After a solid 3Y auction this morning, expectations were for smooth passage in the day's second note sale at 1pm, when the Treasury would sell $32BN in a 9-Y 11-Month reopening of benchmark 10Y paper. The result was more or less in line with expectations... well, maybe a little less.

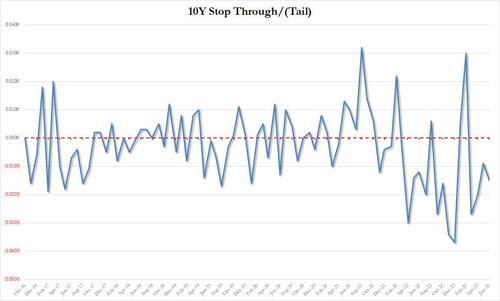

Pricing at a high yield of 3.791%, the suction tailed then When Issued 3.7765% by 1.5bps. This was the 4th consecutive tail in a row, and 13 of the past 16 auction that tailed the WI.

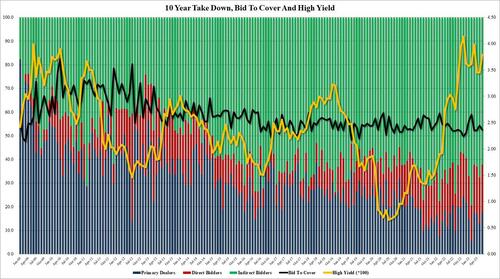

The bid to cover of 2.36, down from 2.45 last month, and below the recent (6-auction) average of 2.44.

The internals were on the soft side too, with Indirects awarded 62.3% of the auction, down from 67.5% last month and below the 66.4% average (it was the lowest since December). And with Directs taking down 19.9%, or in line with recent months, Dealers were left with 17.8% of the allotment, up from 13.0%, and above the recent average of 15.0%.

Overall, an ok auction, with demand coming light vs this morning's 3Y issuance, but to be expected at a time when the Fed is expected to hike at least once more and when the Treasury is busy replenishing some $1 trillion in TGA cash.

After a solid 3Y auction this morning, expectations were for smooth passage in the day’s second note sale at 1pm, when the Treasury would sell $32BN in a 9-Y 11-Month reopening of benchmark 10Y paper. The result was more or less in line with expectations… well, maybe a little less.

Pricing at a high yield of 3.791%, the suction tailed then When Issued 3.7765% by 1.5bps. This was the 4th consecutive tail in a row, and 13 of the past 16 auction that tailed the WI.

The bid to cover of 2.36, down from 2.45 last month, and below the recent (6-auction) average of 2.44.

The internals were on the soft side too, with Indirects awarded 62.3% of the auction, down from 67.5% last month and below the 66.4% average (it was the lowest since December). And with Directs taking down 19.9%, or in line with recent months, Dealers were left with 17.8% of the allotment, up from 13.0%, and above the recent average of 15.0%.

Overall, an ok auction, with demand coming light vs this morning’s 3Y issuance, but to be expected at a time when the Fed is expected to hike at least once more and when the Treasury is busy replenishing some $1 trillion in TGA cash.

Loading…