Authored by Lance Roberts via RealInvestmentAdvice.com,

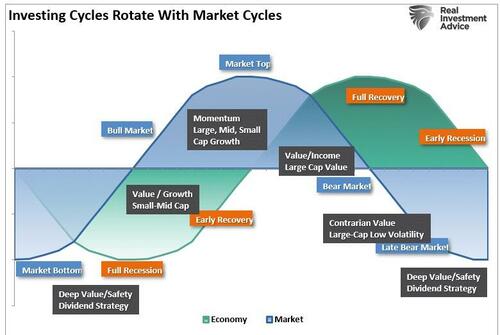

Recently, retail investors have started chasing small-cap stocks in hopes of both a rate-cutting cycle by the Federal Reserve and avoiding a recession. Such would seem logical given that, historically, small capitalization companies tend to perform best during the early stages of an economic recovery.

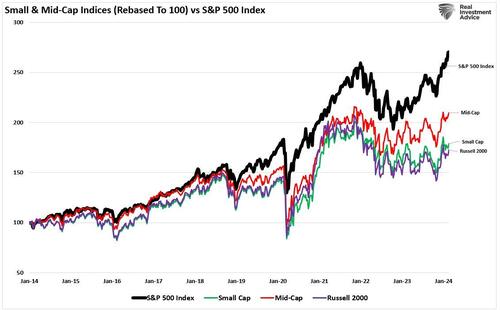

The recent exuberance for small-cap equities is also unsurprising, given the long period of underperformance relative to the S&P 500 market-capitalization-weighted index. The hope of a “catch-up” trade as a “rising tide lifts all boats” is a perennial bet by investors, and as shown, small and mid-cap stocks have indeed rallied with a lag to their large capitalization brethren.

However, some issues also plague smaller capitalization companies that remain. The first, as noted by Goldman Sachs, remains a fundamental one.

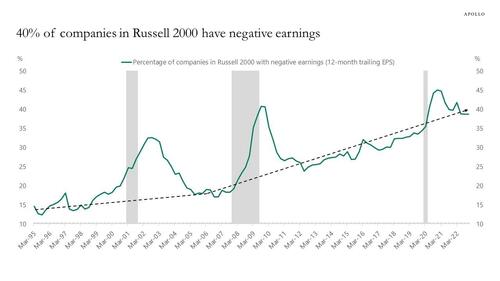

“I’m surprised how easy it is to find someone who wants to call the top in tech and slide those chips into small cap. Aside from the prosect of short-term pain trades, I don’t get the fundamental argument for sustained outperformance of an index where 1-in-3 companies will be unprofitable this year.”

As shown in the chart by Apollo below, in the 1990s, 15% of companies in the Russell 2000 had negative 12-month trailing EPS. Today, that share is 40%.

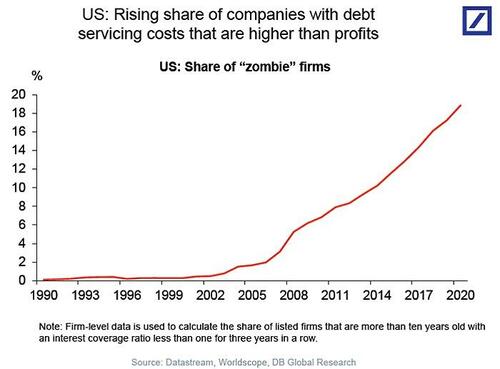

Besides the obvious that retail investors are chasing a rising slate of unprofitable companies that are also heavily leveraged and dependent on debt issuance to stay afloat (a.k.a. Zombies), these companies are susceptible to actual changes in the underlying economy.

So, is there a case to be made for small and mid-capitalization companies in the current environment? We can turn to the National Federation of Independent Business (NFIB) for that analysis.

The NFIB Report Tells A Very Different Story

The primary economic data points continue to be very robust. Low unemployment, strong economic growth, and declining rates of inflation. As I have heard recently by more mainstream analysts, “What’s not to love?”

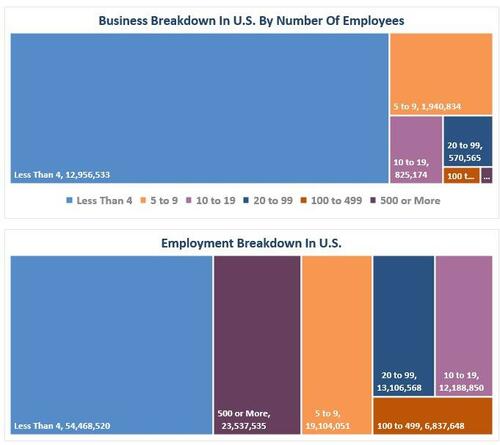

Understanding that small and mid-sized businesses comprise a substantial percentage of the U.S. economy is crucial. Roughly 60% of all companies in the U.S. have less than ten employees.

