Many voters are upset about the economy, with the question of why driving a lot of conversation in Washington.

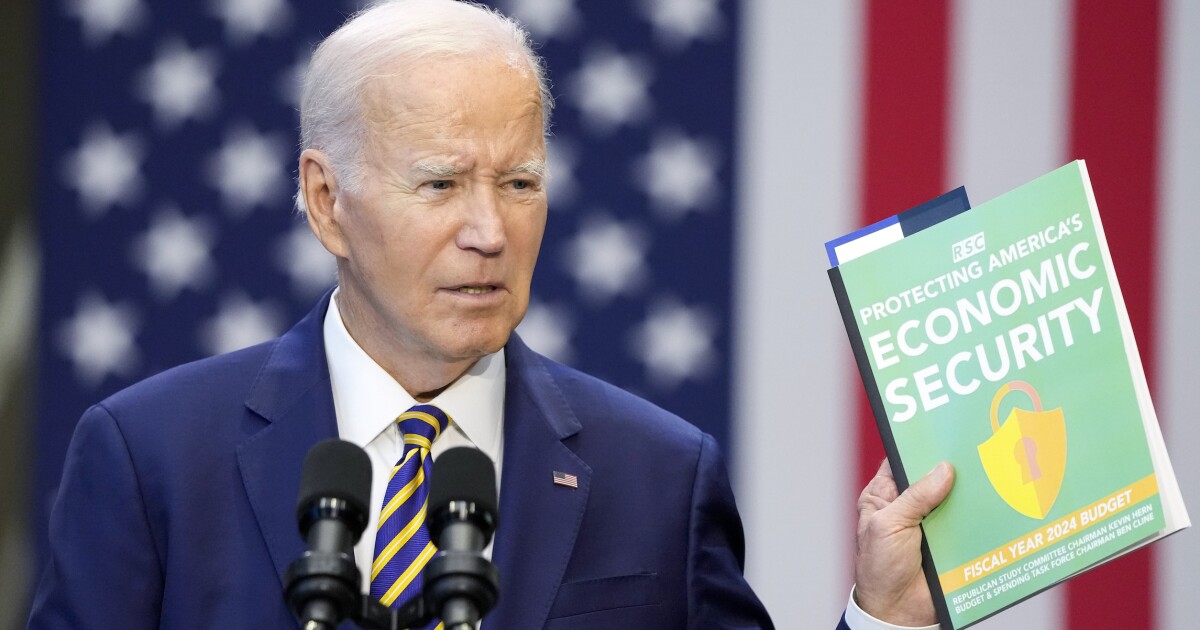

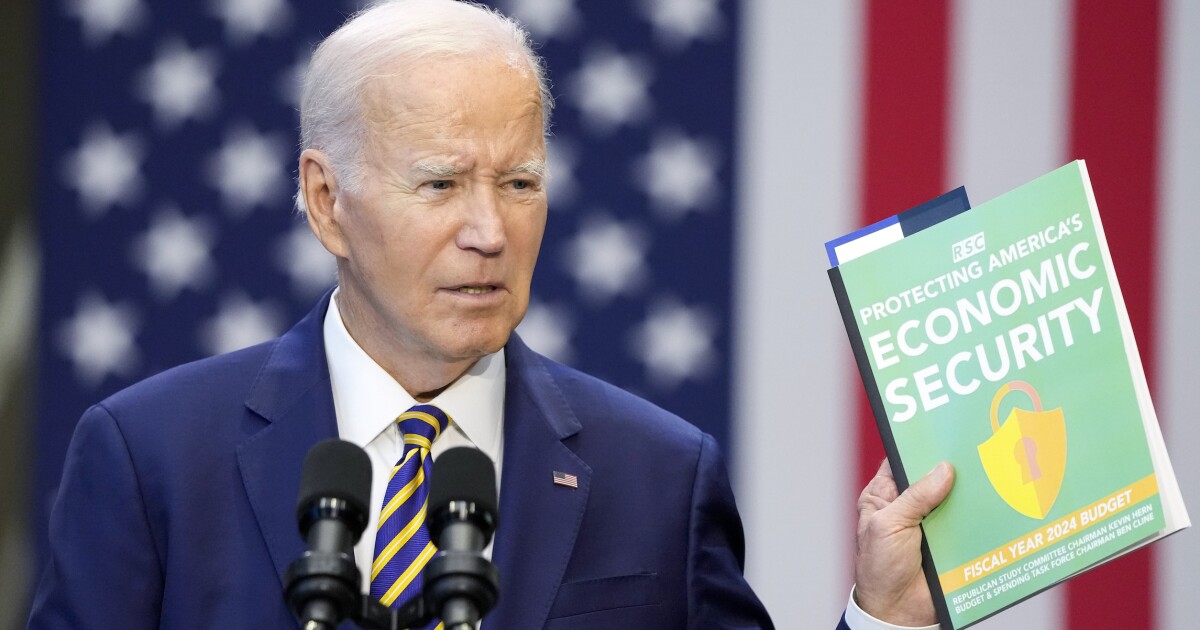

The White House continues to point out the positives, such as strong gross domestic product growth and low unemployment, while polls show that consumers are more focused on high inflation — and they’re giving President Joe Biden negative marks as a result.

HOME ECONOMICS: HIGH HOUSING COSTS MAY HAUNT BIDEN ON THE 2024 CAMPAIGN TRAIL

Stories are circulating on social media of people lamenting high prices on everything from housing to hamburgers. This includes posts on the controversial TikTok platform popular with younger people, who represent a traditional Democratic stronghold.

“Sixteen dollars for a burger, a large fry, and a drink,” Topher Olive says in a TikTok video that has drawn nearly 6,000 comments. “It’s just crazy.”

Stories in the New York Times and Washington Post have focused on the social media side of the equation, quoting administration officials who are working to counter the narrative.

Biden’s 2024 deputy campaign manager, Rob Flaherty, told the New York Times that the campaign is working with TikTok creators to “amplify a positive, affirmative message” about the economy, while other officials told the outlet they’re concerned about some posts that border on misinformation which “social media platforms should be policing.”

The president’s critics in the Republican Party see the situation as more straightforward — voters are rightly upset about inflation.

“Joe Biden has stopped touting ‘Bidenomics’ because Americans overwhelmingly disapprove of his economic agenda,” Republican National Committee spokeswoman Anna Kelly said. “As prices continue to rise and real wages continue to fall, families can’t afford four more years.”

The White House rolled out “Bidenomics” as a catchphrase over the summer to get the electorate to pay more attention to historically low unemployment rates, strong manufacturing sector growth, trillions of dollars in infrastructure investments, and surging GDP.

But few people seem to be buying it, and Biden has stopped using the term since early November. In contrast, the president said “Bidenomics” more than 100 times between June and October.

Instead, the Biden administration may be focusing its fire on how Republicans, and especially former President Donald Trump, would handle the economy.

