By Gautham Krishnan of Container News

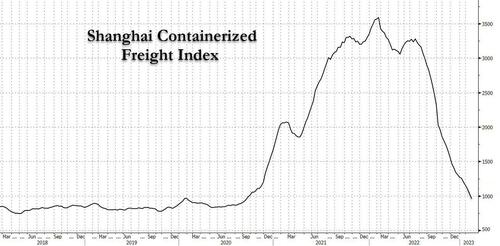

The Shanghai Containerized Freight Index (SCFI) issued after Chinese New Year 2023 saw the index fall into the triple digits, closing at US$995 for the week ending 10 February 2023.

This was a level last annexed in January 2020, the opening days of the pandemic phase. However, that wasn't a first. These levels were seen in 2012, 2015 and 2017, indicating that the spot rates at least have now hit pre-pandemic levels.

The manufacturing struggle in China is still imminent as the latest figures for February suggest that the factory gates prices for Jan 2023 in China are still lower, hinting that the green shoots that were seen in early Jan 2023 owing to the relaxation of the Chinese Zero-Covid policy may have been a possible one-off.

Even as inflation in Europe sees recovery from the trough at the end of the third quarter of 2022, growth estimates in the global set-up for 2023, remain muted and hawkish. Add to that the scenario of the shipping world as 2023 stepped in 2022 January saw some of the highest congestions, while 40 days into 2023 seldom saw ports reporting 10+ waiting days, barring some, say the Baltimore port in the United States.

A string of new container ships will see joining the existing fleet in 2023, with the total growing by about 10% by the year's end, should the delivery timelines remain intact. The fleet growth will be a little over a fourth of the existing fleet capacity, if one were to also account for the possible scrapping of older vessels, by 2027, given the robust order book activity across the yards.

The world's largest vessel operator, MSC has a size of about 39% of the existing fleet capacity in various stages of a new building. All these could look to tame inflation in the medium term, but also put resistance on prices, indicating that while we aren't sure of the extent of the fall coming, there could be upside resistance.

According to Chris Bryant, a Bloomberg οpinion columnist, Maersk foresees global container demand for the year to fall by 2.5%. It is also foreseeing the contract rates to fall and settle in line with the spot market. (It must already be seen that the long-term rates on Xeneta took a 13% dive, the previous month to register the fifth straight month of consecutive losses.) This could be a big hit in terms of the overall yield.

Rightly so, even the guidance numbers for the logistics giant stipulate the same. Its operating profit numbers for 2023 are seen somewhere between US$2-5 Billion for 2023, just about 6-15% of its 2022 numbers at US$31 billion. In fact, they are just a tad better than the 2019 numbers of US$1.7 billion.

On the flip side though, the rate of falls has come down significantly, at least on trade lanes which have borne the bigger brunt. The sharper falls in recent weeks have been attributed to the China-US East Coast and the Transatlantic trade.

While the former didn't correct much in line with the China-Europe and China-USWC trade, thanks to the shift in cargo lanes from US West Coast to East Coast owing to port waiting times, the latter hit a high in terms of rates in the fourth quarter of 2022.

We also saw the Chinese Containerized Freight Index (CCFI), the cousin of the SCFI, pulling up a weekly gain post the Chinese New Year thanks to rates across China-Japan, China-South America and the Mediterranean & Persian Sea trade. Intelligent contracting measures and batching seem to be what the shippers should look out for in the near-term while also cautiously approaching the rate movements.

By Gautham Krishnan of Container News

The Shanghai Containerized Freight Index (SCFI) issued after Chinese New Year 2023 saw the index fall into the triple digits, closing at US$995 for the week ending 10 February 2023.

This was a level last annexed in January 2020, the opening days of the pandemic phase. However, that wasn’t a first. These levels were seen in 2012, 2015 and 2017, indicating that the spot rates at least have now hit pre-pandemic levels.

The manufacturing struggle in China is still imminent as the latest figures for February suggest that the factory gates prices for Jan 2023 in China are still lower, hinting that the green shoots that were seen in early Jan 2023 owing to the relaxation of the Chinese Zero-Covid policy may have been a possible one-off.

Even as inflation in Europe sees recovery from the trough at the end of the third quarter of 2022, growth estimates in the global set-up for 2023, remain muted and hawkish. Add to that the scenario of the shipping world as 2023 stepped in 2022 January saw some of the highest congestions, while 40 days into 2023 seldom saw ports reporting 10+ waiting days, barring some, say the Baltimore port in the United States.

A string of new container ships will see joining the existing fleet in 2023, with the total growing by about 10% by the year’s end, should the delivery timelines remain intact. The fleet growth will be a little over a fourth of the existing fleet capacity, if one were to also account for the possible scrapping of older vessels, by 2027, given the robust order book activity across the yards.

The world’s largest vessel operator, MSC has a size of about 39% of the existing fleet capacity in various stages of a new building. All these could look to tame inflation in the medium term, but also put resistance on prices, indicating that while we aren’t sure of the extent of the fall coming, there could be upside resistance.

According to Chris Bryant, a Bloomberg οpinion columnist, Maersk foresees global container demand for the year to fall by 2.5%. It is also foreseeing the contract rates to fall and settle in line with the spot market. (It must already be seen that the long-term rates on Xeneta took a 13% dive, the previous month to register the fifth straight month of consecutive losses.) This could be a big hit in terms of the overall yield.

Rightly so, even the guidance numbers for the logistics giant stipulate the same. Its operating profit numbers for 2023 are seen somewhere between US$2-5 Billion for 2023, just about 6-15% of its 2022 numbers at US$31 billion. In fact, they are just a tad better than the 2019 numbers of US$1.7 billion.

On the flip side though, the rate of falls has come down significantly, at least on trade lanes which have borne the bigger brunt. The sharper falls in recent weeks have been attributed to the China-US East Coast and the Transatlantic trade.

While the former didn’t correct much in line with the China-Europe and China-USWC trade, thanks to the shift in cargo lanes from US West Coast to East Coast owing to port waiting times, the latter hit a high in terms of rates in the fourth quarter of 2022.

We also saw the Chinese Containerized Freight Index (CCFI), the cousin of the SCFI, pulling up a weekly gain post the Chinese New Year thanks to rates across China-Japan, China-South America and the Mediterranean & Persian Sea trade. Intelligent contracting measures and batching seem to be what the shippers should look out for in the near-term while also cautiously approaching the rate movements.

Loading…