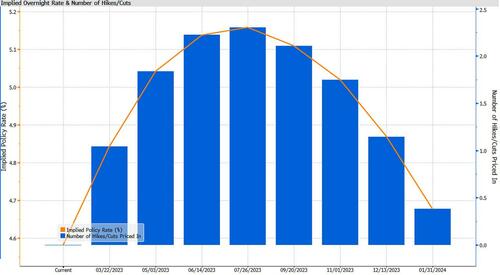

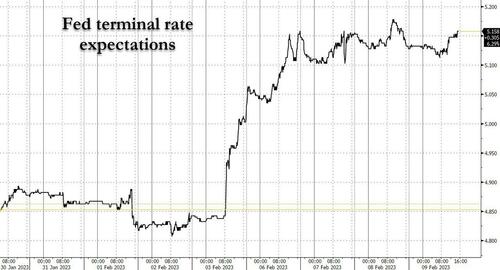

Unlike yesterday, when a triple whammy of Fed speakers (Williams, Kashkari, and Waller) all sung from the same hawkish hymn-sheet, saying there is 'more work to do', 'higher for longer', 'no rate cuts this year' and pushed terminal rate hike expectations for July to a new cycle high of 5.18%, today the hawkish Fed rhetoric took a break, and terminal odds dipped modestly...

... even as the implied number of rate cuts by year end has continued to shrink from ~2 pre-payrolls to just over one.

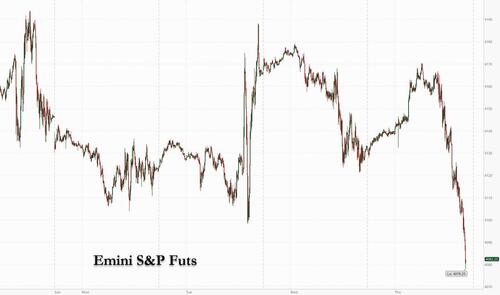

And yet, a day which started off on the front foot, with futures rising as high as 4,170 overnight on the back of solid European earnings and a burst of liquidity in China, drifted lower all session despite a dovish initial claims print, which not only rose from last week...

... but also from a year ago, a welcome inflection point to a labor market that seemingly refuses to bend or break no matter how many rate hikes the Fed throws at it.

But with little macro news, and no Fed speakers, markets turned to other indicators, and after briefly freaking out over a large 25K ES 2/17 4050 put trade (which hit on Wednesday, and which some have erroneously attribute to Carl Icahn), coupled with a very bearish note from one of Goldman's most popular FICC trading desk bulls, the direction of stocks turned decisively lower sliding more than 1%...

... in the process breaching the recent upward channel to the downside...

... and undoing all post-FOMC gains...

... as all equity sectors turned red.

Meanwhile, in micro, Disney failed to keep its post-earnings surge, turning red late in the day...

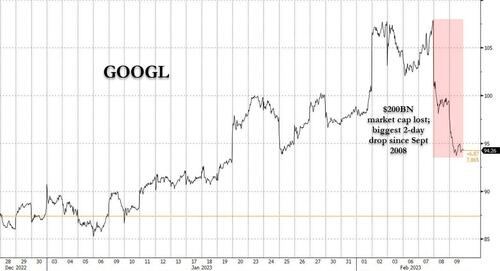

... while the mauling in GOOGLE continued for a second day, the stock sliding as much as 5%, bringing the 2-day market cap loss to just shy of $200 billion, or over 12% - the biggest 2-day drop since Sept 2008!

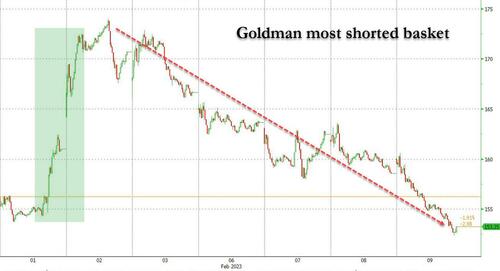

With sentiment stomped, the most-shorted stocks which enjoyed a renaissance for much of the past month, sank for 5th straight day after last week's epic squeeze...

