.com/AVQPoBAQGn

— FOX Business (@FoxBusiness) September 26, 2024

Loading…