Simply, small businesses drive the economy, employment, and wages. Therefore, what the NFIB says is highly relevant to what is happening in the actual economy versus the headline economic data from Government sources.

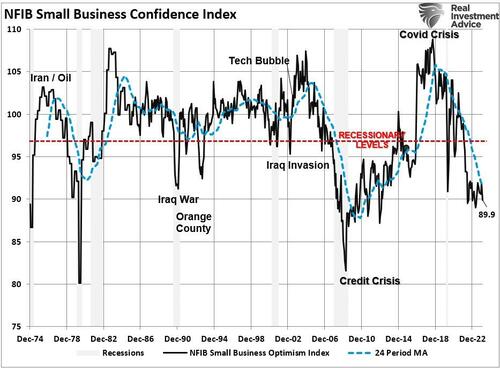

For example, despite Government data that suggests that the economy is strong and unlikely to enter a recession this year, the NFIB small business confidence survey declined in its latest reading. It remained at levels that have historically been associated with recessionary economies.

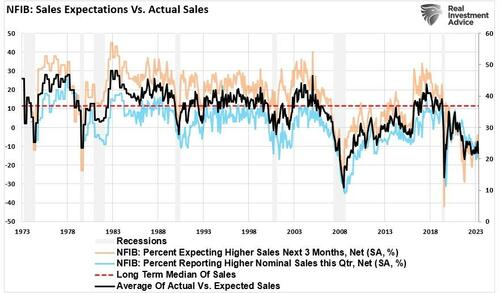

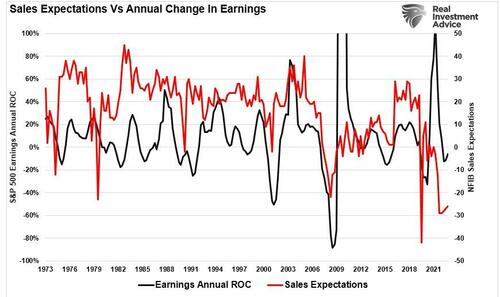

Unsurprisingly, selling a product, good, or service drives business optimism and confidence. If consumer demand is high, the business owners are more confident about the future. However, despite headlines of a strong consumer, both actual and expected sales by small businesses remain weak.

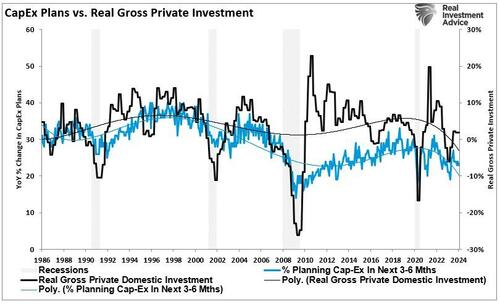

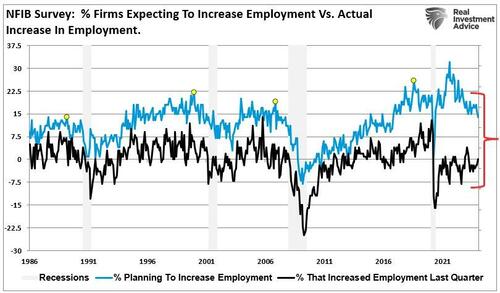

Furthermore, if the economy and the underlying demand were as strong as recent headlines suggest, the business would be ramping up capital expenditures to meet that demand. However, such is not the case regarding capital expenditures and actual versus planned employment.

There is an essential disconnect between reported economic data and what is happening within the economy. Of course, this brings us to whether investors are making a mistake by betting on small capitalization stocks.

The Potential Risk In Small Caps

In the short term, some momentum behind small-cap stocks bolsters the arguments for bets on those companies. However, over a longer time frame, earnings and fundamentals will matter.

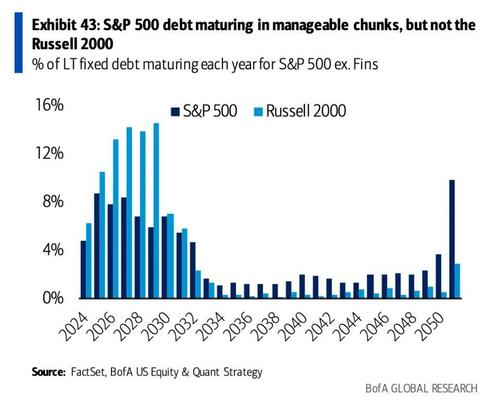

As noted above, many companies in the Russell 2000 have little profitability and large debt loads. Unlike many companies in the S&P 500 that refinanced debt at substantially lower rates, many of the Russell 2000 were unable. If interest rates are still elevated when that “debt wall” matures, refinancing debt at higher rates could further impair profitability.