The broader selloff pushed the VIX well above 20, but once again it was all about the VIXX (the expected vol of VIX) which extended its recent surge (as options traders begin to price in event risk around next week's CPI print).

Despite the broader risk-off mood in stocks, which traditionally is benign for rates as capital seeks to hide, bonds were also aggressively sold off, with yields higher across the curve today fairly uniformly...

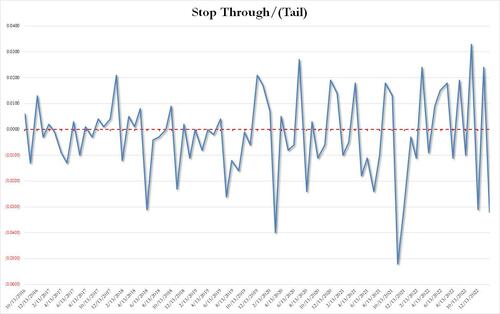

... driven by today's terrible 30Y auction which pushed yields to session highs after the auction stopped with one of the biggest tails in recent years.

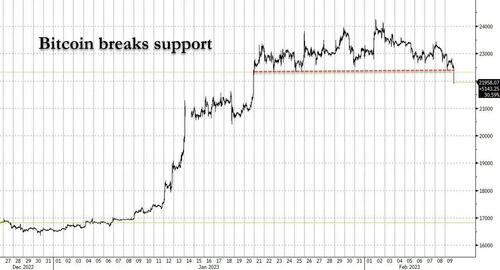

Finally, the pain was shared by crypto investors as well, and while bitcoin had managed to decouple with risk assets in recent days, today the convergence hit with a bang as Bitcoin, Ether and other cryptos tumbled after exchange Kraken settled with the SEC agreeing to end staking services, putting in question the viability of such exchanges as Coinbase. The selloff hammered bitcoin which dropped below $22K and breached support that held since late January.

Oh, and just in case anyone thinks that gold may have been spared from today's mauling, one look at the chart below reveals that nothing was safe in today's broad-based puke fest.

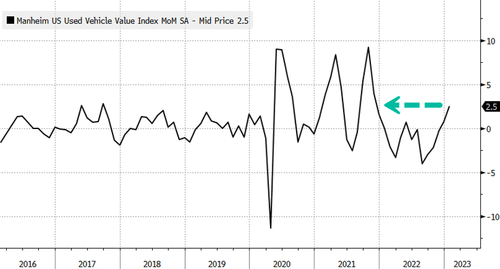

What was behind today's sharp reversal across all asset classes? There was no clear catalyst although as JPM said, investors are prepping for Tuesday’s CPI given a dearth of catalytic information this week, and where yesterday's sharply higher Manheim Used Car print (the bigget st increase since late 2021) appears to have shifted expectations toward a hotter print. Why has this print shifted expectations? JPM consumer-sector Cash Trader Brian Heavey says, “Used car vehicle index ticks higher MoM for first time since May. This has started to pop up in conversations (and while there is some seasonality here - i.e., dealerships front loading inventory for the year), this had been a big source of disinflation so something to watch”.

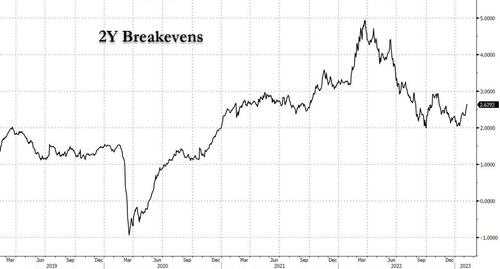

As JPM concludes, "we may be in store for a choppy next few trading sessions as, in 2022, bond vol tended to its largest increases around both the CPI and Fed Days. Given that yesterday’s Fedspeak attempted to put 50bps hikes back on the table, if necessary, a hotter than expected print could produce stronger than expected outcomes."And don't look now, but 2y Breakevens are starting to rise...

