'Soft' data slumped today: Consumer confidence crumbled and there was a regional Fed rout - Philly Fed Services was really ugly, Richmond Fed Manufacturing was ugly, and Texas Services was negative for the 22nd straight month...

...as 'hard' data improved with durable goods orders rebounding and home prices accelerated once again (but that is offset by a decline in core shipments, which will weigh on GDP)...

Source: Bloomberg

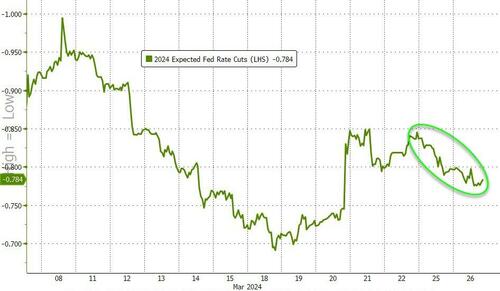

The STIRs market focused on the bad news and pushed rate-cut expectations modestly higher (dovish)...

Source: Bloomberg

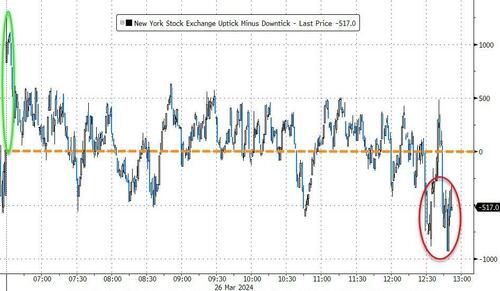

The stock market initially loved it either way - bad was good and good was good - but the majors could not hold on to their overnight highs and late-day sell programs took all the majors red on the day...

That is the 3rd down day for the S&P 500 in a row.

There were two sell programs in the last 30 mins...

Source: Bloomberg

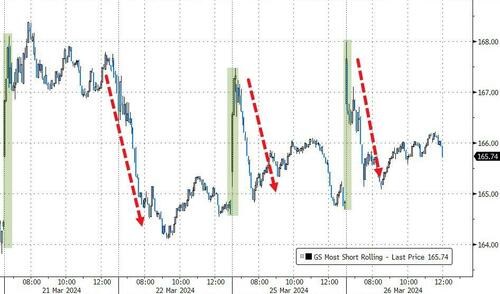

Another day, another opening short-squeeze faded...

Source: Bloomberg

Mag7 stocks were dumped late on spoiling the party...

Source: Bloomberg

The longer-end of the bond curve outperformed today (with the short-end modestly higher in yield) with 30Y -2bps on the day, helped by a strong 5Y (record size) auction. The stronger than expected durable goods orders print snapped yields to yesterday's highs but the soft-date weakness (and the auction) wore yields lower as the day went on...

Source: Bloomberg

After yesterday's big surge (on net zero ETF inflows), bitcoin held on to the $70,000 level today...

Source: Bloomberg

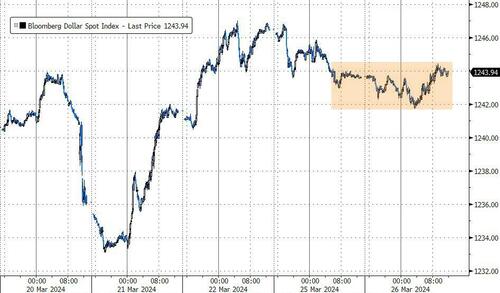

The dollar ended practically unchanged, rallying back from modest weakness overnight...

