Headline translation (as requested):

-

FUBAR: F**ked up beyond all repair...

-

BOHICA: Bend over, here it comes...

-

SNAFU: Situation normal, all f**ked up...

-

TARFU: Totally and royally f**ked up...

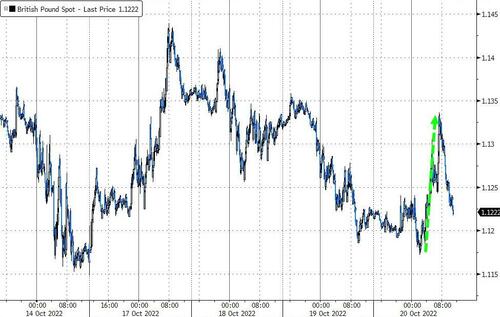

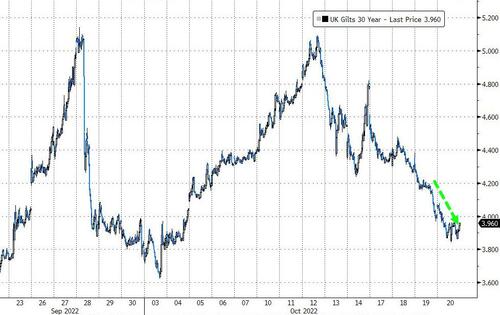

The day started with more chaos in Blighty with Truss becoming the shortest-ternured Prime Minister in British history (girl-power!).

Gilts and Cable rallied on the news...

Source: Bloomberg

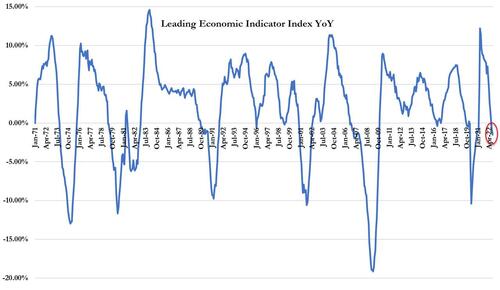

Then US existing home sales puked (as expected) and Leading Economic Indicators really puked more than expected (now back underwater YoY)...

Things were not helped by more hawkish FedSpeak, dissuading investors of the belief in a pivot...

Philly Fed's Patrick Harker spooked stocks with comments that rates would rise thru 2023 then pause (no pivot):

"Sometime next year, we are going to stop hiking rates," Harker said.

"At that point, I think we should hold at a restrictive rate for a while to let monetary policy do its work. It will take a while for the higher cost of capital to work its way through the economy."

...then Fed's Lisa Cook doubled-down, warning that "risks to inflation are skewed to the upside."

"Inflation is too high, it must come down and we will keep at it until the job is done,” she said Thursday during opening remarks at a panel discussion with business and community leaders in Spartanburg, South Carolina.

“This likely will require ongoing rate hikes and then keeping policy restrictive for some time.”

"Policy must be based on whether we see inflation actually falling in the data, rather than just in forecasts."

All of which helped push the market's terminal rate expectations above 5.00% (in March and May 2023) for the first time this cycle... and also started to see the subsequent rate-cuts being priced out (a pause not a pivot)...

Source: Bloomberg

Meanwhile in FX... pic.twitter.com/lbjeI0hlRy

— zerohedge (@zerohedge) October 20, 2022

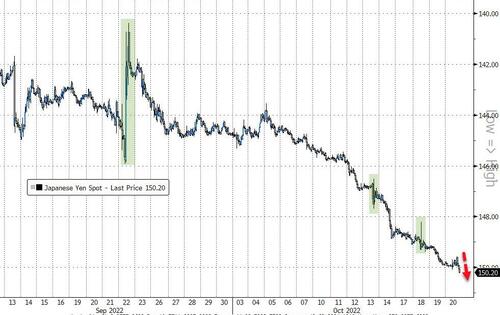

Japan's chaotic status quo continues as USDJPY breached 150 for the first time since 1990 (despite multipler interventions in the last few weeks)...

Source: Bloomberg

As the 10Y JGB yield topped the BoJ's 25bps yield cap for over a month...

