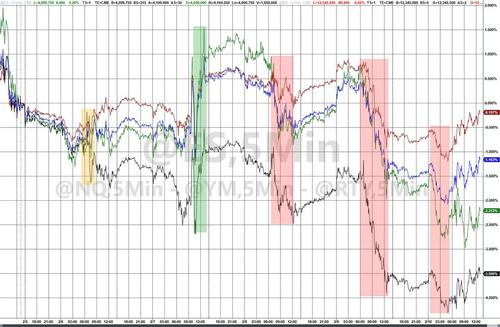

Goldman sums up the week's equity trading succinctly:

This week has been most aggressive aggregate net selling across HFs and LO$ on the year (Monday-Thursday) by a factor of 4x. LOs showed the largest weekly net selling since the first week of 2023, but HFs added to this selling dynamic as well, selling the most in a week since mid-Dec of ’23.

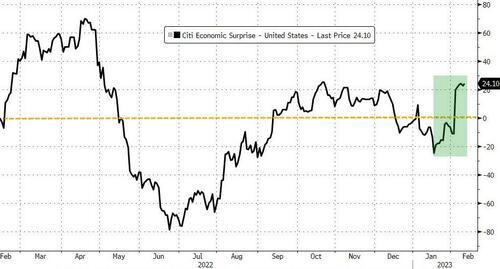

With the 'imminent H1 recession / Fed pivot' narrative taking a beating recently with US macro data surprising to the upside, and FedSpeak has (once again) reassured that there will be no pivot...

Source: Bloomberg

This 'adjustment' has sent the market's expectations for The Fed's rate-trajectory significantly hawkishly higher with terminal rates adding 35bps of additional hikes this week alone...

Source: Bloomberg

All of which prompted pain for bond and stock bulls this week with all the US major equity indices in the red on the week, led by a puke in Small Caps and Big-Tech. The Dow was the least ugly horse in the glue factory...

The energy sector was the only one to close the week green with Consumer Discretionary and Real Estate puking hardest...

Source: Bloomberg

(who could have seen that coming?)

Translation: just as tech is now outperforming every other sector as a result of a seemingly endless short squeeze, the same hedge funds which are rapidly degrossing as they have no idea what to do... are apparently convinced that the sector to short is energy despite a near record buyback announced by Chevron and record cash flow from Exxon. Translation: they are about to be steamrolled again, only instead of tech, the next big squeeze will be in energy as all those recent shorts are violently unwound.

...and bonds have been a one-way street higher in yields since the better than expected payrolls print. The short-end (actually more the belly) has significantly underperformed this week as hawkish reality is priced back in...

Source: Bloomberg

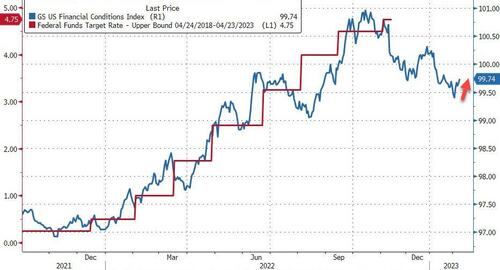

And this has started to 'tighten' financial conditions (despite Powell's nonchalance) after four months of extreme loosening (which implies 'peak Fed' has already occurred...

Source: Bloomberg

And notably, with rates rising again, the multiple expansion that lifted stocks all year is facing peril...

Source: Bloomberg

After an almost non-stop short-squeeze all year, the 'most shorted' stock basket is down 6 straight days and the biggest weekly drop since September.

Source: Bloomberg

The dollar ended the week modestly higher, holding its gains from last Friday's payrolls print...

Source: Bloomberg

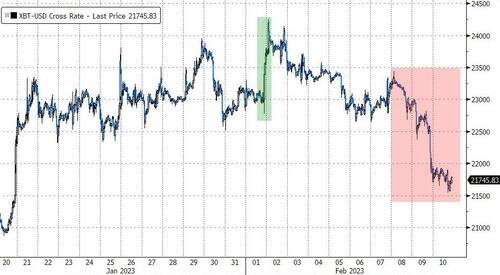

Bitcoin tumbled this week after last week's surge, breaking back below $22k...

Source: Bloomberg

Gold extended last week's losses, unable to break back above $1900...

Oil prices rebounded significantly this week with WTI back above $80...

