Authored by Tom Mitchelhill via CoinTelegraph.com,

Newly compiled data from BitMEX Research estimates there are 150 crypto ETPs available today, with $50.3 billion in assets under management...

United States-approved spot Bitcoin exchange-traded funds (ETFs) could end up dwarfing the entire $50 billion crypto-related ETF market today.

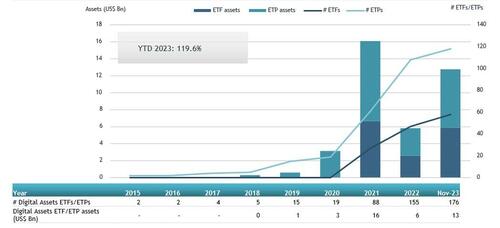

According to new data from BitMEX research, the current global market for crypto exchange-traded products (ETPs) includes approximately 150 products totaling $50.3 billion in assets under management.

Complete List of Cryptocurrency Related ETPs

— BitMEX Research (@BitMEXResearch) December 25, 2023

In anticipation of the SEC approving the spot Bitcoin ETFs, we present what we believe to be a comprehensive list of all the existing crypto related exchange traded products

We have found 150 products with $50.3bn of assets, as at 22… pic.twitter.com/cFUxtuvXgd

The list includes spot and futures funds, and typically track the performance of Bitcoin and Ethereum. The largest ETP on the list is Grayscale’s Bitcoin Trust — which is currently attempting to be converted into a spot ETF product.

Market commentators believe the approval of a spot Bitcoin ETF — widely pegged to be approved by the SEC as early as Jan. 10 — could eventually double the amount of money invested in crypto ETPs.

On Dec. 14, crypto investment fund Bitwise predicted that spot Bitcoin ETFs would be the most successful ETF product ever launched, expecting them to capture some $72 billion in assets under management within the next five years — more than doubling the current market.

Offering a more sober outlook, global fund manager Van Eck estimated that roughly $2.4 billion would flow into a spot Bitcoin products in the first quarter of 2024.

While a spot Bitcoin ETF has never been approved in the U.S., such a product is far from a brand-new development in a global context. Several countries including Canada, Australia, and Germany, already allow investors to buy shares in spot Bitcoin ETFs.

The optimism around spot Bitcoin ETF reflects a wider trend of institutional investment in crypto investment products over the past few months.

A Dec. 21 report from ETF research firm ETFGI revealed that crypto ETFs listed across the globe had attracted year-to-date net inflows of $1.6 billion, with $1.31 billion of that sum being added in November alone. This total investment is nearly double the $750 million net inflows into crypto ETPs in 2022.

$1.3 billion was added to crypto ETFs in November alone. Source: ETFGI

Of the 150 crypto funds, the top 20 ETFs attracted the largest volume of investment, with a total of $1.3 billion flowing into them over the course of 2023.

The ProShares Bitcoin Strategy ETF (BITO) — launched during a crypto bull market in October 2021 — witnessed the largest individual inflows, capturing an additional $278.7 million in 2023.

Authored by Tom Mitchelhill via CoinTelegraph.com,

Newly compiled data from BitMEX Research estimates there are 150 crypto ETPs available today, with $50.3 billion in assets under management…

United States-approved spot Bitcoin exchange-traded funds (ETFs) could end up dwarfing the entire $50 billion crypto-related ETF market today.

According to new data from BitMEX research, the current global market for crypto exchange-traded products (ETPs) includes approximately 150 products totaling $50.3 billion in assets under management.

Complete List of Cryptocurrency Related ETPs

In anticipation of the SEC approving the spot Bitcoin ETFs, we present what we believe to be a comprehensive list of all the existing crypto related exchange traded products

We have found 150 products with $50.3bn of assets, as at 22… pic.twitter.com/cFUxtuvXgd

— BitMEX Research (@BitMEXResearch) December 25, 2023

The list includes spot and futures funds, and typically track the performance of Bitcoin and Ethereum. The largest ETP on the list is Grayscale’s Bitcoin Trust — which is currently attempting to be converted into a spot ETF product.

Market commentators believe the approval of a spot Bitcoin ETF — widely pegged to be approved by the SEC as early as Jan. 10 — could eventually double the amount of money invested in crypto ETPs.

On Dec. 14, crypto investment fund Bitwise predicted that spot Bitcoin ETFs would be the most successful ETF product ever launched, expecting them to capture some $72 billion in assets under management within the next five years — more than doubling the current market.

Offering a more sober outlook, global fund manager Van Eck estimated that roughly $2.4 billion would flow into a spot Bitcoin products in the first quarter of 2024.

While a spot Bitcoin ETF has never been approved in the U.S., such a product is far from a brand-new development in a global context. Several countries including Canada, Australia, and Germany, already allow investors to buy shares in spot Bitcoin ETFs.

The optimism around spot Bitcoin ETF reflects a wider trend of institutional investment in crypto investment products over the past few months.

A Dec. 21 report from ETF research firm ETFGI revealed that crypto ETFs listed across the globe had attracted year-to-date net inflows of $1.6 billion, with $1.31 billion of that sum being added in November alone. This total investment is nearly double the $750 million net inflows into crypto ETPs in 2022.

$1.3 billion was added to crypto ETFs in November alone. Source: ETFGI

Of the 150 crypto funds, the top 20 ETFs attracted the largest volume of investment, with a total of $1.3 billion flowing into them over the course of 2023.

The ProShares Bitcoin Strategy ETF (BITO) — launched during a crypto bull market in October 2021 — witnessed the largest individual inflows, capturing an additional $278.7 million in 2023.

Loading…