Source: Bloomberg

The choices before Japanese policy makers are stark:

-

either relax the yield-curve control framework;

-

or be willing to yen the weaken.

Until then, as we have discussed numerous times, further interventions are doomed to failure.

US equity futures chopped around overnight and then ramped into and across the US cash open. But that rally stalled into the European close and then everything tumbled...

As Bloomberg's Matt Turner noted, the S&P 500 once again on Thursday saw an intraday swing of at least 1% in both directions, the 16th time that’s happened this year. That’s the most for any year since the financial crisis -- and 2022 still has another few months to go.

Similar moves have happened on ~8% of all trading days so far this year, the highest percentage since 2008. The post-crisis average is just 1.1%.

Exxon rallied to a new record highs today (bigger than META) and since it was removed from The Dow (and swapped for Salesforce), it has rallied 154% (while CRM is down 27%)...

Source: Bloomberg

Treasuries were clubbed like a baby seal once again (most of the curve up 8-10bps on the day). 30Y Yields are now up over 23bps on the week...

Source: Bloomberg

Since the lows right after the Sept FOMC meeting (9/21), 30Y Yields are up over 75bps...

Source: Bloomberg

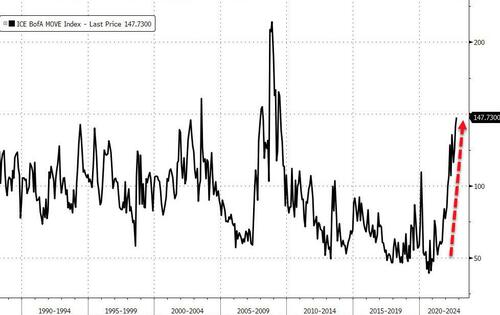

Just for some context, the last 11 days have seen 10Y yields up between 5 and 13bps on 8 occasions - literally massive swings (even adjusting for absolute rate levels) pushing MOVE (Bond VIX) to highs not seen since the GFC...

Source: Bloomberg

The dollar ended the day unchanged after a huge dump'n'pump...

Source: Bloomberg

Bitcoin fell back to $19,000 today but found modest support there...

Source: Bloomberg

Oil prices jumped, extending yesterday's post-Biden gains, on reports that China may lift some of its ZeroCOVID restrictions, but gave a lot of the gains back as stocks started to stumble...

Gold tried but failed to hold earlier gains, with futures tagging $1650 and reversing...

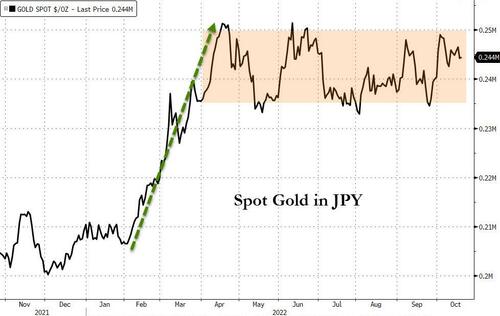

And while Spot Gold prices are testing their lowest levels since April 2020 in USD terms, in JPY terms they have traded sideways (holding their value) as the Japanese currency collapsed in the last few months...

Source: Bloomberg

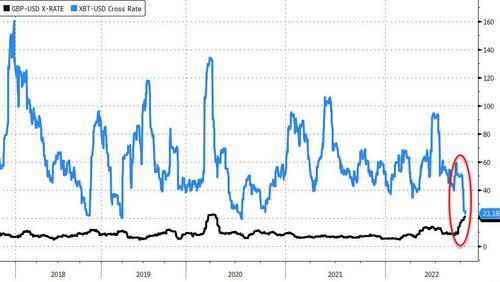

Finally, just for fun, Bloomberg's Michael McDonough noted that the volatility of the 'oldest' currency still in use (GBP) is now about the same as the volatility of the 'youngest' currency...

Source: Bloomberg

"Store of value"?