On Monday, White House deputy press secretary Andrew Bates published a memo titled “The growing MAGAnomics threat of skyrocketing healthcare costs,” purporting that the GOP’s economic proposals will raise costs for families.

But the viral moments may continue on social media, and the White House could risk stepping into controversy again as it works to combat that narrative.

The House Judiciary Committee subpoenaed Flaherty, the deputy campaign manager, last week, seeking testimony over his efforts to influence social media moderation. A reporter asked White House press secretary Karine Jean-Pierre if the administration would seek to block his testimony and if it regretted its past efforts to flag social media content for removal.

Jean-Pierre did not answer directly, referring the question to the White House counsel’s office.

Whether influenced by social media or not, polls consistently show consumer sentiment regarding the economy is not strong.

For example, the University of Michigan’s Index of Consumer Sentiment fell to 61.3 this month, better than last year but still near historic lows.

According to the consumer price index, prices were 18% higher in October 2023 than in October 2020, with grocery prices up more than 20% and gas up 66%. While the Bureau of Labor Statistics found that hourly earnings have outpaced inflation over the last year, it may still take time for consumers to adjust to higher prices that are still rising, albeit at a slower pace than before.

Inflation also shows up when people borrow money for purchases. The Federal Reserve has aggressively raised interest rates in an attempt to combat rising prices, and as a result, the costs to borrow money using an auto loan, credit card, or mortgage have shot up.

Mortgage rates have doubled since early 2022, and the number of respondents who told the Conference Board Consumer Confidence Index that they planned to buy a home in the next year has been cut in half.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Consumer confidence may eventually return now that inflation has reached a more manageable 3% annual rate of growth. Still, the Biden White House appears to have shifted away from its Bidenomics push in favor of highlighting the dangers of Trump’s “MAGAnomics.”

“Efforts to repeal the Affordable Care Act (ACA) and the Inflation Reduction Act put the differences between Bidenomics and MAGAnomics into sharp perspective,” Bates wrote on Monday. “Lower costs for hardworking families made possible by rich special interests paying their fair share in taxes, or tax windfalls for the rich that makes costs skyrocket for the American middle class.”