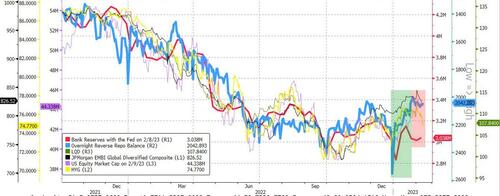

Finally, repos continue to be all that matters... and that's not a good thing anymore...

Source: Bloomberg

It's all one big Fed trade...

Take a look at this (ugly) chart below.

— Paulo Gitz, CFA (@PauloGitz) February 2, 2023

white: Fed Funds rate in August/24 - July/23 (inverted: higher -> more cuts are priced)

other: $SPY, Gold, #bitcoin, $AGG, $HYG, metals

All bottomed in October and topped recently.

This is all one big Fed trade. Nothing else matters. pic.twitter.com/laZFBkVdQT

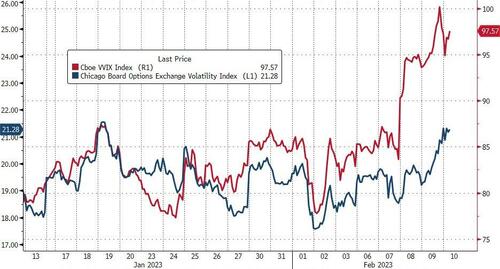

And VVIX is warning that next week is going to be chaotic with CPI and OpEx...

Source: Bloomberg

VVIX always knows...

Goldman sums up the week’s equity trading succinctly:

This week has been most aggressive aggregate net selling across HFs and LO$ on the year (Monday-Thursday) by a factor of 4x. LOs showed the largest weekly net selling since the first week of 2023, but HFs added to this selling dynamic as well, selling the most in a week since mid-Dec of ’23.

With the ‘imminent H1 recession / Fed pivot’ narrative taking a beating recently with US macro data surprising to the upside, and FedSpeak has (once again) reassured that there will be no pivot…

Source: Bloomberg

This ‘adjustment’ has sent the market’s expectations for The Fed’s rate-trajectory significantly hawkishly higher with terminal rates adding 35bps of additional hikes this week alone…

Source: Bloomberg

All of which prompted pain for bond and stock bulls this week with all the US major equity indices in the red on the week, led by a puke in Small Caps and Big-Tech. The Dow was the least ugly horse in the glue factory…

The energy sector was the only one to close the week green with Consumer Discretionary and Real Estate puking hardest…

Source: Bloomberg

(who could have seen that coming?)

Translation: just as tech is now outperforming every other sector as a result of a seemingly endless short squeeze, the same hedge funds which are rapidly degrossing as they have no idea what to do… are apparently convinced that the sector to short is energy despite a near record buyback announced by Chevron and record cash flow from Exxon. Translation: they are about to be steamrolled again, only instead of tech, the next big squeeze will be in energy as all those recent shorts are violently unwound.

…and bonds have been a one-way street higher in yields since the better than expected payrolls print. The short-end (actually more the belly) has significantly underperformed this week as hawkish reality is priced back in…

Source: Bloomberg

And this has started to ‘tighten’ financial conditions (despite Powell’s nonchalance) after four months of extreme loosening (which implies ‘peak Fed’ has already occurred…

Source: Bloomberg

And notably, with rates rising again, the multiple expansion that lifted stocks all year is facing peril…

Source: Bloomberg

After an almost non-stop short-squeeze all year, the ‘most shorted’ stock basket is down 6 straight days and the biggest weekly drop since September.

Source: Bloomberg

The dollar ended the week modestly higher, holding its gains from last Friday’s payrolls print…

Source: Bloomberg

Bitcoin tumbled this week after last week’s surge, breaking back below $22k…

Source: Bloomberg

Gold extended last week’s losses, unable to break back above $1900…

Oil prices rebounded significantly this week with WTI back above $80…

Finally, repos continue to be all that matters… and that’s not a good thing anymore…

Source: Bloomberg

It’s all one big Fed trade…

Take a look at this (ugly) chart below.

white: Fed Funds rate in August/24 – July/23 (inverted: higher -> more cuts are priced)

other: $SPY, Gold, #bitcoin, $AGG, $HYG, metals

All bottomed in October and topped recently.

This is all one big Fed trade. Nothing else matters. pic.twitter.com/laZFBkVdQT

— Paulo Gitz, CFA (@PauloGitz) February 2, 2023

And VVIX is warning that next week is going to be chaotic with CPI and OpEx…

Source: Bloomberg

VVIX always knows…

Loading…