By Bloomberg markets live reporter and analyst Ven Ram

Exactly three decades after George Soros bet successfully against the pound, a host of traders seem to be positioned for further declines in the British currency. History is in their favor.

Sterling may weaken toward parity against the dollar sooner than commonly thought if the euro continues to stay under pressure, increasing correlations between the two Atlantic currencies show.

If that association continues to be strong -- and there is no reason to expect otherwise -- sterling will slide to parity should the euro weaken further toward 0.90 against the greenback.

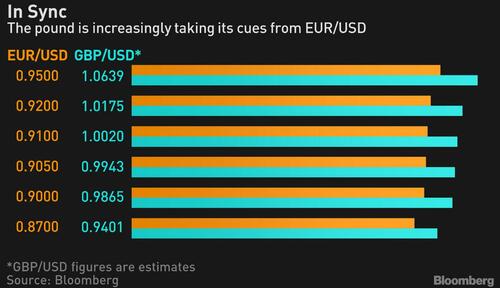

The pound’s rolling three-month correlation against the euro is now near the highest in four years. A parsing of that relationship projects the following levels for GBP/USD if those correlations are sustained in the coming months:

A loud caveat against any overzealous interpretation of the above is that correlation doesn’t imply causation, and the levels posited for cable just show what’s at play in the markets at the moment.

On a fundamental level, sterling has been let down this year by inflation-adjusted yield differentials that have swung in favor of the dollar. While the Bank of England started raising rates before the Federal Reserve in the current cycle, you don’t get any prizes for being the first to start off the blocks in a marathon -- rather, it’s where you are in relation to the destination that counts.

Given where retail-price inflation is, the BOE’s policy rate isn’t even in neutral territory, let alone approach the zip code of restrictive territory, a fact not lost on currency traders.

Sterling is likely to be on the back foot so long as the Fed’s actions keep boosting dollar-denominated real rates further out into positive territory, widening those differentials even more and removing an incentive for traders to chase sterling higher.Positioning on the pound reflects the wave of pessimism that has come to beset the currency: net non-commercial combined combined positions are deeply negative.

Back in 1992, Soros built up huge short positions against sterling after Britain joined the European Exchange Rate Mechanism with inflation running high amid low interest rates, with the latter two conditions eerily reminiscent of the current backdrop.

What is the risk to the plot of a vulnerable pound? A weakening of the current strong correlation with EUR/USD will come as a boost to sterling, though given how elevated the linkage is, it may be foolhardy to expect a breakdown in that correlation until the Fed is done with raising rates.

A scenario where the BOE suddenly amps up its hiking campaign and starts raising rates at a far more vigorous pace than it has done so far in this cycle will also lend sterling a helping hand.

History, as Mark Twain observed, doesn’t repeat itself, but it often rhymes. For the pound, though, history may repeat, rhyme and chime with what happened three decades ago.

By Bloomberg markets live reporter and analyst Ven Ram

Exactly three decades after George Soros bet successfully against the pound, a host of traders seem to be positioned for further declines in the British currency. History is in their favor.

Sterling may weaken toward parity against the dollar sooner than commonly thought if the euro continues to stay under pressure, increasing correlations between the two Atlantic currencies show.

If that association continues to be strong — and there is no reason to expect otherwise — sterling will slide to parity should the euro weaken further toward 0.90 against the greenback.

The pound’s rolling three-month correlation against the euro is now near the highest in four years. A parsing of that relationship projects the following levels for GBP/USD if those correlations are sustained in the coming months:

A loud caveat against any overzealous interpretation of the above is that correlation doesn’t imply causation, and the levels posited for cable just show what’s at play in the markets at the moment.

On a fundamental level, sterling has been let down this year by inflation-adjusted yield differentials that have swung in favor of the dollar. While the Bank of England started raising rates before the Federal Reserve in the current cycle, you don’t get any prizes for being the first to start off the blocks in a marathon — rather, it’s where you are in relation to the destination that counts.

Given where retail-price inflation is, the BOE’s policy rate isn’t even in neutral territory, let alone approach the zip code of restrictive territory, a fact not lost on currency traders.

Sterling is likely to be on the back foot so long as the Fed’s actions keep boosting dollar-denominated real rates further out into positive territory, widening those differentials even more and removing an incentive for traders to chase sterling higher.Positioning on the pound reflects the wave of pessimism that has come to beset the currency: net non-commercial combined combined positions are deeply negative.

Back in 1992, Soros built up huge short positions against sterling after Britain joined the European Exchange Rate Mechanism with inflation running high amid low interest rates, with the latter two conditions eerily reminiscent of the current backdrop.

What is the risk to the plot of a vulnerable pound? A weakening of the current strong correlation with EUR/USD will come as a boost to sterling, though given how elevated the linkage is, it may be foolhardy to expect a breakdown in that correlation until the Fed is done with raising rates.

A scenario where the BOE suddenly amps up its hiking campaign and starts raising rates at a far more vigorous pace than it has done so far in this cycle will also lend sterling a helping hand.

History, as Mark Twain observed, doesn’t repeat itself, but it often rhymes. For the pound, though, history may repeat, rhyme and chime with what happened three decades ago.