Authored by Simon White, Bloomberg macro strategist,

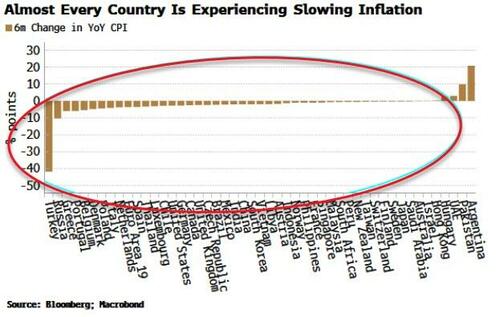

China’s halting recovery will keep the slowing inflation trend gathering pace around the world intact for now, allowing central banks to take their foot off the tightening pedal.

The global disinflationary trend is in full swing. Virtually every country has seen a slowdown in its annual inflation rate.

This is likely to continue for the time being given the situation in China. After another false start, China’s outlook has taken a negative turn.

Real-estate activity continues to decline, house-price growth is low, yields have started to fall again, and imports have dropped, reflecting stagnating demand.

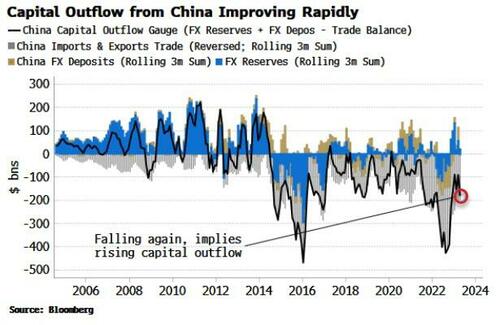

The typically sure-fire sign all is not well in China is when capital outflow picks up, and that is what appears to be happening. The chart below shows a proxy for capital outflow, based on the difference between FX-reserve accumulation and the trade surplus.

In short, if reserves are not growing despite China running a large trade surplus, this tells us capital must be leaking abroad (which, officially, it does not as China has a (nominally) closed capital account).

This also explains the yuan’s depreciation. The fact China has not been leaning against the weakening currency tells us they are allowing it to decline as a pressure valve to ease the capital outflow.

China’s slowdown will keep pressure off commodity prices, and therefore allow global disinflation to continue. However, watch for signs when China is likely to re-stimulate – perhaps in a “flood-like” manner – as a sign for when the disinflationary trend could, in the following three-to-six months, reverse.

The inflation lull will allow the Federal Reserve and other central banks more leeway to ease back for now, but they may be back sooner than they would like when China decides enough is enough.

Authored by Simon White, Bloomberg macro strategist,

China’s halting recovery will keep the slowing inflation trend gathering pace around the world intact for now, allowing central banks to take their foot off the tightening pedal.

The global disinflationary trend is in full swing. Virtually every country has seen a slowdown in its annual inflation rate.

This is likely to continue for the time being given the situation in China. After another false start, China’s outlook has taken a negative turn.

Real-estate activity continues to decline, house-price growth is low, yields have started to fall again, and imports have dropped, reflecting stagnating demand.

The typically sure-fire sign all is not well in China is when capital outflow picks up, and that is what appears to be happening. The chart below shows a proxy for capital outflow, based on the difference between FX-reserve accumulation and the trade surplus.

In short, if reserves are not growing despite China running a large trade surplus, this tells us capital must be leaking abroad (which, officially, it does not as China has a (nominally) closed capital account).

This also explains the yuan’s depreciation. The fact China has not been leaning against the weakening currency tells us they are allowing it to decline as a pressure valve to ease the capital outflow.

China’s slowdown will keep pressure off commodity prices, and therefore allow global disinflation to continue. However, watch for signs when China is likely to re-stimulate – perhaps in a “flood-like” manner – as a sign for when the disinflationary trend could, in the following three-to-six months, reverse.

The inflation lull will allow the Federal Reserve and other central banks more leeway to ease back for now, but they may be back sooner than they would like when China decides enough is enough.

Loading…