Authored by Michael Shellenberger via Substack,

President Joe Biden appears to be doing everything in his power to lower energy prices.

Last month, Biden officials eased sanctions on Venezuela with an eye to increasing oil imports. Next month, Biden will travel to Saudi Arabia with the intention of improving relations and increasing oil production. And yesterday, Biden sent a harshly-worded letter to Exxon and other oil companies, urging them to increase production.

“At a time of war,” Biden wrote, “high refinery profit margins being passed directly onto American families are not acceptable… companies must take immediate actions to increase the supply of gasoline, diesel, and other refined product.”

President Joe Biden speaks at AFL-CIO Convention in Philadelphia on June 14, 2022. (Photo by Nicholas Kamm / AFP)

But none of those actions will lower energy prices. Increasing oil production in Venezuela would take years and it wouldn’t be nearly enough to make up for the reduction of oil imports from Russia. Even Saudi Arabia and United Arab Emirates together could not produce enough oil to offset declining supply from Russia.

And it’s not clear how antagonizing American oil and gas companies will result in more production and lower prices. U.S. refineries are already operating at 94% of their capacity and Exxon invested $50 billion over the last five years to expand oil production by 50%. And, said the CEO of a large, publicly traded energy company, who asked to remain anonymous, “Biden’s attacks on the industry have created an uncertain environment that prevents investment.”

In what might be perceived as the extending of an olive branch, the Biden Administration last night invited oil and gas executives to the White House for talks about how to lower energy prices. And on CNN, Energy Secretary Jennifer Granholm emphasized that the administration is not seeking to destroy oil and gas companies but rather re-tool them. “We are asking the oil and gas companies to diversify,” she said, “and become diversified energy companies.”

But these gestures pale in comparison to the overarching hostility the Biden Administration has directed toward oil and gas companies since taking office. In March, it revoked a permit by a refinery on the U.S. Virgin Islands to expand production. Last month, the Biden administration canceled a massive, one-million acre oil and gas lease in Alaska. And earlier this week, Senator Ron Wyden proposed a large new tax on oil industry profits, which Biden officials say the president may support.

A senior executive at a major U.S. bank that finances oil and gas exploration yesterday told me, “If you were an oil company, why would you invest hundreds of millions of dollars into expanding refining capacity if you thought the federal government or investors would shut you down in the next few years? The narrative coming from the administration is absolutely insane. ”

As a result, mainstream journalists are increasingly calling out Biden officials for the glaring contradiction at the heart of their energy policy. “Are you telling me you want them drilling for more oil?” asked CNN host John Berman of Secretary Granholm yesterday. “You want the refineries putting out more gasoline in five or ten years?”

This clip is ASTONISHING.

— Jason Howerton (@jason_howerton) June 15, 2022

Energy Sec. @JenGranholm demands energy companies to make massive investments to increase oil supply while simultaneously saying they want to shut them down over the next 5-10 years.

WHAT IS THIS WHITE HOUSE?! pic.twitter.com/CTgC4dk92x

“What we’re saying is today we need that supply increased,” she said.

“Of course, in five or ten years — actually in the immediate — we are also pressing on the accelerator, if you will, to move toward clean energy, so that we don’t have to be under the thumb of petro-dictators like Putin, or at the whim of the volatility of fossil fuels. Ultimately American will be most secure when we can rely on our own clean domestic production of energy through solar, through wind —”

“But that’s the problem for these companies,” interrupted Berman.

“These companies are saying, ‘You’re asking me to do more now, invest more now, when, in fact 5 or 10 years from now, we don’t think that demand will be there, and the administration doesn’t even necessarily want it to be there.’”

The result of the Biden Administration’s hostility toward the energy industry is skyrocketing inflation.

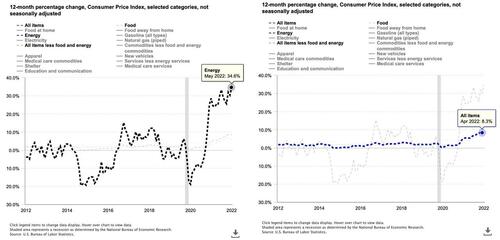

Where energy prices rose 35% over the last year, all prices rose just 8%. In Europe, higher energy prices are responsible for at least half of all inflation.

There are certainly other factors causing inflation, including the ramping up of supply chains following the pandemic, the $1.7 trillion stimulus last year, and China’s lockdown in response to the omicron coronavirus variant. But the non-energy factors behind inflation were temporary, and none explain consistently higher energy prices, which are a major factor in the higher prices of everything, from food to consumer products.