Furthermore, the deep decline in sales expectations may undermine earnings growth estimates for these companies later in the year.

Of course, there are arguments for investing in small-cap stocks currently.

-

The economy could return to much more robust rates of growth.

-

Consumer demand could increase, leading to stronger sales and employment outlooks for companies.

-

The Federal Reserve could cut interest rates sharply ahead of the debt-refinancing in 2024.

-

Inflation could drop sharply, boosting profitability for smaller capitalization companies.

Confidence Matters

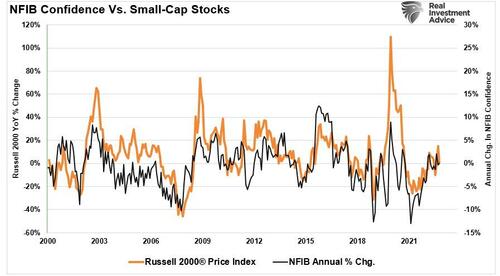

Yes, any of those things are possible. If they emerge, such should quickly reflect in the confidence of businesses surveyed by the NFIB. As shown, there is a high correlation between the annual rate of change of NFIB small business confidence and the Russell 2000 index.

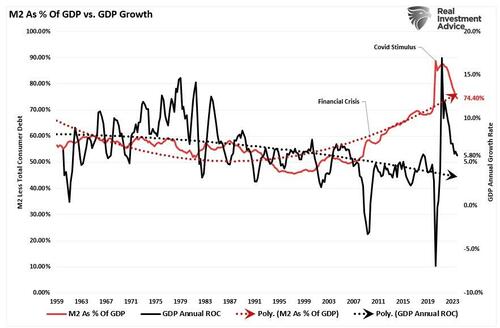

The apparent problem with the wish list for small-cap investors is that more substantial economic growth and consumer demand will push inflationary pressures higher. Such would either keep the Federal Reserve on hold from cutting rates or lead to further increases, neither of which are beneficial for small-cap companies. Lastly, the surge in economic growth over the last two years resulted from a massive increase in Government spending. It is unlikely that the pace of the expenditures can continue, and as monetary supply reverses, economic growth will continue to slow.

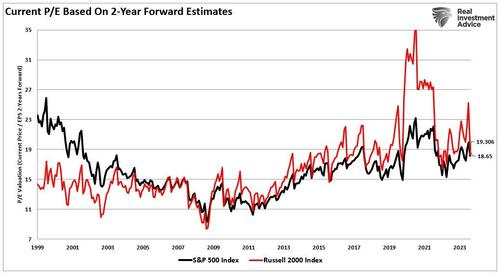

Given this backdrop, assuming current accelerated earnings growth estimates for stocks in the future is a bit unreasonable. On a 2-year forward-looking basis, current valuations for the Russell 2000 are higher than the S&P 500 index, where the top 10 largest companies dominate earnings growth.

Conclusion

Since debt-driven government spending programs have a dismal history of providing the promised economic growth, disappointment over the next year is almost guaranteed.

However, suppose additional amounts of short-term stimulus deliver higher rates of inflation and higher interest rates. In that case, the Federal Reserve may become contained in its ability to continue to provide an “insurance policy” to investors.

There are risks to assuming a solid economic and employment recovery over the next couple of quarters. With consumers running out of savings, the risk of further disappointment in sales expectations will likely continue to weigh on small business owners. This is why we keep a close eye on the NFIB reports.

However, in the short term, there is nothing wrong with being optimistic, and small-cap stocks benefit from the ongoing speculative frenzy in the market. The optimism can last longer with the Federal Reserve set to cut rates and further ease monetary accommodation.

However, regarding your investment portfolio, keeping a realistic perspective on the data will be essential to navigating the risks to come. For small-cap investors, the time to take profits and move to “safer pastures” is likely closer than you think.

Authored by Lance Roberts via RealInvestmentAdvice.com,

Recently, retail investors have started chasing small-cap stocks in hopes of both a rate-cutting cycle by the Federal Reserve and avoiding a recession. Such would seem logical given that, historically, small capitalization companies tend to perform best during the early stages of an economic recovery.

The recent exuberance for small-cap equities is also unsurprising, given the long period of underperformance relative to the S&P 500 market-capitalization-weighted index. The hope of a “catch-up” trade as a “rising tide lifts all boats” is a perennial bet by investors, and as shown, small and mid-cap stocks have indeed rallied with a lag to their large capitalization brethren.

However, some issues also plague smaller capitalization companies that remain. The first, as noted by Goldman Sachs, remains a fundamental one.

