Authored by Simon White, Bloomberg macro strategist,

The relative cost of upside equity protection is outpacing tail-risk insurance as FOMO-driven trading pushes the market higher.

Price is everything. Fashioning reasons why the equity market should be lower has been suspiciously easy this year: recession risk, bank turmoil, debt ceiling, etc. But markets have a habit of causing the greatest number of people the maximum amount of pain – utilitarian they are not.

That’s why it’s essential to always pay attention to measures based on price and nothing else. They are far less corruptible by bias or transient trends.

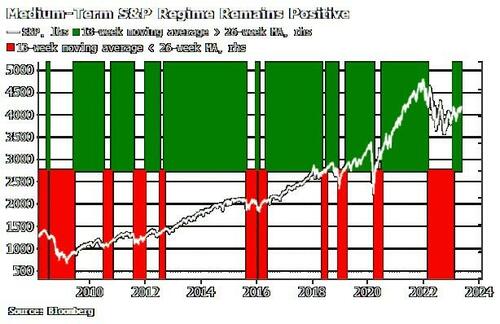

I noted one such measure, the Coppock Signal, had triggered in March. The Coppock is one of the best indications of long-term bottoms in equities. It came on the heels of an even simpler measure, the 13- versus 26-week moving-average crossover signal, indicating the medium-term trend of the market was now positive.

The S&P has ground higher, powered by a very narrow band of mega-cap tech stocks, while the Nasdaq is off to the races.

A new revolution in AI is providing a powerful tailwind and leading to FOMO-driven chasing - no-one wants to be left offside if this ends up being the beginning of a new bull market.

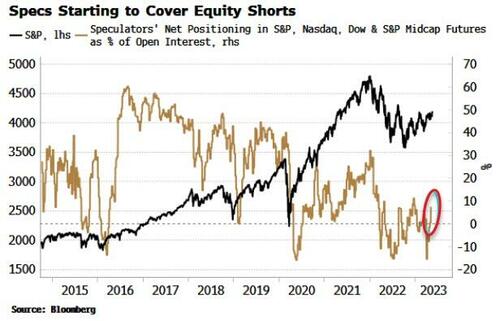

Speculator shorts have begun to be covered, according to CoT data (see chart below). Inferred positioning of CTAs and macro funds shows them getting tentatively, but steadily, longer.

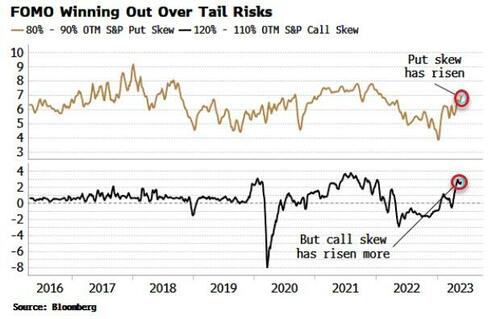

This could rise more sharply based on some of the price behavior in option markets. Put skew has risen, indicating the relative cost of hedging tail-risk in the S&P has climbed to 18-month highs. Higher prices mean markets have greater potential downside.

But call skew has risen by even more, highlighting increased demand for chasing the market higher. The market yesterday was on the cusp of bursting through 4,200, a significant resistance level which could trigger more follow-through if it is breached. Fear of missing out is a powerful, emotive force.

Unfortunately, such wildly speculative behavior can sow the seeds of its own destruction.

Activity in zero-day options continues to dominate, with JPMorgan noting that retail traders have turned from net buyers to significant net sellers of gamma. Selling vol with no margin will add to the market’s inherent instability.

The market may be primed to maintain its medium-term positive trend, but being long will not be relaxing, with potholes and vol spikes (the VIX continues to be low versus cross-asset and realized volatility) along the way.

Authored by Simon White, Bloomberg macro strategist,

The relative cost of upside equity protection is outpacing tail-risk insurance as FOMO-driven trading pushes the market higher.

Price is everything. Fashioning reasons why the equity market should be lower has been suspiciously easy this year: recession risk, bank turmoil, debt ceiling, etc. But markets have a habit of causing the greatest number of people the maximum amount of pain – utilitarian they are not.

That’s why it’s essential to always pay attention to measures based on price and nothing else. They are far less corruptible by bias or transient trends.

I noted one such measure, the Coppock Signal, had triggered in March. The Coppock is one of the best indications of long-term bottoms in equities. It came on the heels of an even simpler measure, the 13- versus 26-week moving-average crossover signal, indicating the medium-term trend of the market was now positive.

The S&P has ground higher, powered by a very narrow band of mega-cap tech stocks, while the Nasdaq is off to the races.

A new revolution in AI is providing a powerful tailwind and leading to FOMO-driven chasing – no-one wants to be left offside if this ends up being the beginning of a new bull market.

Speculator shorts have begun to be covered, according to CoT data (see chart below). Inferred positioning of CTAs and macro funds shows them getting tentatively, but steadily, longer.

This could rise more sharply based on some of the price behavior in option markets. Put skew has risen, indicating the relative cost of hedging tail-risk in the S&P has climbed to 18-month highs. Higher prices mean markets have greater potential downside.

But call skew has risen by even more, highlighting increased demand for chasing the market higher. The market yesterday was on the cusp of bursting through 4,200, a significant resistance level which could trigger more follow-through if it is breached. Fear of missing out is a powerful, emotive force.

Unfortunately, such wildly speculative behavior can sow the seeds of its own destruction.

Activity in zero-day options continues to dominate, with JPMorgan noting that retail traders have turned from net buyers to significant net sellers of gamma. Selling vol with no margin will add to the market’s inherent instability.

The market may be primed to maintain its medium-term positive trend, but being long will not be relaxing, with potholes and vol spikes (the VIX continues to be low versus cross-asset and realized volatility) along the way.

Loading…