Update (1730ET): Shortly after The Fed reported the dramatic data confirming record outflows from the 25 largest US banks last week, rating agency S&P Global lowered its outlooks for Bank of America, JPMorgan Chase, PNC and Truist to stable from positive.

Bloomberg reports that S&P cites “heightened market volatility” as negative for banking sector:

“We have revised our outlooks to stable from positive on the ratings on four large U.S. banks as we believe prevailing market and economic conditions have reduced the probability of an upgrade in the current environment”

S&P affirms its ratings on the banks, “reflecting their continued good performance on a stand-alone basis, including through recent market volatility.”

* * *

The Fed just released its weekly commercial bank data dump showing deposit inflows/outflows.

Two things to note:

1) This is for the week up to 3/24/23 (which includes the post-SVB reaction week)

2) 'Large Banks' includes the top 25 banks (which means SVB was among that group, hence, we get no indication of SVB rotation flows, and also the $30 bn deposit transfer to FRC may impact the results)

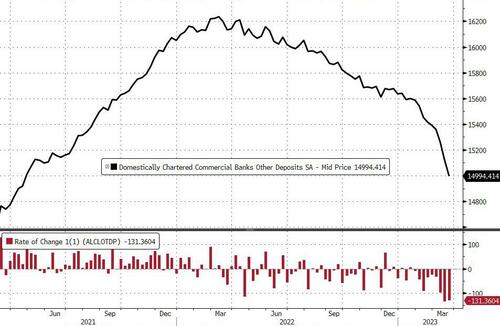

A slowing growth in money-market fund inflows hinted at a slowing pace of deposit outflows from the US domestic commercial banking system last week (even though the last three weeks have seen MM inflows top $300bn), but that was not what we saw, with deposits (ex large time deposits) tumbling $131bn (on a seasonally-adjusted basis)...

Source: Bloomberg

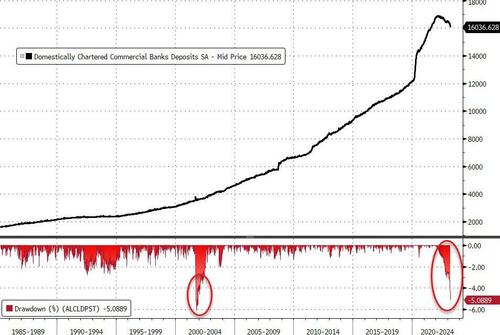

But, while many people's attention has only been drawn to the US domestic bank deposit flows recently, they have been consistently suffering outflows for a year (this data excludes 'large time deposits'). This is the 9th straight weekly decline in deposits...

Source: Bloomberg

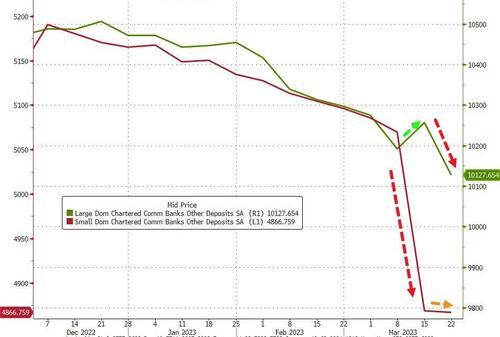

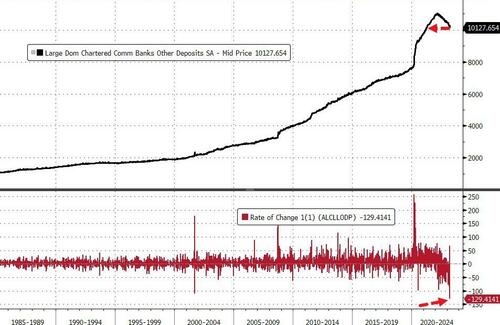

Fascinatingly, both Large and Small banks saw deposit outflows (on a seasonally-adjusted basis) with Large banks losing a huge $129bn of deposits - the biggest weekly outflow ever...

Small banks, on the hand, saw a tiny $1.948 billion outflow (on a seasonally-adjusted basis)...

