So-called 'stablecoins' have been making the mainstream media headlines for all the wrong reasons lately, but this morning there is some potentially good news for what some consider the liquidity backstop for the entire crypto ecosystem.

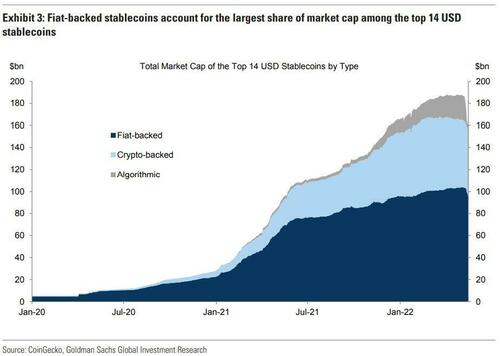

As a reminder, as we detailed here, we can classify stablecoins into three broad categories: fiat-backed, crypto-backed, and algorithmic.

TerraUSD, which suffered a hyperinflationary collapse last week, is an example of a (failed) algorithmic stablecoin.

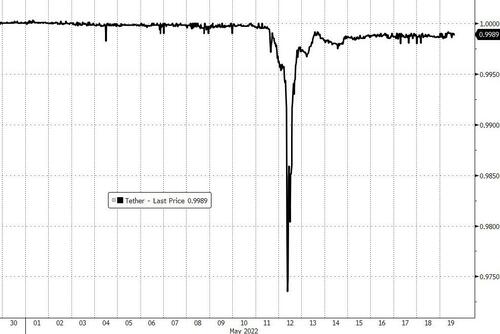

Tether - a fiat-backed stablecoin - suffered $7bn in redemptions last week in a short span of time and for a brief while lost its peg...

...and confidence in these assets faltered.

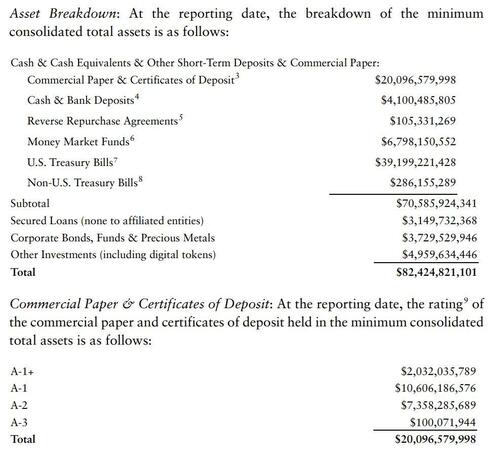

However, this morning Tether Holdings made available its latest quarterly assurance opinion revealing significant reductions in (riskier) commercial paper investments and an overall increase in (safer) U.S. treasury bills, thus overall increasing the strength and liquidity of its reserves backing the peg.

In the report today, they show consolidated total assets amount to at least US$82,424,821,101.

They show a further approximately 17% decrease in its commercial paper holdings over the prior quarter from $24.2B to $19.9B; an action Tether has continued with a further 20% reduction since April 1 2022 and which will be reflected in the Q2 2022 report. Additionally, the average rating of CP/CD has gone up from A-2 to A-1. Secured loans have also gone down by $1B.

The latest report also shows an increase in the group’s investments in money market funds and U.S. treasury bills, which have gone up from $34.5B to $39.2B, an increase of over 13%.

Paolo Ardoino, Tether CTO, said (emphasis ours):

“This past week is a clear example of the strength and resilience of Tether. Tether has maintained its stability through multiple black swan events and highly volatile market conditions and, even in its darkest days, Tether has never once failed to honor a redemption request from any of its verified customers.

This latest attestation further highlights that Tether is fully backed and that the composition of its reserves is strong, conservative, and liquid. As promised, it demonstrates a commitment by the company to reduce its commercial paper investments and in doing so, led to a rise in its holdings in U.S. Treasury Bills. In fact, since April 1 2022, Tether has seen a further reduction of 20% in commercial paper which we will reflect in the Q2 2022 report. As Tether's growth in the market continues to validate the business, we are pleased to share attestations now, and in the future, as part of our ongoing commitment to transparency.”

This is good news as stablecoins provide a useful service within the digital asset ecosystem: users need a less volatile base asset in these markets - ideally without converting back to fiat currency and the traditional banking system, given the frictions and transaction costs involved - and stablecoins have filled this need.

With a fiat-backed stablecoin the size of Tether now backed by more 'stable' assets, the FUD of systemic liquidity risks are reduced, even if the increase in more liquid reserves could be viewed as anticipating more redemptions.

So-called ‘stablecoins’ have been making the mainstream media headlines for all the wrong reasons lately, but this morning there is some potentially good news for what some consider the liquidity backstop for the entire crypto ecosystem.

As a reminder, as we detailed here, we can classify stablecoins into three broad categories: fiat-backed, crypto-backed, and algorithmic.

TerraUSD, which suffered a hyperinflationary collapse last week, is an example of a (failed) algorithmic stablecoin.

Tether – a fiat-backed stablecoin – suffered $7bn in redemptions last week in a short span of time and for a brief while lost its peg…

…and confidence in these assets faltered.

However, this morning Tether Holdings made available its latest quarterly assurance opinion revealing significant reductions in (riskier) commercial paper investments and an overall increase in (safer) U.S. treasury bills, thus overall increasing the strength and liquidity of its reserves backing the peg.

In the report today, they show consolidated total assets amount to at least US$82,424,821,101.

They show a further approximately 17% decrease in its commercial paper holdings over the prior quarter from $24.2B to $19.9B; an action Tether has continued with a further 20% reduction since April 1 2022 and which will be reflected in the Q2 2022 report. Additionally, the average rating of CP/CD has gone up from A-2 to A-1. Secured loans have also gone down by $1B.

The latest report also shows an increase in the group’s investments in money market funds and U.S. treasury bills, which have gone up from $34.5B to $39.2B, an increase of over 13%.

Paolo Ardoino, Tether CTO, said (emphasis ours):

“This past week is a clear example of the strength and resilience of Tether. Tether has maintained its stability through multiple black swan events and highly volatile market conditions and, even in its darkest days, Tether has never once failed to honor a redemption request from any of its verified customers.

This latest attestation further highlights that Tether is fully backed and that the composition of its reserves is strong, conservative, and liquid. As promised, it demonstrates a commitment by the company to reduce its commercial paper investments and in doing so, led to a rise in its holdings in U.S. Treasury Bills. In fact, since April 1 2022, Tether has seen a further reduction of 20% in commercial paper which we will reflect in the Q2 2022 report. As Tether’s growth in the market continues to validate the business, we are pleased to share attestations now, and in the future, as part of our ongoing commitment to transparency.”

This is good news as stablecoins provide a useful service within the digital asset ecosystem: users need a less volatile base asset in these markets – ideally without converting back to fiat currency and the traditional banking system, given the frictions and transaction costs involved – and stablecoins have filled this need.

With a fiat-backed stablecoin the size of Tether now backed by more ‘stable’ assets, the FUD of systemic liquidity risks are reduced, even if the increase in more liquid reserves could be viewed as anticipating more redemptions.