And energy’s role could be even larger than economists can detect.

“When you strip out of the [Consumer Price Index] all the items that are linked to energy (air fares, moving/freight, rental cars, delivery services, new and used vehicles),” noted economist David Rosenberg, “the core was +0.36% and the [year-over-year] steadied near 4%. ”

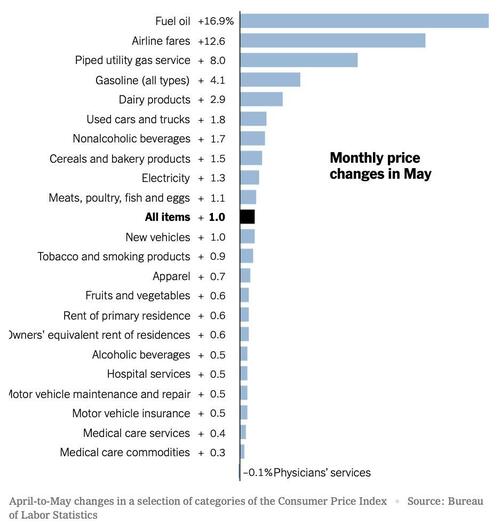

The numbers speak for themselves. In the U.S., the monthly price change in May for all items was 1% but for fuel oil, airline fares, piped utility natural gas, and gasoline the price changes were 17%, 13%, 8%, and 4% respectively.

Some say there's nothing Biden can do to increase energy production but my sources say that Biden could significantly increase oil/gas production within 12 - 18 months. How?

First, they say, he should invoke the National Defense Act for Oil and Gas. This will enable the acceleration of required permits for oil and gas projects, they say.

Second, he should announce a national commitment to purchase oil to fill the Strategic Petroleum Reserve (SPR) at a floor of $80/barrel. That will, they say, be a powerful incentive for the oil guys.

Third, he should announce trade agreements with the international community to supply them with LNG (liquified natural gas) Doing so will incentivize natural gas production and create a surplus of energy for exports with an "American-First asterisk (keep nat gas storage full while exporting).

Biden’s doing none of that. As a result, Biden’s hostility to expanded energy production could result in recession. The Federal Reserve yesterday raised interest rates more than at any point since 1994 and could raise them again next month in an increasingly desperate battle against inflation.

“It may take a recession to stamp out inflation,” concludes Bloomberg, “one that may cost Biden a second term.”

Why is that? Politicians are famously self-interested, focused on their own preservation at all costs. Why, then, is Biden not only wrecking the economy, by failing to take action to lower energy prices, but also destroying his own presidency?

An Aging Ideology

An awkward exchange between Biden and Jimmy Kimmel on ABC’s “Jimmy Kimmel Live!”

Authored by Michael Shellenberger via Substack,

President Joe Biden appears to be doing everything in his power to lower energy prices.

Last month, Biden officials eased sanctions on Venezuela with an eye to increasing oil imports. Next month, Biden will travel to Saudi Arabia with the intention of improving relations and increasing oil production. And yesterday, Biden sent a harshly-worded letter to Exxon and other oil companies, urging them to increase production.

“At a time of war,” Biden wrote, “high refinery profit margins being passed directly onto American families are not acceptable… companies must take immediate actions to increase the supply of gasoline, diesel, and other refined product.”

President Joe Biden speaks at AFL-CIO Convention in Philadelphia on June 14, 2022. (Photo by Nicholas Kamm / AFP)

But none of those actions will lower energy prices. Increasing oil production in Venezuela would take years and it wouldn’t be nearly enough to make up for the reduction of oil imports from Russia. Even Saudi Arabia and United Arab Emirates together could not produce enough oil to offset declining supply from Russia.

And it’s not clear how antagonizing American oil and gas companies will result in more production and lower prices. U.S. refineries are already operating at 94% of their capacity and Exxon invested $50 billion over the last five years to expand oil production by 50%. And, said the CEO of a large, publicly traded energy company, who asked to remain anonymous, “Biden’s attacks on the industry have created an uncertain environment that prevents investment.”

In what might be perceived as the extending of an olive branch, the Biden Administration last night invited oil and gas executives to the White House for talks about how to lower energy prices. And on CNN, Energy Secretary Jennifer Granholm emphasized that the administration is not seeking to destroy oil and gas companies but rather re-tool them. “We are asking the oil and gas companies to diversify,” she said, “and become diversified energy companies.”