Source: Bloomberg (note different scales)

We note that the skew could be impacted by the $30bn rotation from "big banks" to FRC (a small bank)...

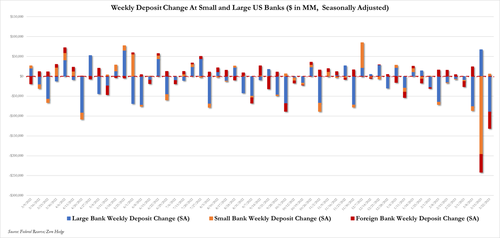

On a non-seasonally-adjusted basis, following the $196BN in small banks last week, we saw a $5.8BN INFLOW for small banks in the week ended March 22 (with foreign banks seeing another large weekly outflow of $41BN)...

The biggest (SA) large bank deposit outflow on record takes the overall level of deposits (ex-large deposits) to its lowest since March 2021...

In fact, outside of 9/11 (where infrastructure damage and closures prompted a blockage in payments/transfers), the total 5% drawdown in US domestic commercial bank deposits is the largest in history...

Source: Bloomberg

Bear in mind this data includes the post-SVB period, where we had US regional banks all tumbling further and Yellen offering no guaranteed deposits, FRC stock collapse amid bailouts (though that will skew the data due to that $30bn infusion), and the fear of Credit Suisse's collapse... and the ongoing gap between deposit rates and TSY yields...

4% rates appears to have been the trigger for rotation (from deposits to MM)...

4/8

— Jim Bianco biancoresearch.eth (@biancoresearch) March 29, 2023

Money market flows overlaid with interest rates showed things changed when rates exceeded 4%.

--

The middle panel in the chart below shows total assets in money market mutual funds are now above $5 trillion for the first time. The bottom panel shows cumulative inflows into… pic.twitter.com/IGxiYo4Gbx

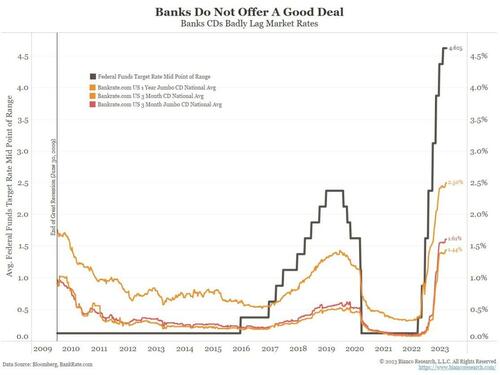

So with outflows continuing (and the spread between banks and TSY/MM fund yields), will banks start to compete for deposits? (Well not the biggest ones, for sure)...

“There are two key questions raised by the recent deposit turmoil,” Barclays Plc strategist Joseph Abate wrote in a note last week.

“How many deposits do banks ultimately lose to higher yielding money market funds? And how costly is it to replace this funding?”

Until now, when banks have lost deposits they haven’t had to compete aggressively so rates have lagged the Fed’s rate increases, and balances at government-only money fund balances had been flat since the hiking cycle began.

“But now that depositors have noticed, this dynamic is about to change,” Abate said.

And if the small ones start to 'compete' their profitability will collapse even further.

Which probably explains why regional banks just can't bounce...

Still think this bank-run is over?

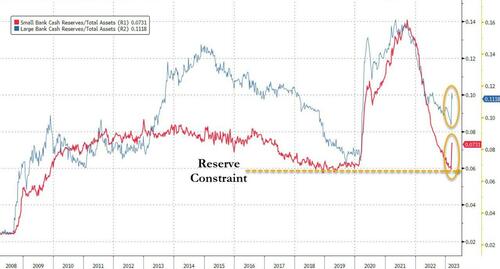

It's easy to tell from here - as we detailed previously (and as far back as Nov) - as long as we are above the reserve constraint level for small banks, there is stability courtesy of the Fed's massive reserve injection.

The closer we get to the critical level, the greater the risk of bank failures and Fed panic.

Update (1730ET): Shortly after The Fed reported the dramatic data confirming record outflows from the 25 largest US banks last week, rating agency S&P Global lowered its outlooks for Bank of America, JPMorgan Chase, PNC and Truist to stable from positive.

