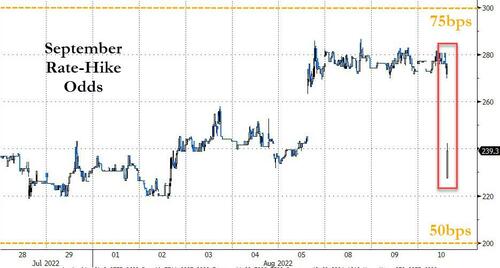

A colder than expected CPI print - driven by slowing energy price gains offsetting continued gains in shelter costs - prompted an immediate knee jerk reaction sending rate-hike odds tumbling.

September went from pricing in an 80% chance of a 75bps hike to around 30% chance instantly...

This prompted wild euphoria in stocks because surely this means The Fed pivot is back on...

And bond yields plunged, led by the short-end (and steepening the curve)...

The dollar dived lower, helping to send commodities higher with oil spiking and gold futures up to $1825...

Just one thing though, as Jason Bloom notes, head of fixed income and alternatives ETF product strategy at Invesco, watch prices going forward:

“Good news for stocks and bonds. But watch commodity prices in Q4 and beyond when the SPR release ends and the Ukrainian harvest goes missing. No doubt CPI will begin to trend lower. But the 2% in 2024 expectation depends largely on a flat to lower commodity price environment. Highly unlikely in my opinion.”

Michael Pond, head of inflation market strategy at Barclays Plc, says on Bloomberg TV:

“This is a necessary print for the Fed, but it’s not sufficient. We need to see a lot more. You can think about this print sort of like the weather: it’s better today than it has been over the past few days. But it’s still summer. There’s still a lot of humidity.”

Morgan Stanley economists led by Ellen Zentner write:

“Fed officials are unlikely to see this report as a signal to deviate from their steep tightening path we foresee through the end of this year. That said, this report makes a 50 basis points more likely at the September meeting rather than 75, but a lot will depend on the August CPI release next month.”

But for now the ammo for the squeeze (or forced participation is there in stocks)

A colder than expected CPI print – driven by slowing energy price gains offsetting continued gains in shelter costs – prompted an immediate knee jerk reaction sending rate-hike odds tumbling.

September went from pricing in an 80% chance of a 75bps hike to around 30% chance instantly…

This prompted wild euphoria in stocks because surely this means The Fed pivot is back on…

And bond yields plunged, led by the short-end (and steepening the curve)…

The dollar dived lower, helping to send commodities higher with oil spiking and gold futures up to $1825…

Just one thing though, as Jason Bloom notes, head of fixed income and alternatives ETF product strategy at Invesco, watch prices going forward:

“Good news for stocks and bonds. But watch commodity prices in Q4 and beyond when the SPR release ends and the Ukrainian harvest goes missing. No doubt CPI will begin to trend lower. But the 2% in 2024 expectation depends largely on a flat to lower commodity price environment. Highly unlikely in my opinion.”

Michael Pond, head of inflation market strategy at Barclays Plc, says on Bloomberg TV:

“This is a necessary print for the Fed, but it’s not sufficient. We need to see a lot more. You can think about this print sort of like the weather: it’s better today than it has been over the past few days. But it’s still summer. There’s still a lot of humidity.”

Morgan Stanley economists led by Ellen Zentner write:

“Fed officials are unlikely to see this report as a signal to deviate from their steep tightening path we foresee through the end of this year. That said, this report makes a 50 basis points more likely at the September meeting rather than 75, but a lot will depend on the August CPI release next month.”

But for now the ammo for the squeeze (or forced participation is there in stocks)