“I’m surprised how easy it is to find someone who wants to call the top in tech and slide those chips into small cap. Aside from the prosect of short-term pain trades, I don’t get the fundamental argument for sustained outperformance of an index where 1-in-3 companies will be unprofitable this year.”

As shown in the chart by Apollo below, in the 1990s, 15% of companies in the Russell 2000 had negative 12-month trailing EPS. Today, that share is 40%.

Besides the obvious that retail investors are chasing a rising slate of unprofitable companies that are also heavily leveraged and dependent on debt issuance to stay afloat (a.k.a. Zombies), these companies are susceptible to actual changes in the underlying economy.

So, is there a case to be made for small and mid-capitalization companies in the current environment? We can turn to the National Federation of Independent Business (NFIB) for that analysis.

The NFIB Report Tells A Very Different Story

The primary economic data points continue to be very robust. Low unemployment, strong economic growth, and declining rates of inflation. As I have heard recently by more mainstream analysts, “What’s not to love?”

Understanding that small and mid-sized businesses comprise a substantial percentage of the U.S. economy is crucial. Roughly 60% of all companies in the U.S. have less than ten employees.

Simply, small businesses drive the economy, employment, and wages. Therefore, what the NFIB says is highly relevant to what is happening in the actual economy versus the headline economic data from Government sources.

For example, despite Government data that suggests that the economy is strong and unlikely to enter a recession this year, the NFIB small business confidence survey declined in its latest reading. It remained at levels that have historically been associated with recessionary economies.

Unsurprisingly, selling a product, good, or service drives business optimism and confidence. If consumer demand is high, the business owners are more confident about the future. However, despite headlines of a strong consumer, both actual and expected sales by small businesses remain weak.

Furthermore, if the economy and the underlying demand were as strong as recent headlines suggest, the business would be ramping up capital expenditures to meet that demand. However, such is not the case regarding capital expenditures and actual versus planned employment.

There is an essential disconnect between reported economic data and what is happening within the economy. Of course, this brings us to whether investors are making a mistake by betting on small capitalization stocks.

The Potential Risk In Small Caps

In the short term, some momentum behind small-cap stocks bolsters the arguments for bets on those companies. However, over a longer time frame, earnings and fundamentals will matter.

As noted above, many companies in the Russell 2000 have little profitability and large debt loads. Unlike many companies in the S&P 500 that refinanced debt at substantially lower rates, many of the Russell 2000 were unable. If interest rates are still elevated when that “debt wall” matures, refinancing debt at higher rates could further impair profitability.

Furthermore, the deep decline in sales expectations may undermine earnings growth estimates for these companies later in the year.

Of course, there are arguments for investing in small-cap stocks currently.

-

The economy could return to much more robust rates of growth.

-

Consumer demand could increase, leading to stronger sales and employment outlooks for companies.

-

The Federal Reserve could cut interest rates sharply ahead of the debt-refinancing in 2024.

-

Inflation could drop sharply, boosting profitability for smaller capitalization companies.

Confidence Matters

Yes, any of those things are possible. If they emerge, such should quickly reflect in the confidence of businesses surveyed by the NFIB. As shown, there is a high correlation between the annual rate of change of NFIB small business confidence and the Russell 2000 index.

The apparent problem with the wish list for small-cap investors is that more substantial economic growth and consumer demand will push inflationary pressures higher. Such would either keep the Federal Reserve on hold from cutting rates or lead to further increases, neither of which are beneficial for small-cap companies. Lastly, the surge in economic growth over the last two years resulted from a massive increase in Government spending. It is unlikely that the pace of the expenditures can continue, and as monetary supply reverses, economic growth will continue to slow.

Given this backdrop, assuming current accelerated earnings growth estimates for stocks in the future is a bit unreasonable. On a 2-year forward-looking basis, current valuations for the Russell 2000 are higher than the S&P 500 index, where the top 10 largest companies dominate earnings growth.

Conclusion

Since debt-driven government spending programs have a dismal history of providing the promised economic growth, disappointment over the next year is almost guaranteed.

However, suppose additional amounts of short-term stimulus deliver higher rates of inflation and higher interest rates. In that case, the Federal Reserve may become contained in its ability to continue to provide an “insurance policy” to investors.

There are risks to assuming a solid economic and employment recovery over the next couple of quarters. With consumers running out of savings, the risk of further disappointment in sales expectations will likely continue to weigh on small business owners. This is why we keep a close eye on the NFIB reports.

However, in the short term, there is nothing wrong with being optimistic, and small-cap stocks benefit from the ongoing speculative frenzy in the market. The optimism can last longer with the Federal Reserve set to cut rates and further ease monetary accommodation.

However, regarding your investment portfolio, keeping a realistic perspective on the data will be essential to navigating the risks to come. For small-cap investors, the time to take profits and move to “safer pastures” is likely closer than you think.

Loading…