A bad data week...

Source: Bloomberg

...was good news for doves as rate-cut expectations soared...

Source: Bloomberg

...and despite yesterday's bloodbathery, all the US majors managed to rally into the green for the week early on today, with Small Caps literally exploding higher (up around 7% on the week!). A late-day selloff dragged Nasdaq red on the week though...

That was the Russell 2000's best week since November and broke it out to its highest since Jan 2022...

Source: Bloomberg

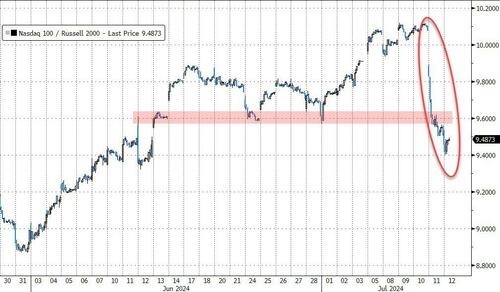

...and the biggest RTY/NDX outperformance week since Nov 2020...

Source: Bloomberg

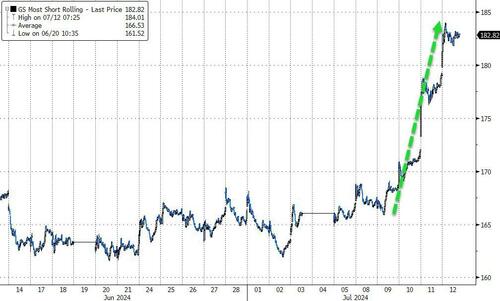

Small Caps were aided by a massive short-squeeze this week which saw "most shorted" stocks soaring 10% - the biggest squeeze since Dec...

Source: Bloomberg

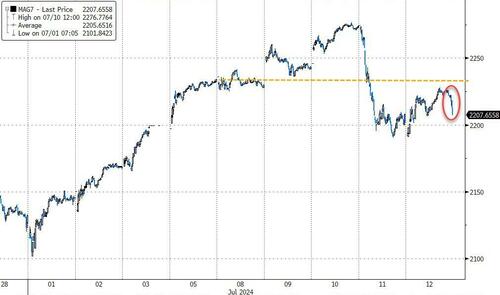

And while MAG7 stocks ended the week lower, it was only marginally, as today's bounce back erased some of yesterday's losses...but the late-day selling was predominantly among the mega-cap tech names...

Source: Bloomberg

And of course, after yesterday saw all 7 names ending red (for the first time since April), the rebound today was 'inevitable'...

Source: Bloomberg

0-DTE tracked stocks up and down today but the late-day selling pressure in stocks was NOT related to 0-DTE flow, in fact they bought the dip...

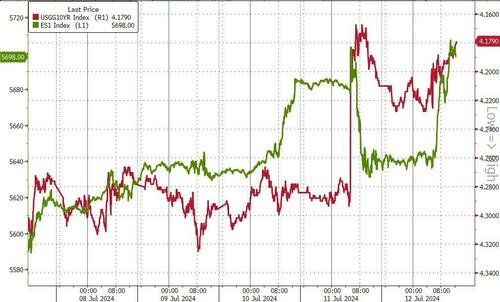

Stocks vs bonds this week... no idea!!!

Source: Bloomberg

Treasury yields tumbled on the week, led by the short-end...

Source: Bloomberg

...which prompted a dramatic bull steepening and almost un-inversion of the curve (2s30s)...

Source: Bloomberg

The dollar tumbled for the second straight week (the biggest two-week drop since December), erasing all of the gains seen since June payrolls...

Source: Bloomberg

Thanks in large part to USDJPY and BoJ 'help'...

Source: Bloomberg

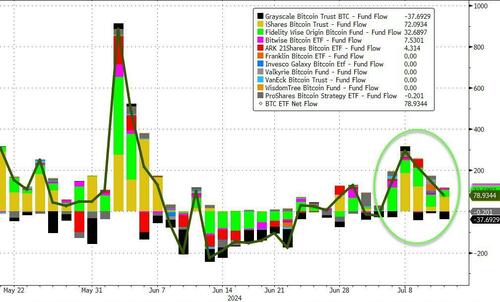

Bitcoin managed gains on the week as ETF inflows dominated the German govt's dumpfest (as they emptied their coffers of every coin)...

Source: Bloomberg

BTC ETFs saw inflows for 5 straight days...

Source: Bloomberg

Gold surged back up near record highs this week, closing the week back above $2400...

Source: Bloomberg

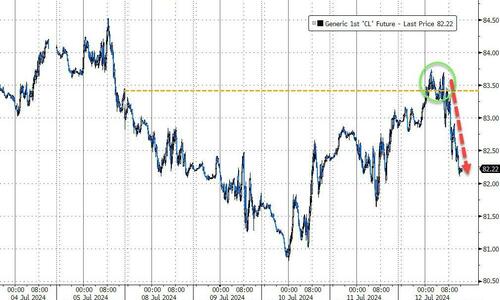

Thanks to weakness today, crude prices ended the week lower as WTI rejected $83.50...

Source: Bloomberg

Finally, it was a big week for market moves but in the big picture equities remain in a universe of their own relative to global liquidity...

Source: Bloomberg

Are stocks expecting a massive liquidity fest?

A bad data week…

Source: Bloomberg

…was good news for doves as rate-cut expectations soared…

Source: Bloomberg

…and despite yesterday’s bloodbathery, all the US majors managed to rally into the green for the week early on today, with Small Caps literally exploding higher (up around 7% on the week!). A late-day selloff dragged Nasdaq red on the week though…

That was the Russell 2000’s best week since November and broke it out to its highest since Jan 2022…

Source: Bloomberg

…and the biggest RTY/NDX outperformance week since Nov 2020…

Source: Bloomberg

Small Caps were aided by a massive short-squeeze this week which saw “most shorted” stocks soaring 10% – the biggest squeeze since Dec…

Source: Bloomberg

And while MAG7 stocks ended the week lower, it was only marginally, as today’s bounce back erased some of yesterday’s losses…but the late-day selling was predominantly among the mega-cap tech names…

Source: Bloomberg

And of course, after yesterday saw all 7 names ending red (for the first time since April), the rebound today was ‘inevitable’…

Source: Bloomberg

0-DTE tracked stocks up and down today but the late-day selling pressure in stocks was NOT related to 0-DTE flow, in fact they bought the dip…

Stocks vs bonds this week… no idea!!!

Source: Bloomberg

Treasury yields tumbled on the week, led by the short-end…

Source: Bloomberg

…which prompted a dramatic bull steepening and almost un-inversion of the curve (2s30s)…

Source: Bloomberg

The dollar tumbled for the second straight week (the biggest two-week drop since December), erasing all of the gains seen since June payrolls…

Source: Bloomberg

Thanks in large part to USDJPY and BoJ ‘help’…

Source: Bloomberg

Bitcoin managed gains on the week as ETF inflows dominated the German govt’s dumpfest (as they emptied their coffers of every coin)…

Source: Bloomberg

BTC ETFs saw inflows for 5 straight days…

Source: Bloomberg

Gold surged back up near record highs this week, closing the week back above $2400…

Source: Bloomberg

Thanks to weakness today, crude prices ended the week lower as WTI rejected $83.50…

Source: Bloomberg

Finally, it was a big week for market moves but in the big picture equities remain in a universe of their own relative to global liquidity…

Source: Bloomberg

Are stocks expecting a massive liquidity fest?

Loading…