Last month was a big surprise: as readers will recall, for the month of July, the BLS did not yet get the memo, and instead "Job Openings Unexpectedly Surged To Two For Every Unemployed Worker, Crashing Fed's Plans To Nuke The Job Market." Needless to say that made no sense, and as we warned at the time "this is not the first time the DOL was forced to manipulate data - we caught them almost a decade ago in a gaping disconnected between data series one which they were forced to subsequently admit was a mistake - and we expect that the BLS will do the same and completely revise both its JOLTS and labor market data."

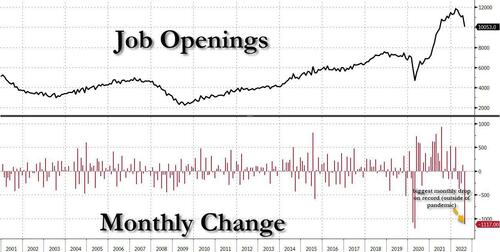

Fast forward to today, when the BLS did just as we expected, and in a release that was not merely a surprise, but sheer JOLTing shock, reported that not only was the July surge revised sharply lower, but that in August the labor market cratered as job openings tumbled to just above 10 million from a downward revised July print of 11.1 million, a collapse of 1.1 million in job openings, the biggest one-month crash outside of the covid global lockdown crash in April which was clearly an outlier.

According to the BLS, the largest decreases in job openings were in health care and social assistance (-236,000), other services (-183,000), and retail trade (-143,000)

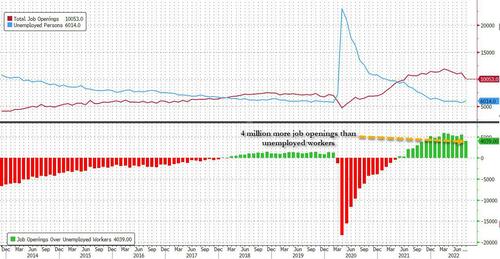

Still, while the first derivative of job openings was a disaster, the absolute number of openings remained high: at 10.05 million, there was still a generous 4.039 million more job openings than unemployed workers... which nonetheless was the lowest number since October 2021.

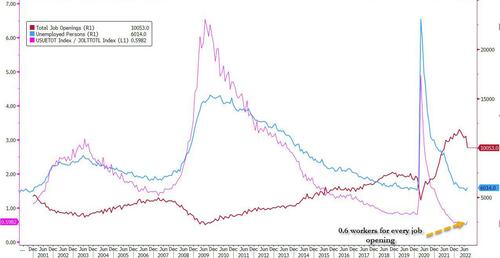

It also meant that the number of workers competing for every job opening barely budged and was just off its all time lows, rising to 0.6 in August.

It wasn't just job openings which plunged: hiring did too, and in August, the BLS reported that total hires dipped to 6.277 million which would have been the lowest print since May 2021 if only the BLS had not strategically revised the July print sharply lower to 6.238MM from above 6.3MM. In any case, the trend here too is clear: down and to the right. According to the BLS, the only notable decline in hiring was in the federal government, which saw 8,000 fewer hires.

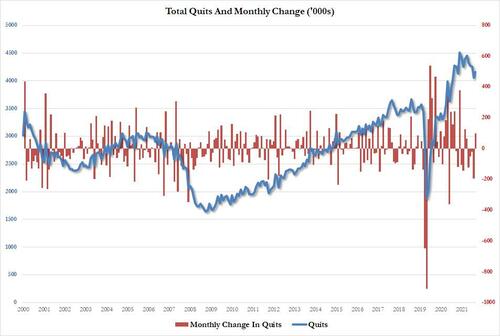

But while openings and hires were ugly, one category remained solid: in August the number of quits rose again, and after dropping to the lowest in a year in July at 4.058 million, quits rose modestly to 4.158 million... although as the labor recession spreads expect this number to plummet.

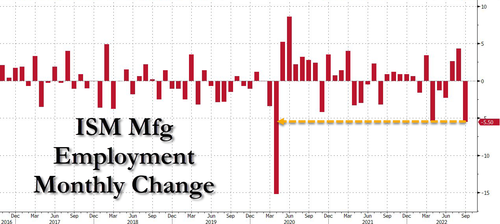

In retrospect, the dismal labor prints perhaps should not have been a surprise because if one ignores the clearly politicized nonfarm payrolls report, the latest ADP change of just 132K was ugly, but it was the collapse in the ISM Mfg employment index that was the real shocker.