But these gestures pale in comparison to the overarching hostility the Biden Administration has directed toward oil and gas companies since taking office. In March, it revoked a permit by a refinery on the U.S. Virgin Islands to expand production. Last month, the Biden administration canceled a massive, one-million acre oil and gas lease in Alaska. And earlier this week, Senator Ron Wyden proposed a large new tax on oil industry profits, which Biden officials say the president may support.

A senior executive at a major U.S. bank that finances oil and gas exploration yesterday told me, “If you were an oil company, why would you invest hundreds of millions of dollars into expanding refining capacity if you thought the federal government or investors would shut you down in the next few years? The narrative coming from the administration is absolutely insane. ”

As a result, mainstream journalists are increasingly calling out Biden officials for the glaring contradiction at the heart of their energy policy. “Are you telling me you want them drilling for more oil?” asked CNN host John Berman of Secretary Granholm yesterday. “You want the refineries putting out more gasoline in five or ten years?”

This clip is ASTONISHING.

Energy Sec. @JenGranholm demands energy companies to make massive investments to increase oil supply while simultaneously saying they want to shut them down over the next 5-10 years.

WHAT IS THIS WHITE HOUSE?! pic.twitter.com/CTgC4dk92x

— Jason Howerton (@jason_howerton) June 15, 2022

“What we’re saying is today we need that supply increased,” she said.

“Of course, in five or ten years — actually in the immediate — we are also pressing on the accelerator, if you will, to move toward clean energy, so that we don’t have to be under the thumb of petro-dictators like Putin, or at the whim of the volatility of fossil fuels. Ultimately American will be most secure when we can rely on our own clean domestic production of energy through solar, through wind —”

“But that’s the problem for these companies,” interrupted Berman.

“These companies are saying, ‘You’re asking me to do more now, invest more now, when, in fact 5 or 10 years from now, we don’t think that demand will be there, and the administration doesn’t even necessarily want it to be there.’”

The result of the Biden Administration’s hostility toward the energy industry is skyrocketing inflation.

Where energy prices rose 35% over the last year, all prices rose just 8%. In Europe, higher energy prices are responsible for at least half of all inflation.

There are certainly other factors causing inflation, including the ramping up of supply chains following the pandemic, the $1.7 trillion stimulus last year, and China’s lockdown in response to the omicron coronavirus variant. But the non-energy factors behind inflation were temporary, and none explain consistently higher energy prices, which are a major factor in the higher prices of everything, from food to consumer products.

And energy’s role could be even larger than economists can detect.

“When you strip out of the [Consumer Price Index] all the items that are linked to energy (air fares, moving/freight, rental cars, delivery services, new and used vehicles),” noted economist David Rosenberg, “the core was +0.36% and the [year-over-year] steadied near 4%. ”

The numbers speak for themselves. In the U.S., the monthly price change in May for all items was 1% but for fuel oil, airline fares, piped utility natural gas, and gasoline the price changes were 17%, 13%, 8%, and 4% respectively.

Some say there’s nothing Biden can do to increase energy production but my sources say that Biden could significantly increase oil/gas production within 12 – 18 months. How?

First, they say, he should invoke the National Defense Act for Oil and Gas. This will enable the acceleration of required permits for oil and gas projects, they say.

Second, he should announce a national commitment to purchase oil to fill the Strategic Petroleum Reserve (SPR) at a floor of $80/barrel. That will, they say, be a powerful incentive for the oil guys.

Third, he should announce trade agreements with the international community to supply them with LNG (liquified natural gas) Doing so will incentivize natural gas production and create a surplus of energy for exports with an “American-First asterisk (keep nat gas storage full while exporting).

Biden’s doing none of that. As a result, Biden’s hostility to expanded energy production could result in recession. The Federal Reserve yesterday raised interest rates more than at any point since 1994 and could raise them again next month in an increasingly desperate battle against inflation.

“It may take a recession to stamp out inflation,” concludes Bloomberg, “one that may cost Biden a second term.”

Why is that? Politicians are famously self-interested, focused on their own preservation at all costs. Why, then, is Biden not only wrecking the economy, by failing to take action to lower energy prices, but also destroying his own presidency?

An Aging Ideology

An awkward exchange between Biden and Jimmy Kimmel on ABC’s “Jimmy Kimmel Live!”