Headline translation (as requested):

-

FUBAR: F**ked up beyond all repair…

-

BOHICA: Bend over, here it comes…

-

SNAFU: Situation normal, all f**ked up…

-

TARFU: Totally and royally f**ked up…

The day started with more chaos in Blighty with Truss becoming the shortest-ternured Prime Minister in British history (girl-power!).

[embedded content]

Gilts and Cable rallied on the news…

Source: Bloomberg

Then US existing home sales puked (as expected) and Leading Economic Indicators really puked more than expected (now back underwater YoY)…

Things were not helped by more hawkish FedSpeak, dissuading investors of the belief in a pivot…

Philly Fed’s Patrick Harker spooked stocks with comments that rates would rise thru 2023 then pause (no pivot):

“Sometime next year, we are going to stop hiking rates,” Harker said.

“At that point, I think we should hold at a restrictive rate for a while to let monetary policy do its work. It will take a while for the higher cost of capital to work its way through the economy.”

…then Fed’s Lisa Cook doubled-down, warning that “risks to inflation are skewed to the upside.”

“Inflation is too high, it must come down and we will keep at it until the job is done,” she said Thursday during opening remarks at a panel discussion with business and community leaders in Spartanburg, South Carolina.

“This likely will require ongoing rate hikes and then keeping policy restrictive for some time.”

“Policy must be based on whether we see inflation actually falling in the data, rather than just in forecasts.”

All of which helped push the market’s terminal rate expectations above 5.00% (in March and May 2023) for the first time this cycle… and also started to see the subsequent rate-cuts being priced out (a pause not a pivot)…

Source: Bloomberg

Meanwhile in FX… pic.twitter.com/lbjeI0hlRy

— zerohedge (@zerohedge) October 20, 2022

Japan’s chaotic status quo continues as USDJPY breached 150 for the first time since 1990 (despite multipler interventions in the last few weeks)…

Source: Bloomberg

As the 10Y JGB yield topped the BoJ’s 25bps yield cap for over a month…

Source: Bloomberg

The choices before Japanese policy makers are stark:

Until then, as we have discussed numerous times, further interventions are doomed to failure.

US equity futures chopped around overnight and then ramped into and across the US cash open. But that rally stalled into the European close and then everything tumbled…

As Bloomberg’s Matt Turner noted, the S&P 500 once again on Thursday saw an intraday swing of at least 1% in both directions, the 16th time that’s happened this year. That’s the most for any year since the financial crisis — and 2022 still has another few months to go.

Similar moves have happened on ~8% of all trading days so far this year, the highest percentage since 2008. The post-crisis average is just 1.1%.

Exxon rallied to a new record highs today (bigger than META) and since it was removed from The Dow (and swapped for Salesforce), it has rallied 154% (while CRM is down 27%)…

Source: Bloomberg

Treasuries were clubbed like a baby seal once again (most of the curve up 8-10bps on the day). 30Y Yields are now up over 23bps on the week…

Source: Bloomberg

Since the lows right after the Sept FOMC meeting (9/21), 30Y Yields are up over 75bps…

Source: Bloomberg

Just for some context, the last 11 days have seen 10Y yields up between 5 and 13bps on 8 occasions – literally massive swings (even adjusting for absolute rate levels) pushing MOVE (Bond VIX) to highs not seen since the GFC…

Source: Bloomberg

The dollar ended the day unchanged after a huge dump’n’pump…

Source: Bloomberg

Bitcoin fell back to $19,000 today but found modest support there…

Source: Bloomberg

Oil prices jumped, extending yesterday’s post-Biden gains, on reports that China may lift some of its ZeroCOVID restrictions, but gave a lot of the gains back as stocks started to stumble…

Gold tried but failed to hold earlier gains, with futures tagging $1650 and reversing…

And while Spot Gold prices are testing their lowest levels since April 2020 in USD terms, in JPY terms they have traded sideways (holding their value) as the Japanese currency collapsed in the last few months…

Source: Bloomberg

Finally, just for fun, Bloomberg’s Michael McDonough noted that the volatility of the ‘oldest’ currency still in use (GBP) is now about the same as the volatility of the ‘youngest’ currency…

Source: Bloomberg

“Store of value”?