Source: Bloomberg

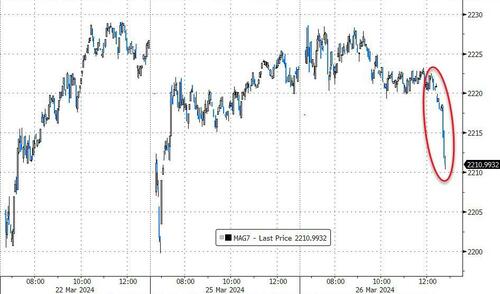

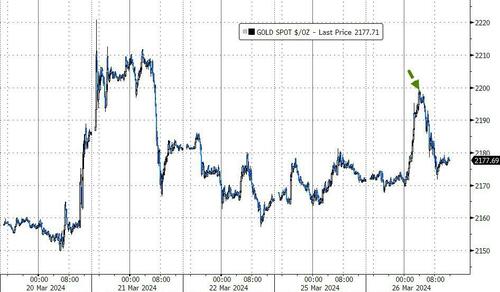

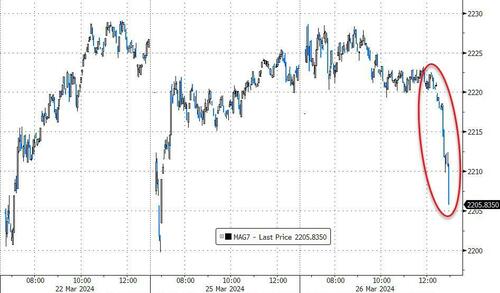

Spot gold prices surged up to $2200 intraday before giving a lot of the gains back to end marginally higher....

Source: Bloomberg

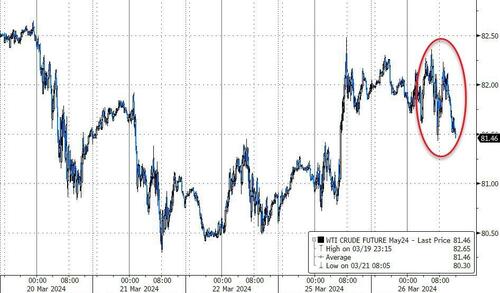

Oil prices dipped ahead of tonight's API inventory data...

Source: Bloomberg

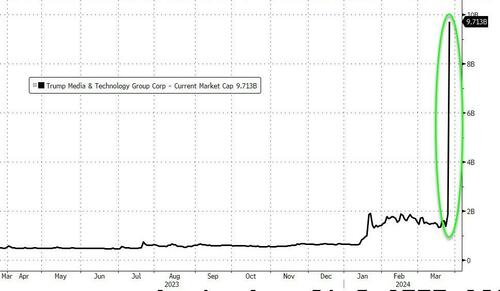

Finally, Trump Media & Technology Group (DJT) rocketed higher today... only to be dumped late on, erasing half of the day's gains...

Source: Bloomberg

...with the company with barely any revenues now worth almost $10BN at its peak today, according to Bloomberg data...

Source: Bloomberg

‘Soft’ data slumped today: Consumer confidence crumbled and there was a regional Fed rout – Philly Fed Services was really ugly, Richmond Fed Manufacturing was ugly, and Texas Services was negative for the 22nd straight month…

…as ‘hard’ data improved with durable goods orders rebounding and home prices accelerated once again (but that is offset by a decline in core shipments, which will weigh on GDP)…

Source: Bloomberg

The STIRs market focused on the bad news and pushed rate-cut expectations modestly higher (dovish)…

Source: Bloomberg

The stock market initially loved it either way – bad was good and good was good – but the majors could not hold on to their overnight highs and late-day sell programs took all the majors red on the day…

That is the 3rd down day for the S&P 500 in a row.

There were two sell programs in the last 30 mins…

Source: Bloomberg

Another day, another opening short-squeeze faded…

Source: Bloomberg

Mag7 stocks were dumped late on spoiling the party…

Source: Bloomberg

The longer-end of the bond curve outperformed today (with the short-end modestly higher in yield) with 30Y -2bps on the day, helped by a strong 5Y (record size) auction. The stronger than expected durable goods orders print snapped yields to yesterday’s highs but the soft-date weakness (and the auction) wore yields lower as the day went on…

Source: Bloomberg

After yesterday’s big surge (on net zero ETF inflows), bitcoin held on to the $70,000 level today…

Source: Bloomberg

The dollar ended practically unchanged, rallying back from modest weakness overnight…

Source: Bloomberg

Spot gold prices surged up to $2200 intraday before giving a lot of the gains back to end marginally higher….

Source: Bloomberg

Oil prices dipped ahead of tonight’s API inventory data…

Source: Bloomberg

Finally, Trump Media & Technology Group (DJT) rocketed higher today… only to be dumped late on, erasing half of the day’s gains…

Source: Bloomberg

…with the company with barely any revenues now worth almost $10BN at its peak today, according to Bloomberg data…

Source: Bloomberg

Loading…