Unlike yesterday, when a triple whammy of Fed speakers (Williams, Kashkari, and Waller) all sung from the same hawkish hymn-sheet, saying there is ‘more work to do’, ‘higher for longer’, ‘no rate cuts this year’ and pushed terminal rate hike expectations for July to a new cycle high of 5.18%, today the hawkish Fed rhetoric took a break, and terminal odds dipped modestly…

… even as the implied number of rate cuts by year end has continued to shrink from ~2 pre-payrolls to just over one.

And yet, a day which started off on the front foot, with futures rising as high as 4,170 overnight on the back of solid European earnings and a burst of liquidity in China, drifted lower all session despite a dovish initial claims print, which not only rose from last week…

… but also from a year ago, a welcome inflection point to a labor market that seemingly refuses to bend or break no matter how many rate hikes the Fed throws at it.

But with little macro news, and no Fed speakers, markets turned to other indicators, and after briefly freaking out over a large 25K ES 2/17 4050 put trade (which hit on Wednesday, and which some have erroneously attribute to Carl Icahn), coupled with a very bearish note from one of Goldman’s most popular FICC trading desk bulls, the direction of stocks turned decisively lower sliding more than 1%…

… in the process breaching the recent upward channel to the downside…

… and undoing all post-FOMC gains…

… as all equity sectors turned red.

Meanwhile, in micro, Disney failed to keep its post-earnings surge, turning red late in the day…

… while the mauling in GOOGLE continued for a second day, the stock sliding as much as 5%, bringing the 2-day market cap loss to just shy of $200 billion, or over 12% – the biggest 2-day drop since Sept 2008!

With sentiment stomped, the most-shorted stocks which enjoyed a renaissance for much of the past month, sank for 5th straight day after last week’s epic squeeze…

The broader selloff pushed the VIX well above 20, but once again it was all about the VIXX (the expected vol of VIX) which extended its recent surge (as options traders begin to price in event risk around next week’s CPI print).

Despite the broader risk-off mood in stocks, which traditionally is benign for rates as capital seeks to hide, bonds were also aggressively sold off, with yields higher across the curve today fairly uniformly…

… driven by today’s terrible 30Y auction which pushed yields to session highs after the auction stopped with one of the biggest tails in recent years.

Finally, the pain was shared by crypto investors as well, and while bitcoin had managed to decouple with risk assets in recent days, today the convergence hit with a bang as Bitcoin, Ether and other cryptos tumbled after exchange Kraken settled with the SEC agreeing to end staking services, putting in question the viability of such exchanges as Coinbase. The selloff hammered bitcoin which dropped below $22K and breached support that held since late January.

Oh, and just in case anyone thinks that gold may have been spared from today’s mauling, one look at the chart below reveals that nothing was safe in today’s broad-based puke fest.

What was behind today’s sharp reversal across all asset classes? There was no clear catalyst although as JPM said, investors are prepping for Tuesday’s CPI given a dearth of catalytic information this week, and where yesterday’s sharply higher Manheim Used Car print (the bigget st increase since late 2021) appears to have shifted expectations toward a hotter print. Why has this print shifted expectations? JPM consumer-sector Cash Trader Brian Heavey says, “Used car vehicle index ticks higher MoM for first time since May. This has started to pop up in conversations (and while there is some seasonality here – i.e., dealerships front loading inventory for the year), this had been a big source of disinflation so something to watch”.

As JPM concludes, “we may be in store for a choppy next few trading sessions as, in 2022, bond vol tended to its largest increases around both the CPI and Fed Days. Given that yesterday’s Fedspeak attempted to put 50bps hikes back on the table, if necessary, a hotter than expected print could produce stronger than expected outcomes.”And don’t look now, but 2y Breakevens are starting to rise…

Loading…