Sony and Honda may have picked the worst possible time to break new EV ground with President Trump at the helm. But the companies will try nonetheless, with Nikkei Asia this past week reporting that the companies are preparing for a "tough debut" under a Trump administration.

They had been working together for two and a half years to collaborate on an EV project.

Now, Sony Honda Mobility (SHM) will unveil a prototype of its electric sedan, the Afeela, at CES 2025 in Las Vegas, Nikkei Asia said. Market watchers are eager to see if Afeela's software-driven approach can thrive in the competitive U.S. EV market, though analysts warn the timing may be unfavorable.

Izumi Kawanishi, president and chief operating officer of SHM said: "The hardware, or car body, is pretty much complete. We'll be working on the software until the last minute."

President-elect Donald Trump is expected to cut EV subsidies, potentially reducing electric vehicle sales by nearly 30%, according to a National Bureau of Economic Research study. Automakers also face challenges from his proposed tariff hikes, which could increase costs.

SHM's Afeela, blending Sony's tech expertise with Honda's automotive strengths, aims to compete in this tough market by prioritizing software and entertainment. The prototype, featuring 45 cameras and sensors, AI-driven features, and updateable software, emphasizes self-parking and driver-assistance tools. Entertainment-focused elements include panoramic screens, noise-canceling audio, and rear-seat displays.

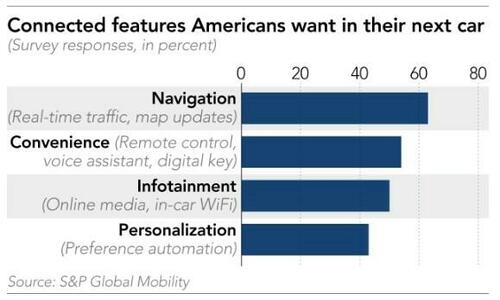

The Nikkei Asia report said experts believe Afeela's success hinges on its software, not hardware, and aligns with consumer preferences for connected services, navigation, and advanced driver-assistance systems.

Jin Tang of Mizuho Bank notes that software-defined vehicles are judged on electrification and digital integration, where Sony’s technologies should excel, but improvements in AI and autonomous driving may come gradually. Dunne emphasizes intuitive automotive software, stating, "Most automakers out there don't get it right," but believes Sony could be "several steps ahead" in this area.

SHM's 50 billion yen venture aims to benefit both parent companies—Sony expanding its sensor business and Honda improving tech-focused car development. Competing against Tesla, which holds half the U.S. EV market, SHM will face challenges, with a realistic sales goal of 30,000–40,000 units annually, especially if subsidies are reduced.

Priced around $50,000, the Afeela targets affluent buyers, emphasizing advanced features like entertainment and augmented reality, developed with Epic Games. Analyst Nakanishi predicts SHM will thrive as autonomous driving grows, leveraging its entertainment expertise.

Kawanishi views the launch as "the starting line," focusing on software-driven updates to redefine the car ownership experience.

Kawanishi concluded: "All businesses have ups and downs, so we won't live and die by it. If we think about the environment, EVs will spread, and sooner or later, that's the way the world will go."

Sony and Honda may have picked the worst possible time to break new EV ground with President Trump at the helm. But the companies will try nonetheless, with Nikkei Asia this past week reporting that the companies are preparing for a “tough debut” under a Trump administration.

They had been working together for two and a half years to collaborate on an EV project.

Now, Sony Honda Mobility (SHM) will unveil a prototype of its electric sedan, the Afeela, at CES 2025 in Las Vegas, Nikkei Asia said. Market watchers are eager to see if Afeela’s software-driven approach can thrive in the competitive U.S. EV market, though analysts warn the timing may be unfavorable.

Izumi Kawanishi, president and chief operating officer of SHM said: “The hardware, or car body, is pretty much complete. We’ll be working on the software until the last minute.”

President-elect Donald Trump is expected to cut EV subsidies, potentially reducing electric vehicle sales by nearly 30%, according to a National Bureau of Economic Research study. Automakers also face challenges from his proposed tariff hikes, which could increase costs.

SHM’s Afeela, blending Sony’s tech expertise with Honda’s automotive strengths, aims to compete in this tough market by prioritizing software and entertainment. The prototype, featuring 45 cameras and sensors, AI-driven features, and updateable software, emphasizes self-parking and driver-assistance tools. Entertainment-focused elements include panoramic screens, noise-canceling audio, and rear-seat displays.

The Nikkei Asia report said experts believe Afeela’s success hinges on its software, not hardware, and aligns with consumer preferences for connected services, navigation, and advanced driver-assistance systems.

Jin Tang of Mizuho Bank notes that software-defined vehicles are judged on electrification and digital integration, where Sony’s technologies should excel, but improvements in AI and autonomous driving may come gradually. Dunne emphasizes intuitive automotive software, stating, “Most automakers out there don’t get it right,” but believes Sony could be “several steps ahead” in this area.

SHM’s 50 billion yen venture aims to benefit both parent companies—Sony expanding its sensor business and Honda improving tech-focused car development. Competing against Tesla, which holds half the U.S. EV market, SHM will face challenges, with a realistic sales goal of 30,000–40,000 units annually, especially if subsidies are reduced.

Priced around $50,000, the Afeela targets affluent buyers, emphasizing advanced features like entertainment and augmented reality, developed with Epic Games. Analyst Nakanishi predicts SHM will thrive as autonomous driving grows, leveraging its entertainment expertise.

Kawanishi views the launch as “the starting line,” focusing on software-driven updates to redefine the car ownership experience.

Kawanishi concluded: “All businesses have ups and downs, so we won’t live and die by it. If we think about the environment, EVs will spread, and sooner or later, that’s the way the world will go.”

Loading…