After a long-ish July 4th weekend, some liquidity returned today but activity levels were relatively flat compared to the last two weeks.

Goldman's trading desk noted they were tilted slightly better to buy:

-

LOs are +6% better to buy with demand for Energy, Cons Disc and Mats outweighing supply in Tech, Staples & Comm Svcs

-

HFs are +4% better to buy with demand in HCare 2x larger than Industrials, driven by covering. Every other sector’s net $ skew is +/-$30mm with demand in Cons Disc, Energy, Utes, REITs & supply in Comms Svcs, Fins, Tech & Staples

The cash open saw some chaos with The Dow and Small Caps immediately panic bid but heading into the European close, those excited gains sold off and everything but Small Caps fell back into the red...

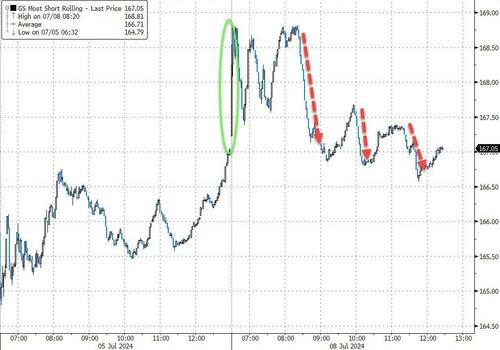

The best example of the chaos was in "most shorted" stocks which squeezed bigly at the open, then oscillated back and forth before fading back as Europe closed...

Source: Bloomberg

The 'Energy vs AI' trade swung back in AI's favor today as Tech outperformed and Energy stocks lagged...

Source: Bloomberg

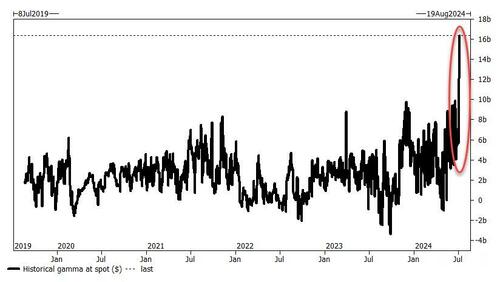

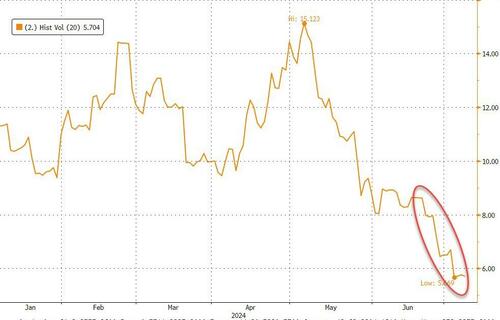

The massive (record) long gamma is tamping down all volatility...

Source: Goldman Sachs

...as Goldman noted today's very tight range-bound session, with the SPX intraday band just 26bps, but under the surface there are clear signs of Low Momentum strength driven by cover demand coupled with continued inflows into Mag7...

Source: Bloomberg

Treasuries were mixed but also traded in a very narrow range with the long-end outperforming modestly (2Y +2bps, 30Y -2bps)...

Source: Bloomberg

The dollar was well and truly in the doldrums today, barely managing to show signs of life...

Source: Bloomberg

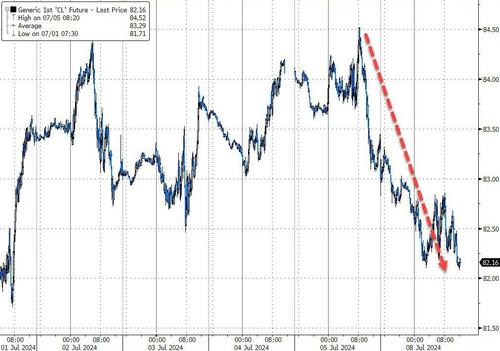

Crude prices tumbled back towards $82 (WTI) from $84.50 highs late Friday...

Source: Bloomberg

Crypto was chaotic too; dumping overnight back near $54,000, then panic bid all the way above $58,000 into the European session and then dumping back to $55k during the US session...

Source: Bloomberg

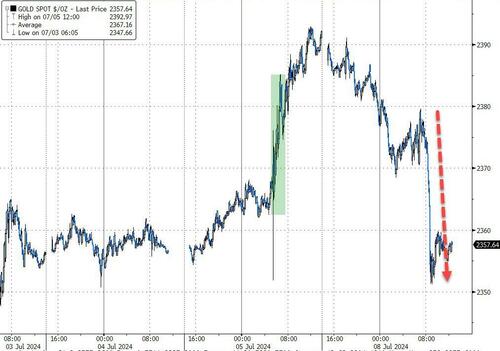

Friday's post-payrolls pump in gold was dumped today, back into July 4th's range...

Source: Bloomberg

Finally, with the record long gamma comes the (almost) record low realized volatility...

Source: Bloomberg

Somewhere, Minsky is turning in his grace at the lack of concern and quiet complacency... that's slowly building the ammo for a 'Moment'.

After a long-ish July 4th weekend, some liquidity returned today but activity levels were relatively flat compared to the last two weeks.

Goldman’s trading desk noted they were tilted slightly better to buy:

-

LOs are +6% better to buy with demand for Energy, Cons Disc and Mats outweighing supply in Tech, Staples & Comm Svcs

-

HFs are +4% better to buy with demand in HCare 2x larger than Industrials, driven by covering. Every other sector’s net $ skew is +/-$30mm with demand in Cons Disc, Energy, Utes, REITs & supply in Comms Svcs, Fins, Tech & Staples

The cash open saw some chaos with The Dow and Small Caps immediately panic bid but heading into the European close, those excited gains sold off and everything but Small Caps fell back into the red…

The best example of the chaos was in “most shorted” stocks which squeezed bigly at the open, then oscillated back and forth before fading back as Europe closed…

Source: Bloomberg

The ‘Energy vs AI’ trade swung back in AI’s favor today as Tech outperformed and Energy stocks lagged…

Source: Bloomberg

The massive (record) long gamma is tamping down all volatility…

Source: Goldman Sachs

…as Goldman noted today’s very tight range-bound session, with the SPX intraday band just 26bps, but under the surface there are clear signs of Low Momentum strength driven by cover demand coupled with continued inflows into Mag7…

Source: Bloomberg

Treasuries were mixed but also traded in a very narrow range with the long-end outperforming modestly (2Y +2bps, 30Y -2bps)…

Source: Bloomberg

The dollar was well and truly in the doldrums today, barely managing to show signs of life…

Source: Bloomberg

Crude prices tumbled back towards $82 (WTI) from $84.50 highs late Friday…

Source: Bloomberg

Crypto was chaotic too; dumping overnight back near $54,000, then panic bid all the way above $58,000 into the European session and then dumping back to $55k during the US session…

Source: Bloomberg

Friday’s post-payrolls pump in gold was dumped today, back into July 4th’s range…

Source: Bloomberg

Finally, with the record long gamma comes the (almost) record low realized volatility…

Source: Bloomberg

Somewhere, Minsky is turning in his grace at the lack of concern and quiet complacency… that’s slowly building the ammo for a ‘Moment’.

Loading…