By Michael Msika, Bloomberg Markets Live reporter and strategist

For investors worried about frothy stock valuations, recently out-of-favor European energy stocks might be the answer.

After five months of losses, the sector is up more than 6% in March and it’s heading for the best month since late 2022. The reversal comes as worries about overheated markets and the tech-led rally grow, and investors are again lured to cash-rich, stable companies.

Energy is a “cash machine and a geopolitical hedge,” say Berenberg strategists Jonathan Stubbs and Leoni Externest. They see support from record relative valuation lows, high cash generation as well as continued share buybacks. Furthermore, the sector offers a natural buffer against the escalation of global tensions, according to the broker.

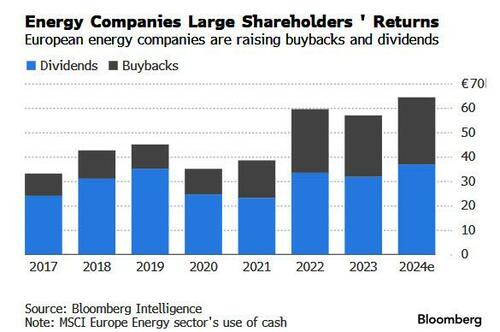

The industry’s total dividends are set to rise to about €37 billion ($40 billion) this year and buybacks are seen reaching a record €27 billion, according to Bloomberg Intelligence data. The dividend yield stands at 4.8%, about 40% higher than for the broader market.

Oddo strategist Thomas Zlowodzki upgraded energy stocks to overweight last week, adding to upbeat recommendations from JPMorgan and Barclays. “The recent rebound in oil prices is set to continue, driven by short, medium and long-term factors,” he says, citing geopolitical tensions, discipline by OPEC and slowing global production. He also sees the consensus as “too conservative” and expects 1% EPS growth in 2024 and 5% in 2025 versus the mid-single digit drop seen currently.

The conflict in the Middle East, as well as potential consequences of the attack in Russia last weekend are likely to keep tensions high around oil supply. Separately, an ongoing economic recovery in Europe, stimulus in China and a resilient US economy are all supportive for demand.

Still, Bank Of America strategists expect demand to fade as the global economic outlook turns sour, keeping an underweight stance. The latest earnings season confirmed a slowdown in profits and earnings are expected to falter further. Energy shares are still trailing the broader market year-to-date, even as Brent oil has surged 13% in 2024.

Yet investors started to respond. According to a BoA European fund manager survey published in March, energy is the sector that has seen the largest increase in positioning compared with February. Still, only a net 3% of respondents are overweight, making it under-owned against historical data. Meanwhile, investors see energy as the most undervalued sector out there, the survey shows.

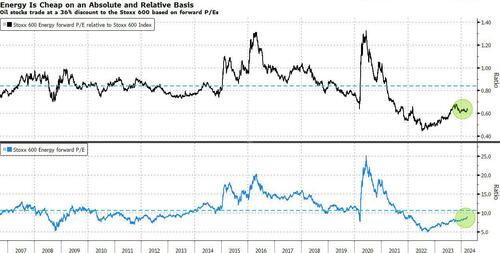

The sector is cheap on an absolute and a relative basis, trading at forward P/E of 8.9, a 36% discount to the broader market. Both figures are significantly away from long-term averages, and should higher oil prices start feeding into earnings upgrades, the sector might look even cheaper.

Finally, the technical picture is also pointing to some upside ahead, according to DayByDay technical analyst Valerie Gastaldy. “The oil and gas sector relative strength has been consolidating for one year. It is now time for a bounce, as it’s back at the previous low area,” she says.

By Michael Msika, Bloomberg Markets Live reporter and strategist

For investors worried about frothy stock valuations, recently out-of-favor European energy stocks might be the answer.

After five months of losses, the sector is up more than 6% in March and it’s heading for the best month since late 2022. The reversal comes as worries about overheated markets and the tech-led rally grow, and investors are again lured to cash-rich, stable companies.

Energy is a “cash machine and a geopolitical hedge,” say Berenberg strategists Jonathan Stubbs and Leoni Externest. They see support from record relative valuation lows, high cash generation as well as continued share buybacks. Furthermore, the sector offers a natural buffer against the escalation of global tensions, according to the broker.

The industry’s total dividends are set to rise to about €37 billion ($40 billion) this year and buybacks are seen reaching a record €27 billion, according to Bloomberg Intelligence data. The dividend yield stands at 4.8%, about 40% higher than for the broader market.

Oddo strategist Thomas Zlowodzki upgraded energy stocks to overweight last week, adding to upbeat recommendations from JPMorgan and Barclays. “The recent rebound in oil prices is set to continue, driven by short, medium and long-term factors,” he says, citing geopolitical tensions, discipline by OPEC and slowing global production. He also sees the consensus as “too conservative” and expects 1% EPS growth in 2024 and 5% in 2025 versus the mid-single digit drop seen currently.

The conflict in the Middle East, as well as potential consequences of the attack in Russia last weekend are likely to keep tensions high around oil supply. Separately, an ongoing economic recovery in Europe, stimulus in China and a resilient US economy are all supportive for demand.

Still, Bank Of America strategists expect demand to fade as the global economic outlook turns sour, keeping an underweight stance. The latest earnings season confirmed a slowdown in profits and earnings are expected to falter further. Energy shares are still trailing the broader market year-to-date, even as Brent oil has surged 13% in 2024.

Yet investors started to respond. According to a BoA European fund manager survey published in March, energy is the sector that has seen the largest increase in positioning compared with February. Still, only a net 3% of respondents are overweight, making it under-owned against historical data. Meanwhile, investors see energy as the most undervalued sector out there, the survey shows.

The sector is cheap on an absolute and a relative basis, trading at forward P/E of 8.9, a 36% discount to the broader market. Both figures are significantly away from long-term averages, and should higher oil prices start feeding into earnings upgrades, the sector might look even cheaper.

Finally, the technical picture is also pointing to some upside ahead, according to DayByDay technical analyst Valerie Gastaldy. “The oil and gas sector relative strength has been consolidating for one year. It is now time for a bounce, as it’s back at the previous low area,” she says.

Loading…