And now that the "first" BLS hand is finally aware of what the "other" BLS hand is doing, expect this Friday's job report to be just as shocking as today's jolts, something which the market already is pricing in and sending stock soaring as expectations of a Fed pivot soar again. Why? Because as the Fed's own WSJ mouthpiece, Nick Timiraos just said, "today's collapse in JOLTS is exactly what the Powell Fed has been looking for. Here is Powell on Sept. 22: "Job openings could come down significantly—and they need to—without as much of a an increase in unemployment as has happened in earlier historical episodes."

This is exactly what the Powell Fed has been looking for. Here is Powell on Sept. 22:

— Nick Timiraos (@NickTimiraos) October 4, 2022

"Job openings could come down significantly—and they need to—without as much of a an increase in unemployment as has happened in earlier historical episodes."

The buy signal couldn't be more clear.

Last month was a big surprise: as readers will recall, for the month of July, the BLS did not yet get the memo, and instead “Job Openings Unexpectedly Surged To Two For Every Unemployed Worker, Crashing Fed’s Plans To Nuke The Job Market.” Needless to say that made no sense, and as we warned at the time “this is not the first time the DOL was forced to manipulate data – we caught them almost a decade ago in a gaping disconnected between data series one which they were forced to subsequently admit was a mistake – and we expect that the BLS will do the same and completely revise both its JOLTS and labor market data.”

Fast forward to today, when the BLS did just as we expected, and in a release that was not merely a surprise, but sheer JOLTing shock, reported that not only was the July surge revised sharply lower, but that in August the labor market cratered as job openings tumbled to just above 10 million from a downward revised July print of 11.1 million, a collapse of 1.1 million in job openings, the biggest one-month crash outside of the covid global lockdown crash in April which was clearly an outlier.

According to the BLS, the largest decreases in job openings were in health care and social assistance (-236,000), other services (-183,000), and retail trade (-143,000)

Still, while the first derivative of job openings was a disaster, the absolute number of openings remained high: at 10.05 million, there was still a generous 4.039 million more job openings than unemployed workers… which nonetheless was the lowest number since October 2021.

It also meant that the number of workers competing for every job opening barely budged and was just off its all time lows, rising to 0.6 in August.

It wasn’t just job openings which plunged: hiring did too, and in August, the BLS reported that total hires dipped to 6.277 million which would have been the lowest print since May 2021 if only the BLS had not strategically revised the July print sharply lower to 6.238MM from above 6.3MM. In any case, the trend here too is clear: down and to the right. According to the BLS, the only notable decline in hiring was in the federal government, which saw 8,000 fewer hires.

But while openings and hires were ugly, one category remained solid: in August the number of quits rose again, and after dropping to the lowest in a year in July at 4.058 million, quits rose modestly to 4.158 million… although as the labor recession spreads expect this number to plummet.

In retrospect, the dismal labor prints perhaps should not have been a surprise because if one ignores the clearly politicized nonfarm payrolls report, the latest ADP change of just 132K was ugly, but it was the collapse in the ISM Mfg employment index that was the real shocker.

And now that the “first” BLS hand is finally aware of what the “other” BLS hand is doing, expect this Friday’s job report to be just as shocking as today’s jolts, something which the market already is pricing in and sending stock soaring as expectations of a Fed pivot soar again. Why? Because as the Fed’s own WSJ mouthpiece, Nick Timiraos just said, “today’s collapse in JOLTS is exactly what the Powell Fed has been looking for. Here is Powell on Sept. 22: “Job openings could come down significantly—and they need to—without as much of a an increase in unemployment as has happened in earlier historical episodes.”

This is exactly what the Powell Fed has been looking for. Here is Powell on Sept. 22:

“Job openings could come down significantly—and they need to—without as much of a an increase in unemployment as has happened in earlier historical episodes.”

— Nick Timiraos (@NickTimiraos) October 4, 2022

The buy signal couldn’t be more clear.