Bloomberg reports that S&P cites “heightened market volatility” as negative for banking sector:

“We have revised our outlooks to stable from positive on the ratings on four large U.S. banks as we believe prevailing market and economic conditions have reduced the probability of an upgrade in the current environment”

S&P affirms its ratings on the banks, “reflecting their continued good performance on a stand-alone basis, including through recent market volatility.”

* * *

The Fed just released its weekly commercial bank data dump showing deposit inflows/outflows.

Two things to note:

1) This is for the week up to 3/24/23 (which includes the post-SVB reaction week)

2) ‘Large Banks’ includes the top 25 banks (which means SVB was among that group, hence, we get no indication of SVB rotation flows, and also the $30 bn deposit transfer to FRC may impact the results)

A slowing growth in money-market fund inflows hinted at a slowing pace of deposit outflows from the US domestic commercial banking system last week (even though the last three weeks have seen MM inflows top $300bn), but that was not what we saw, with deposits (ex large time deposits) tumbling $131bn (on a seasonally-adjusted basis)…

Source: Bloomberg

But, while many people’s attention has only been drawn to the US domestic bank deposit flows recently, they have been consistently suffering outflows for a year (this data excludes ‘large time deposits’). This is the 9th straight weekly decline in deposits…

Source: Bloomberg

Fascinatingly, both Large and Small banks saw deposit outflows (on a seasonally-adjusted basis) with Large banks losing a huge $129bn of deposits – the biggest weekly outflow ever…

Small banks, on the hand, saw a tiny $1.948 billion outflow (on a seasonally-adjusted basis)…

Source: Bloomberg (note different scales)

We note that the skew could be impacted by the $30bn rotation from “big banks” to FRC (a small bank)…

On a non-seasonally-adjusted basis, following the $196BN in small banks last week, we saw a $5.8BN INFLOW for small banks in the week ended March 22 (with foreign banks seeing another large weekly outflow of $41BN)…

The biggest (SA) large bank deposit outflow on record takes the overall level of deposits (ex-large deposits) to its lowest since March 2021…

In fact, outside of 9/11 (where infrastructure damage and closures prompted a blockage in payments/transfers), the total 5% drawdown in US domestic commercial bank deposits is the largest in history…

Source: Bloomberg

Bear in mind this data includes the post-SVB period, where we had US regional banks all tumbling further and Yellen offering no guaranteed deposits, FRC stock collapse amid bailouts (though that will skew the data due to that $30bn infusion), and the fear of Credit Suisse’s collapse… and the ongoing gap between deposit rates and TSY yields…

4% rates appears to have been the trigger for rotation (from deposits to MM)…

4/8

Money market flows overlaid with interest rates showed things changed when rates exceeded 4%.

—

The middle panel in the chart below shows total assets in money market mutual funds are now above $5 trillion for the first time. The bottom panel shows cumulative inflows into… pic.twitter.com/IGxiYo4Gbx— Jim Bianco biancoresearch.eth (@biancoresearch) March 29, 2023

So with outflows continuing (and the spread between banks and TSY/MM fund yields), will banks start to compete for deposits? (Well not the biggest ones, for sure)…

“There are two key questions raised by the recent deposit turmoil,” Barclays Plc strategist Joseph Abate wrote in a note last week.

“How many deposits do banks ultimately lose to higher yielding money market funds? And how costly is it to replace this funding?”

Until now, when banks have lost deposits they haven’t had to compete aggressively so rates have lagged the Fed’s rate increases, and balances at government-only money fund balances had been flat since the hiking cycle began.

“But now that depositors have noticed, this dynamic is about to change,” Abate said.

And if the small ones start to ‘compete’ their profitability will collapse even further.

Which probably explains why regional banks just can’t bounce…

Still think this bank-run is over?

It’s easy to tell from here – as we detailed previously (and as far back as Nov) – as long as we are above the reserve constraint level for small banks, there is stability courtesy of the Fed’s massive reserve injection.

The closer we get to the critical level, the greater the risk of bank failures and Fed panic.

Loading…