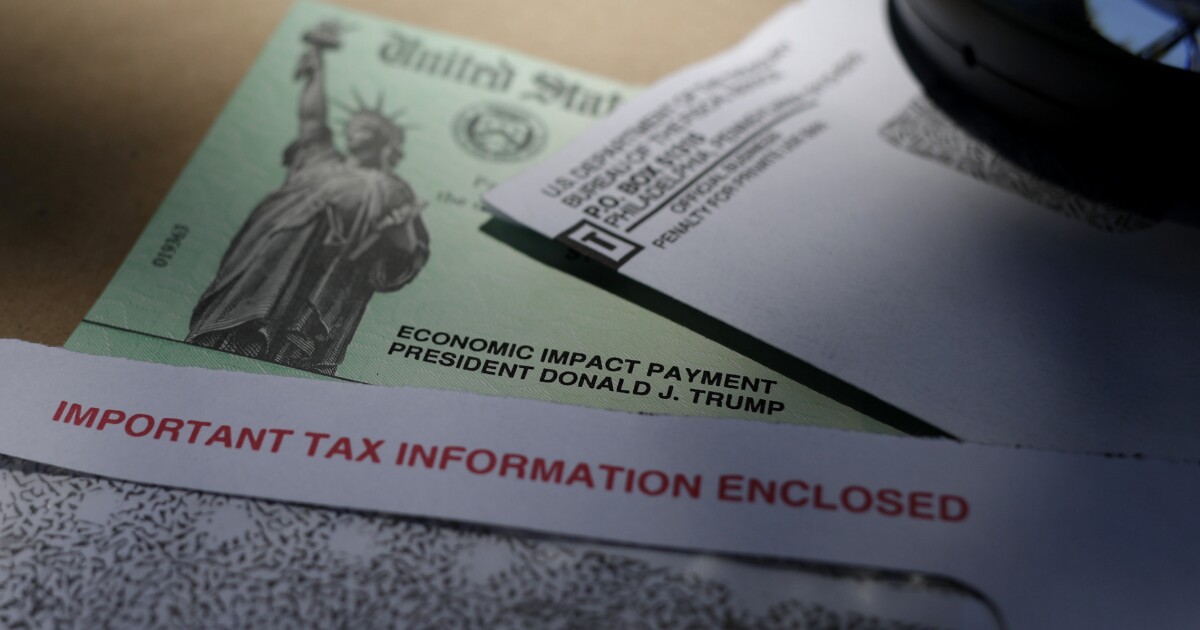

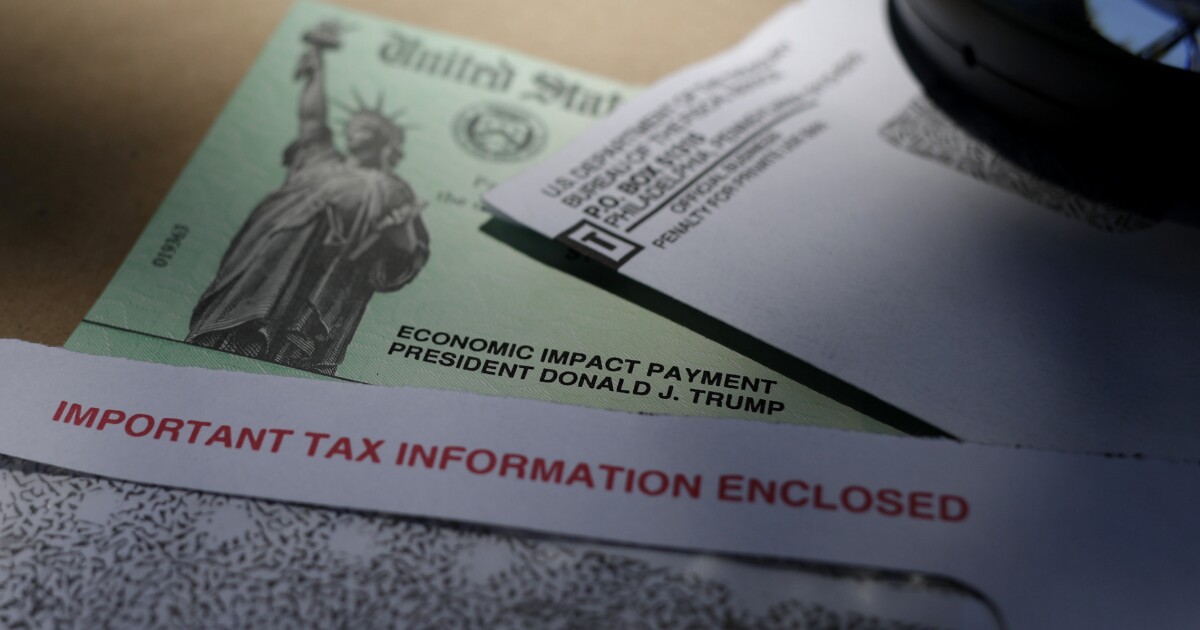

Millions of taxpayers are still eligible for COVID-19 relief stimulus payments, with the deadline to claim the financial relief fast approaching.

Between 8 million and 9 million people could be eligible for additional COVID-19 relief through either a stimulus payment or the Child Tax Credit, according to the Government Accountability Office.

STIMULUS UPDATE: MILLIONS COULD STILL BE ELIGIBLE FOR COVID-19 STIMULUS PAYMENTS

Families with little to no income that do not pay taxes have until Nov. 15 to submit their simplified tax returns to see if they are eligible for additional COVID-19 relief. Other taxpayers who missed the April 15 filing deadline earlier this year had until mid-October to submit their tax returns, with the deadline passing on Oct. 17.

The relief payments are part of the federal government’s efforts to ease the financial strain brought upon by the pandemic. Officials allocated $931 billion to go toward direct COVID-19 stimulus payments between April 2020 and December 2021, with Congress approving the money to be distributed in three waves for close to 165 million people.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Individual filers with annual incomes under $75,000 and married couples filing jointly with a total income of less than $150,000 are eligible for all three payments.

Additionally, families with children are eligible for the Child Tax Credit, which aims to reduce financial hardship and food insecurity. About 84% of children in the country benefited from those credits between July and December 2021.